Maharashtra Stamp Duty Act 2020

05072020 On 31st March 2020 the Central Government has extended the applicability of stamp duty by 3 months. Stamping of instruments relating to.

03072020 Thereafter the Government of Maharashtra has vide its order dated 28th March 2020 by modifying the provisions of Section 149 A of the Maharashtra Municipal Corporation Act 1949 and Section 144 F of the Mumbai Municipal Corporation Act 1888 granted a concession of 1 on aggregate stamp duty and applicable surcharge payable on the instruments of Sale Gift and Usufructuary Mortgage thereby reducing the stamp duty.

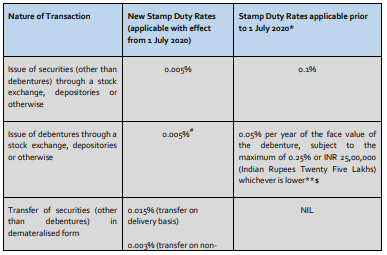

Maharashtra stamp duty act 2020. The provisions of the amended Indian Stamp Act which were to come into force from 1 April 2020 will now come into force from 1 July 2020. Ad Indywidualne zajęcia z native speakerami online. The creation of a mortgage by deposit of title deeds.

Two key amendments to the Maharashtra Stamp Act 1958 have been introduced in relation to stamping of documents encompassing multiple transactions and stamp duty rates in case of mortgage by deposit of title deeds and mortgage deed. In Mumbai stamp duty is levied under the Maharashtra Stamp Duty Act. On 11th May 2020 the Maharashtra government has lost Rs 3885 crore in stamp duty in 40 days of lockdown.

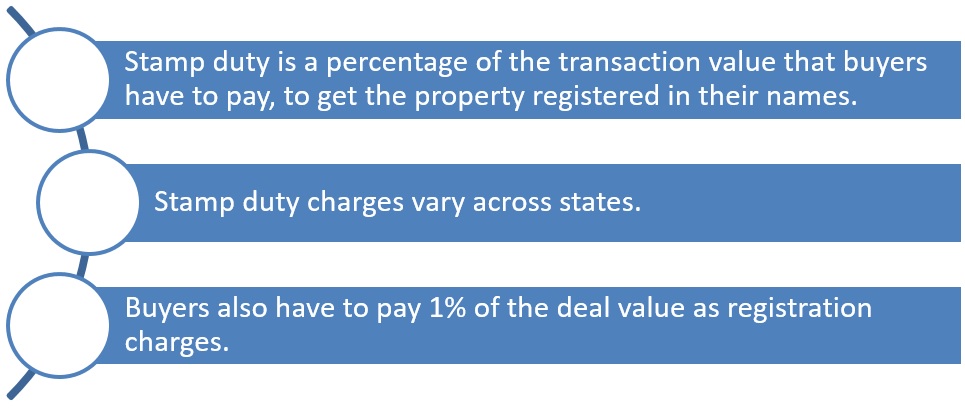

For charging stamp duty the instrument is not to be treated by the name it bears but by the substance or real nature of the transaction recorded therein. An extra 1 per cent duty is applicable in Mumbai compared with the rest of the state. Know How Will It Benefit You Heres all you need to know Stamp Duty.

An Overview On Stamp Duty And Registration Charges Maharashtra Stamp Act Introduction In India the Indian Stamp Act 1899 ISA is a central legislation while states have their own local stamp act to administer with issues rising within that particular state. On 9 December 2020 the Maharashtra Cabinet discussed and approved these amendments. 14042021 The state government on December 24 2020 announced a reduction in the stamp duty on lease agreements of immovable property.

Stamp duty charges in Mumbai are 6 per cent while registration charges are 1 per cent 1. This includes whether the property is located in urban or rural areas the total cost of the transaction etc. Stamp duty rates for agreements that relate to.

Odbywaj lekcje zdalnie - gdziekolwiek jesteś kiedykolwiek chcesz. The stamp duty on lease deed has been reduced to 2 from 5 till December 31 2020 and to 3 from January 1 2021 to March 31 2021. These amendments were earlier discussed by the Maharashtra Cabinet and approved on December 9 2020.

27082020 The phased reduction in the stamp duty rates from the present 5 in Mumbai and Pune to 2 until December 2020 and 3 January March 2021 is a much-awaited measure from the Government of. This additional duty was levied on Mumbai in order to fund various infrastructural projects. 3 It shall come into force on such date as the State Government may by notification in the Official Gazette direct.

Stamping of instruments relating to. Earlier in April 2020 the Maharashtra government has reduced stamp duty on properties for the next two years in the areas. 27082020 Maharashtra Slashes Stamp Duty To 2 Until Dec 2020.

It is to be noted that stamp duty is not uniform across states and varies according to the type of documents. Stamp duty rates on property depend upon several criteria across Maharashtra state. 30112020 Stamp duty charges in Maharashtra.

1 This Act may be called 1the Maharashtra Stamp Act. Principles for the Application of the Act. 3 It shall come into force on such date as the State Government may by notification in the Official Gazette direct.

2 It extends to the whole of the 2State of Maharashtra. 07052020 Taking cognizance of this issue the Office of the Inspector General of Registration and Stamp Controller Maharashtra State Authorities vide its circular bearing reference number NoO5Stamp20ExplanationMN 062014620 dated April 27 2020 Circular has clarified certain provisions of the Maharashtra Stamp Act 1958 Act particularly on the timelines within which stamp duty needs to be paid on instruments forming part of lending transactions which are not. Ad Indywidualne zajęcia z native speakerami online.

On 9 December 2020 the Maharashtra Cabinet discussed and approved these amendments. The cut is applicable to lease agreements of over 29 years. 59 rows 41 S17 of the Act provides that all instruments chargeable with duty and executed.

08042017 - 1 This Act may be called the Maharashtra Stamp Act. The creation of a mortgage by deposit of title deeds. Odbywaj lekcje zdalnie - gdziekolwiek jesteś kiedykolwiek chcesz.

2 It extends to the whole of the State of Maharashtra. In this Act unless there is anything repugnant in the subject or context. The stamp duty is imposed upon the instrument and not upon the transaction.

- In this Act unless there is anything repugnant in the subject or context-. 09122020 stamp duty rates for agreements that relate to. This also varies depending on the gender of the owner of the property.

Maharashtra stamp act 2020 Maharashtra Stamp Act.

Maharashtra Stamp Duty The Latest News In Maharashtra 2020

Maharashtra Stamp Duty The Latest News In Maharashtra 2020

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Hind Law House S The Maharashtra Stamp Act By A K Gupte Gaurav Sethi Jatin Sethi

Hind Law House S The Maharashtra Stamp Act By A K Gupte Gaurav Sethi Jatin Sethi

Works Contract And Levy Of Stamp Duty Under The Maharashtra Stamp Act Scc Blog

Works Contract And Levy Of Stamp Duty Under The Maharashtra Stamp Act Scc Blog

Stamp Duty In Maharashtra Stamp Duty Calculator

Stamp Duty In Maharashtra 2021 Women Buyers To Get 1 Concession

Stamp Duty In Maharashtra 2021 Women Buyers To Get 1 Concession

The Maharashtra Stamp Act Daily Law Times Private Limited Book Store

The Maharashtra Stamp Act Daily Law Times Private Limited Book Store

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Buy The Maharashtra Stamp Act 2021 Book Online At Low Prices In India The Maharashtra Stamp Act 2021 Reviews Ratings Amazon In

Buy The Maharashtra Stamp Act 2021 Book Online At Low Prices In India The Maharashtra Stamp Act 2021 Reviews Ratings Amazon In

Will Maharashtra Stamp Duty Rates Cut Help In Reviving Realty Demand Real Estate News

Will Maharashtra Stamp Duty Rates Cut Help In Reviving Realty Demand Real Estate News

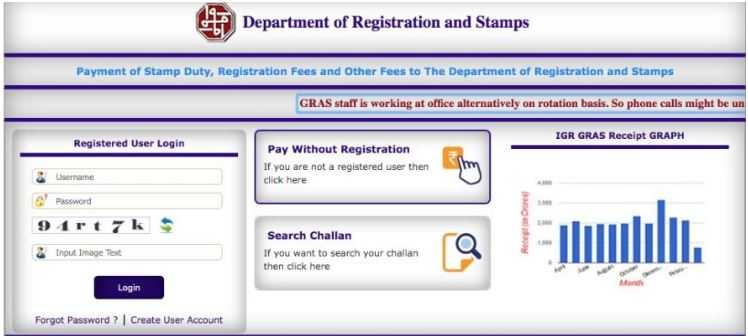

Maharashtra Stamp Act Definition Charges Payment Modes Calculation And Process Of Online Payment Of Stamp Duty And Registration Charges

Maharashtra Stamp Act Definition Charges Payment Modes Calculation And Process Of Online Payment Of Stamp Duty And Registration Charges

Stamp Duty Ready Reckoner For Maharashtra 18 19

Stamp Duty Ready Reckoner For Maharashtra 18 19

The Maharashtra Stamp Act Ebc Webstore

The Maharashtra Stamp Act Ebc Webstore

Buy The Maharashtra Stamp Act 2021 Book Online At Low Prices In India The Maharashtra Stamp Act 2021 Reviews Ratings Amazon In

Buy The Maharashtra Stamp Act 2021 Book Online At Low Prices In India The Maharashtra Stamp Act 2021 Reviews Ratings Amazon In

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Stamp Duty And Registration Charges In Mumbai Maharashtra

Stamp Duty And Registration Charges In Mumbai Maharashtra

Post a Comment for "Maharashtra Stamp Duty Act 2020"