Stamp Duty And Registration Fees Calculator Rajasthan 2020

In the case of a woman buyer she would have to pay Rs 50000. Stamp duty for a male in Rajasthan is 5 Rs.

1 Hike In Stamp Duty On Property Registration Rajasthan Government Realtynxt

1 Hike In Stamp Duty On Property Registration Rajasthan Government Realtynxt

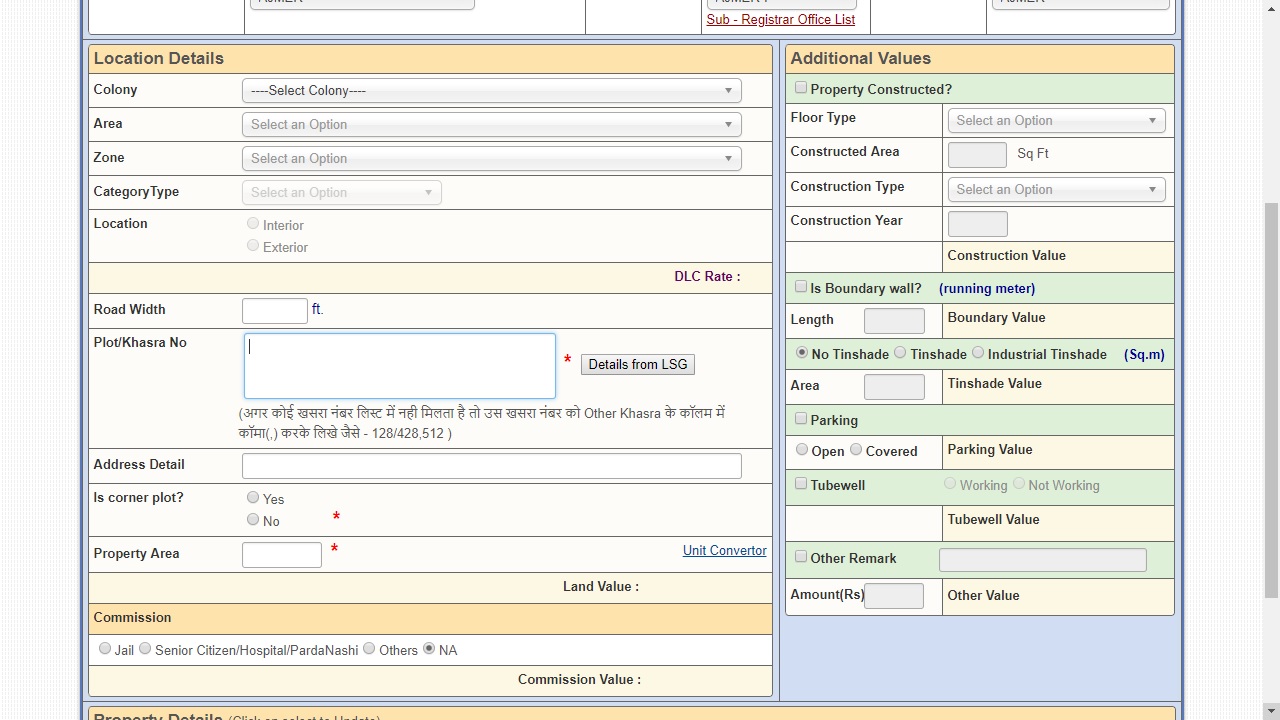

Rajasthan E-panjiyan DLC Fees Search for stamp duty and registration fees calculator rajasthan igrsrajasthangovin.

Stamp duty and registration fees calculator rajasthan 2020. Stamps Dept Head Office Ajmer Office No. New rates have been implemented under the notification provided by Rajasthan Finance Act 2015. This stamp duty calculator will help you find the amount of stamp duty on.

GST Registration Calculator prior to 2019 XLSX 319MB Determine when your business is liable for GST registration for periods prior to 2019. Rs 320- approx Rs 320- approx Rs 320- approx Total stamp duty and registration. What are the stamp duty and registration charges in Jaipur.

88 Rs 320. Stamp Duty for registration of property documents will be charged at Rs. Registration charges tend to be 1 of the propertys market value.

Purchase mortgage loan refinance in Malaysia. 14092020 For males stamp duty and registration charges are 625 percent and 4 percent respectively. To avoid any shortfall in funds when buying your home and registering the property in your name ensure that you also requisition for the stamp duty and.

This is one of the reasons why it may actually be a good idea to buy a property in your wifes name in Rajasthan. Besides stamp duty there are also registration charges cess and surcharges. 75 Rs 320.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. 19032021 30 of the stamp duty ie 12 of the total sale consideration Registration Fees. 50000 Stamp Duty for a female is 4 Total amount paid to buy the property would be Rs.

So suppose Vimesh Bishnoi is buying a property worth Rs 10 lakhs the stamp duty on real estate comes to Rs 60000. The cost of stamp duty is generally 5-7 of the propertys market value. 20022020 Existing DLC rates will be reduced by 10 to facilitate industries and DLC rates will not be revised in next year also.

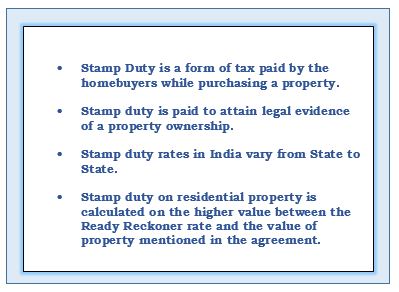

Stamp Duty and Registration Fee Detail Common Fee for all the Documents Surcharge on Stamp Duty. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Facility of online payment of stamp duty will be provided on loan documents executed by Banks and NBFCs online on the portal of National e-governance Services LtdNeSL.

1020 30 CSI Charges If property Value is not exceed Rs. 10052020 Rajasthan stamp duty rates search 2020. 11 00000 with all the additional taxes.

Collector Stamps will be given powers similar to civil court to prevent evasion of the stamp duty in case of misclassification of documents. Stamp duty and registration charges are among the additional costs that a homebuyer has to pay after purchasing a property. 200 CSI Charges Where it exceed 50000.

28022020 As per the amendments made in the Indian Stamp Act relating to the rate of stamp duty on securities instruments provisions of the Rajasthan Stamp Act will be amended according to Rajasthan Budget 2020. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Calculate now and get free quotation.

1 hike in stamp duty on property registration. This is in wake of the dip in sales due to the economic fallout of the Covid-19 pandemic. The amount you have to pay will vary from state to state and in some states even according to gender.

23022020 Currently the state government levies 5 stamp duty from men and 4 from women on property including 1 registration fee. 17032020 In Jaipur the stamp duty charges vary from 5-6 percent for males and females and the registration charges are fixed at one percent for everyone. Female property owners enjoy a marginal rebate.

Stamp duty and registration charges in Jaipur are governed by The Rajasthan Stamps. Currently the Stamp Duty for property registration of land or building in Punjab is 10 of property value. IBHLs stamp duty calculator will help you find out the exact amount that you will be required to pay as stamp duty in any state or city.

Sunil Bhatia Joint Director Computer IG Registration. 62 Rs 320. 10022020 Maharashtra has slashed the stamp duty fees on real estate properties to 2 till December 2020 and to 3 from January 2020 to March 2020.

1 of the total sale consideration 1 of the total sale consideration 1 of the total sale consideration CSI. GST Registration Calculator from 2019. The non-payment of stamp duty and registration charges may result in the non-registration of the property and can be a cause of legal dispute at a later stage.

The stamp duty and registration charges for females are 520 percent and 4 percent correspondingly August 10 2020. Calculate Stamp Duty Legal Fees for property sales. This calculator has been revised in 2019.

What will be the Stamp Duty charges and Registration Fee If a homebuyer male is looking to buy a property apartmentflat in Andhra Pradesh of Rs. Rajasthan Government RealtyNXT. Rates of stamp duty will be increased by 1.

Rajasthan Stamp Duty Calculator. 18092020 Calculate the stamp duty charges levied for property registration in different States and Union Territories UTs by using the stamp duty calculator. 16122020 Stamp duty in Rajasthan in 2020.

As such these charges can run into lakhs of rupees. For men in Rajasthan stamp duty is 6 while women enjoy a lower stamp duty at 5.

Stamp Duty Calculator Online House Stamp Duty Calculator Indiabulls Home Loan

Stamp Duty Calculator Online House Stamp Duty Calculator Indiabulls Home Loan

How Is The Stamp Duty Calculated On Resale Flats In India Quora

Rajasthan Property Registration Stamp Duty Procedure Indiafilings

Rajasthan Property Registration Stamp Duty Procedure Indiafilings

Stamp Duty And Registration Charges In Shimla

Stamp Duty And Registration Charges In Shimla

Property Stamp Duty Registration Charge 2019 2020 Update

Property Stamp Duty Registration Charge 2019 2020 Update

Dlc Rates In Rajasthan Stamp Duty Property Registration Youtube

Dlc Rates In Rajasthan Stamp Duty Property Registration Youtube

What Are The Stamp Duty Registration Charges In Rajasthan

What Are The Stamp Duty Registration Charges In Rajasthan

Rajasthan Property Registration Stamp Duty Procedure Indiafilings

Rajasthan Property Registration Stamp Duty Procedure Indiafilings

What Is The Procedure For Property Registration In Andhra Pradesh

What Is The Procedure For Property Registration In Andhra Pradesh

Flat Land And Property Stamps And Registration Charges In Bangalore And India Basunivesh

Flat Land And Property Stamps And Registration Charges In Bangalore And India Basunivesh

Stamp Duty And Registration Charges In Jaipur

Stamp Duty And Registration Charges In Jaipur

Property Registration Fee Stamp Duty Charges In India 2019 2020

Property Registration Fee Stamp Duty Charges In India 2019 2020

Rajasthan Property Registration Stamp Duty Procedure Indiafilings

Rajasthan Property Registration Stamp Duty Procedure Indiafilings

Stamp Duty Calculator Calculate Stamp Duty Online

Stamp Duty Calculator Calculate Stamp Duty Online

How Do We Calculate The Stamp Duty And Registration Charges Of A Property In Bangalore Quora

Rajasthan Property Registration Stamp Duty Procedure Indiafilings

Rajasthan Property Registration Stamp Duty Procedure Indiafilings

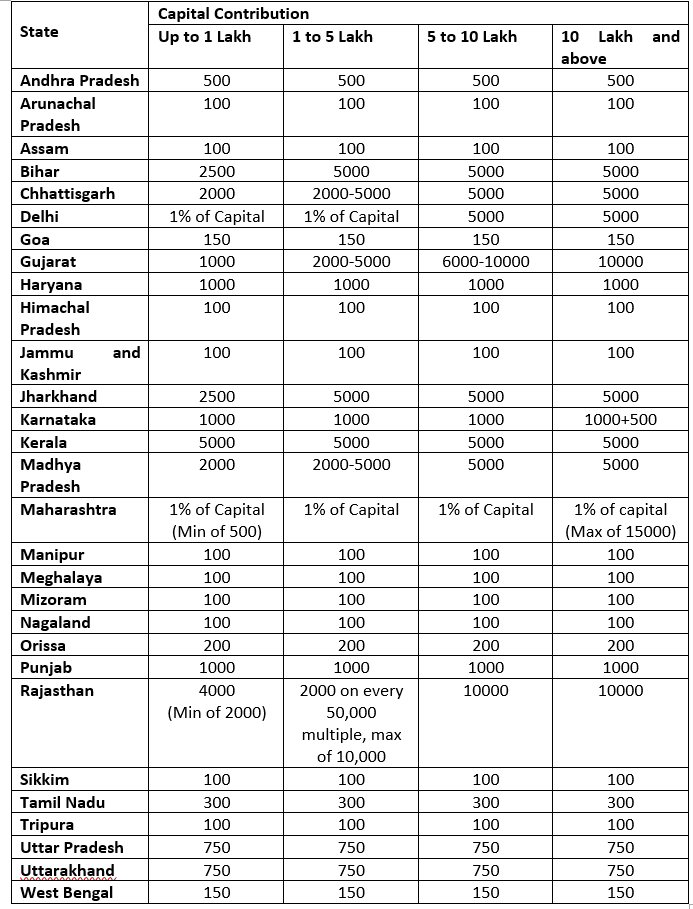

State Wise Stamp Duty In India

State Wise Stamp Duty In India

What Is The Difference Between Judicial Non Judicial Stamp Paper

What Is The Difference Between Judicial Non Judicial Stamp Paper

State Wise Rates Of Stamp Duty On Llp Agreement Legalwiz In

State Wise Rates Of Stamp Duty On Llp Agreement Legalwiz In

Post a Comment for "Stamp Duty And Registration Fees Calculator Rajasthan 2020"