Maharashtra Stamp Act 2020 Pdf Schedule

The Stamp Duty is calculated as per Schedule-I. Subject to the provisions of this Act and the exemptions contained in Schedule I the following instruments shall be chargeable with duty of the amount indicated in Schedule I as the proper duty therefor respectively that.

Desi Kanoon Law Economics And Politics Stamp Duty Implication On Online Submission Of Documents With Registrar Of Companies

Desi Kanoon Law Economics And Politics Stamp Duty Implication On Online Submission Of Documents With Registrar Of Companies

14042021 Stamp duty on lease agreements.

Maharashtra stamp act 2020 pdf schedule. Start Working with Your Docs. The provisions of the amended Indian Stamp Act which were to come into force from 1 April 2020 will now come into force from 1 July 2020. 3 It shall come into force on such date as the State Government may by notification in the Official Gazette direct.

Upload Edit Sign. Export PDF Forms Online. 03072020 Thereafter the Government of Maharashtra has vide its order dated 28th March 2020 by modifying the provisions of Section 149 A of the Maharashtra Municipal Corporation Act 1949 and Section 144 F of the Mumbai Municipal Corporation Act 1888 granted a concession of 1 on aggregate stamp duty and applicable surcharge payable on the instruments of Sale Gift and Usufructuary Mortgage thereby reducing the stamp.

SCHEDULE I Article 6 Agreement relating to Deposit of Title Deeds Pawn Pledge or The deposit of title deeds or instrument. 2 It extends to the whole of the State of Maharashtra. Add Signature Fields.

STAMP DUTY It is an indirect tax collected by the State Government in Maharashtra. The amount of Stamp Duty payable depends on type of documents. Schedule I to the Stamp Act shall be deemed to have been validly levied and collected in accordance with law as if the provisions of the said article 25 as amended by the Maharashtra Tax Laws Levy Amendment and Validation Act 1997 had been continuously in force at.

Ad Save Time Converting PDF to Editable Online. Ad Save Time Signing. Ad Save Time Converting PDF to Editable Online.

23022021 The Maharashtra Stamp Amendment and Validation Ordinance 2021. Proviso to sub-clause b of sub-section 1 Provided that in no case the amount of the penalty shall exceed four times the deficient portion of the stamp duty. 59 rows Only the instruments specified in the Schedule I to the Act are covered by this Act.

1 This Act may be called 1the Maharashtra Stamp Act. - In this Act unless there is anything repugnant in the subject or context-. Section 5 of the Act has been substituted and shall be deemed to have been substituted with effect from the August 11 2015 with the following.

The stamp duty on lease deed has been reduced to 2 from 5 till December 31 2020 and to 3 from January 1 2021 to March 31 2021. 08042017 - 1 This Act may be called the Maharashtra Stamp Act. 05072020 On 31st March 2020 the Central Government has extended the applicability of stamp duty by 3 months.

On 11th May 2020 the Maharashtra government has lost Rs 3885 crore in stamp duty in 40 days of lockdown. In this Act unless there is anything repugnant in the subject or context. Export PDF Forms Online.

3 It shall come into force on such date as the State Government may by notification in the Official Gazette direct. The state government on December 24 2020 announced a reduction in the stamp duty on lease agreements of immovable property. Act LX of 1958 1.

1 This Act may be called the Bombay Stamp Act. 2 It extends to the whole of the State of Maharashtra. 1 This Act may be called the Maharashtra Stamp Act.

3 It shall come into force on such date as the state Government may. By notification in the Official Gazette direct. Stamp Duty is payable under Section 3 of The Maharashtra Stamp Act.

Ad Save Time Signing. 2 It extends to the whole of the 2State of Maharashtra. Definitions- In this Act unless there is anything repugnant in the subject or context.

Upload Edit Sign. The Governor of Maharashtra promulgated the Maharashtra Stamp Amendment and Validation Ordinance 2021 on February 09 2021. Get Started for Free.

Add Signature Fields. Deficient portion of the stamp duty. 1958 2 It Extends to the whole of the 1Stamp of Maharashtra.

The Maharashtra Stamp Act Bom. Principles for the Application of the Act. Get Started for Free.

Start Working with Your Docs. 3 It shall come into force on such date as the State Government may by notification in the official Gazette direct.

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

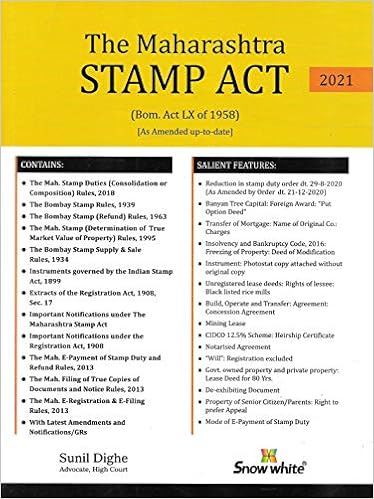

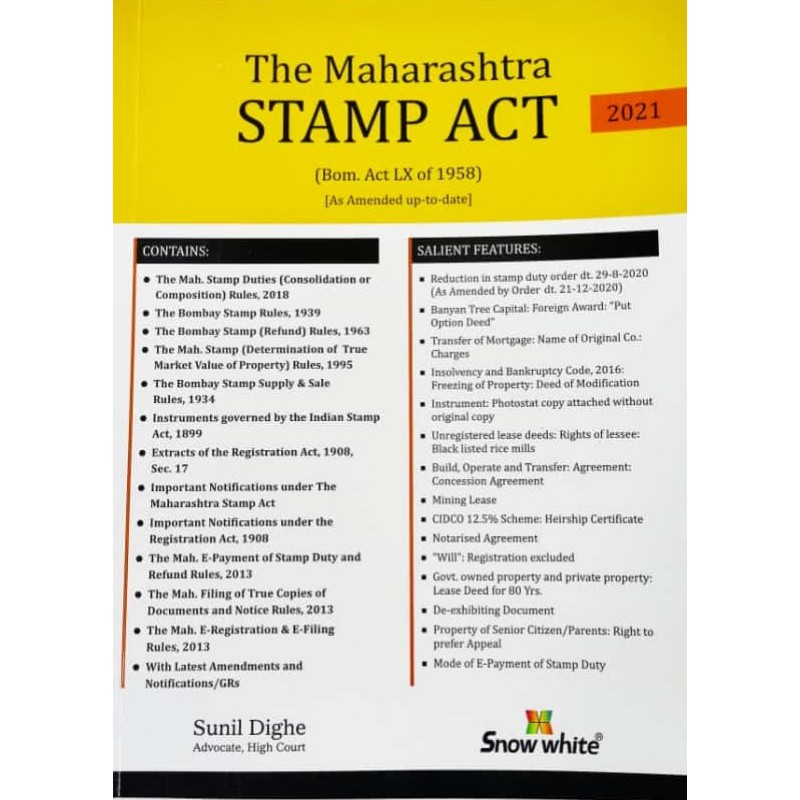

Buy The Maharashtra Stamp Act 2021 Book Online At Low Prices In India The Maharashtra Stamp Act 2021 Reviews Ratings Amazon In

Buy The Maharashtra Stamp Act 2021 Book Online At Low Prices In India The Maharashtra Stamp Act 2021 Reviews Ratings Amazon In

Rates Of Stamp Duty In The State Of Gujarat Ebizfiling

Rates Of Stamp Duty In The State Of Gujarat Ebizfiling

Stamp Duty On Gift In Maharashtra

Stamp Duty On Gift In Maharashtra

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

The Maharashtra Stamp Act Ebc Webstore

The Maharashtra Stamp Act Ebc Webstore

Property Registration Fee Stamp Duty Charges In India 2019 2020

Property Registration Fee Stamp Duty Charges In India 2019 2020

Buy The Maharashtra Stamp Act 2021 Book Online At Low Prices In India The Maharashtra Stamp Act 2021 Reviews Ratings Amazon In

Buy The Maharashtra Stamp Act 2021 Book Online At Low Prices In India The Maharashtra Stamp Act 2021 Reviews Ratings Amazon In

Snow White S Maharashtra Stamp Act 1958 By Adv Sunil Dighe

Snow White S Maharashtra Stamp Act 1958 By Adv Sunil Dighe

Stamp Duty And Registration Charges In Mumbai Maharashtra

Stamp Duty And Registration Charges In Mumbai Maharashtra

Gift Deed Format Clauses Stamp Duty How To Draft Gift Deed 2021

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Post a Comment for "Maharashtra Stamp Act 2020 Pdf Schedule"