Is There A Stamp Duty Holiday On Buy To Let

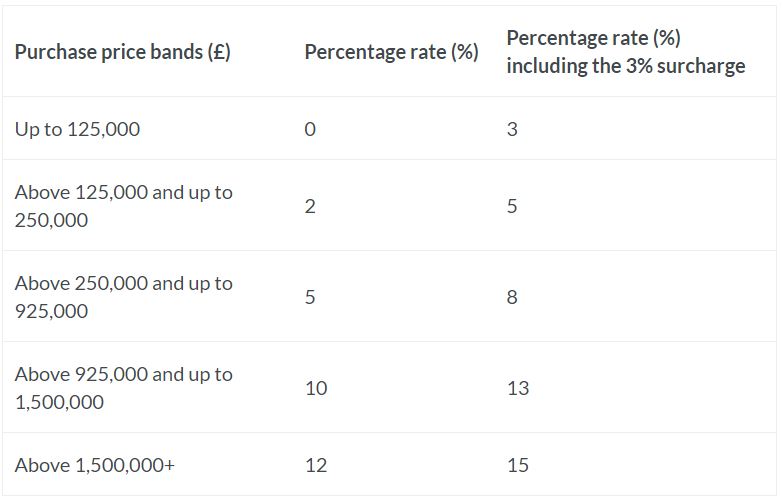

11032021 When you buy any property in addition to your main residence be it a second home a holiday home or a buy-to-let there is an additional Stamp Duty charge known as Higher Rates on Additional Dwellings tax HRAD. This starts at 3 and then rises in bands climbing to 15 for the most expensive properties.

Stamp Duty What You Have To Know About The Changes Stamp Duty Stamp Duties

Stamp Duty What You Have To Know About The Changes Stamp Duty Stamp Duties

Stamp duty land tax SDLT is a tax on property or land bought in England and Northern Ireland.

Is there a stamp duty holiday on buy to let. Does the SDLT holiday apply to buy to let. These measures were unveiled by chancellor Rishi Sunak when the nation first emerged from coronavirus lockdown last summer with an original deadline date of 31st March 2021. Ill provide you with an example of someone buying an additional property in England and Northern Ireland.

What is stamp duty. 04032021 Rates are different depending on whether the property is residential a second home or buy-to-let. Properties worth up to 500000 are currently exempt from the property tax meaning savings of.

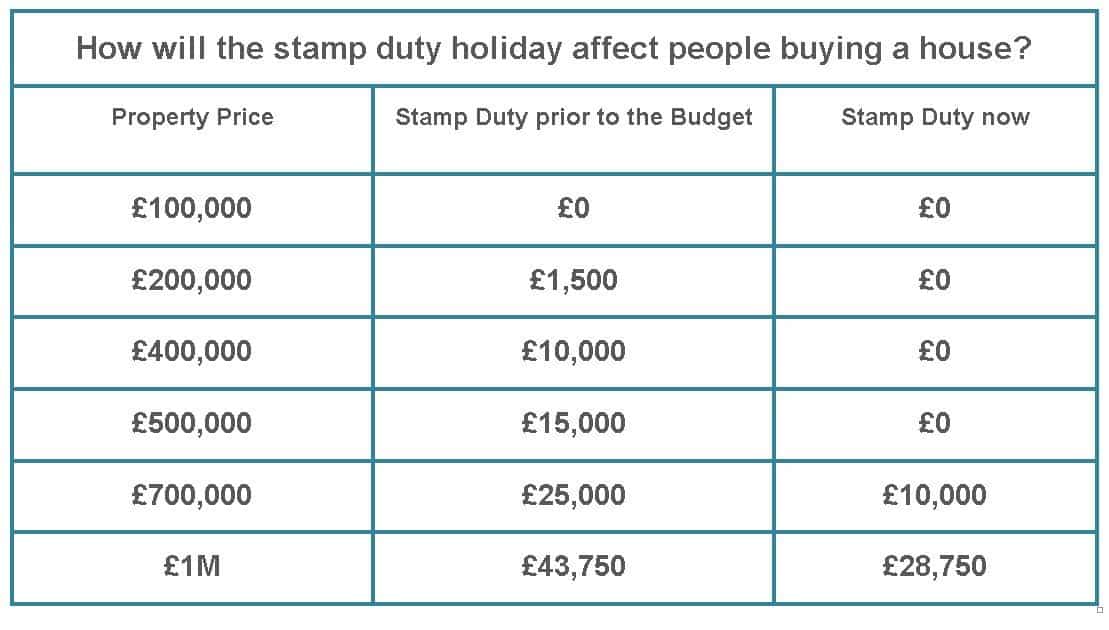

However the stamp duty holiday will still apply to the original Stamp Duty Rate meaning there is still a benefit for Buy to Let investors. Stamp duty holiday boosts buy-to-let landlords The threshold at which stamp duty kicks in will be lifted from 125000 to 500000 in England and Northern Ireland. This confirms that UK buy to let landlords will benefit from the Stamp Duty Land Tax Holiday from 8th July 2020 to 31st March 2021.

14122020 Buy-to-let landlords are joining the rush to take advantage of the stamp duty holiday with the proportion of property sales agreed with investors hitting its. However the pre-existing 3 surcharge on such purchases will still apply. So property investors spending less than 500000 will only need to pay 3 tax on top of the.

FT Montage Getty Chris. We have seen a surge in enquiries and instructions for buy to let property since the announcement and you can understand why. 01092020 For landlords who tend to buy properties valued up to 125000 there will be no savings at all of course meaning the Stamp Duty holiday has no impact on them at all.

24022021 When you buy any property in addition to your main residence be it a second home a holiday home or a buy-to-let there is an additional stamp duty charge. The tax break which the Chancellor introduced in July 2020 was brought in to help boost the housing market. These properties are.

09072020 Those purchasing second homes or buy-to-let properties also benefit from the stamp duty holiday. Since April 2016 anyone buying an additional property including buy to let landlords and those purchasing a second home have paid a 3 surcharge on the standard rate of stamp duty. Under the current scheme buyers do not have to pay stamp.

The stamp duty holiday will now not end until 31 June and it is estimated that there will be around 300000 property transactions that will benefit from the tax break. This 0 Stamp Duty Land Tax holiday rate applies to UK landlords irrespective if they purchase a buy to let property in. 24032021 Stamp duty holiday for buy to let property investors Stamp duty land tax SDLT is a tax on the purchase of property or land in England and Northern Ireland.

01102020 There hasnt been much good news in 2020. 18032021 A buy-to-let is a property that has been bought to be rented out to tenants rather than to be lived in by the buyer. How does the stamp duty holiday work.

09092020 Professionalisation more appealing than ever Since Chancellor Rishi Sunak announced a stamp duty holiday until March 2021 buyers have been rushing to the market. Property investors who purchase through limited companies will also be exempt up to 500000. But in July 2020 homebuyers got some in the form of a stamp duty holiday until 31 March 2021.

10032021 The stamp duty holiday means that property buyers pay no stamp duty on the first 500000 of the purchase price when buying in England or Northern Ireland. 04032021 Rishi Sunak has used the Budget to extend the stamp duty holiday until the end of June. 09072020 Chancellor Rishi Sunak has announced a stamp duty holiday which will run until 31 March 2021 in a bid to boost the struggling housing market which has taken a hit due to the coronavirus pandemic.

However if you are buying a second home does the stamp. As the SDLT holiday applies to purchases of all residential properties up to 500000 it does mean that property investors in the buy to let market stand to benefit. This starts at 3 and then rises in bands climbing to 15 for the most expensive properties.

Stamp Duty Calculator Planned Housing Developments In Devon Cornwall Somerset Dorset

Stamp Duty Calculator Planned Housing Developments In Devon Cornwall Somerset Dorset

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

What Is The New Stamp Duty Rate Will I Have To Pay Home Security Systems Best Home Security System Home Automation System

What Is The New Stamp Duty Rate Will I Have To Pay Home Security Systems Best Home Security System Home Automation System

Stamp Duty Holiday What Does It Mean For Investors

Stamp Duty Holiday What Does It Mean For Investors

Startup Hotspots Being A Landlord Buy To Let Mortgage Richmond Upon Thames

Startup Hotspots Being A Landlord Buy To Let Mortgage Richmond Upon Thames

What Is Stamp Duty My Property Property Stamp Duty

What Is Stamp Duty My Property Property Stamp Duty

New Stamp Duty Charges For Residential Property Purchases North Ainley Solicitors

New Stamp Duty Charges For Residential Property Purchases North Ainley Solicitors

Stamp Duty Buy To Let Business Loans Accounting Accounting Services

Stamp Duty Buy To Let Business Loans Accounting Accounting Services

Stamp Duty Calculator House Property And Business For Sale Http Www Conveyancingqueensland Com Buying Stamp Duty First Home Owners Buying Quotes Stamp Duty

Stamp Duty Calculator House Property And Business For Sale Http Www Conveyancingqueensland Com Buying Stamp Duty First Home Owners Buying Quotes Stamp Duty

Uk S Post Lockdown Buy To Let Hotspots Revealed Let It Be Reveal Uk Post

Uk S Post Lockdown Buy To Let Hotspots Revealed Let It Be Reveal Uk Post

Who Benefits From The Stamp Duty Holiday

Who Benefits From The Stamp Duty Holiday

5 Things You Should Know Before Renewing Rental Agreement For Shops Agreement Being A Landlord Rental

5 Things You Should Know Before Renewing Rental Agreement For Shops Agreement Being A Landlord Rental

9 Reasons Why Should You Get An Online Rent Agreement Agreement Being A Landlord Tenancy Agreement

9 Reasons Why Should You Get An Online Rent Agreement Agreement Being A Landlord Tenancy Agreement

Gavin Gibbons On Twitter Home Buying Process Stamp Duty Investment Property

Gavin Gibbons On Twitter Home Buying Process Stamp Duty Investment Property

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Holiday Property Auction Pearson Estate Agent

Stamp Duty Holiday Property Auction Pearson Estate Agent

Post a Comment for "Is There A Stamp Duty Holiday On Buy To Let"