Can Use Cpf For Additional Buyer Stamp Duty

Exercising your Option to Purchase for resale private property. To find out if you can use your CPF to pay Stamp Duty please visit the CPF website or call CPF at 1800 227 1188 Monday to Friday 800 am.

Buying Property Under Trust To Avoid Absd

Buying Property Under Trust To Avoid Absd

You can also use your CPF funds to pay for BSD and ABSD.

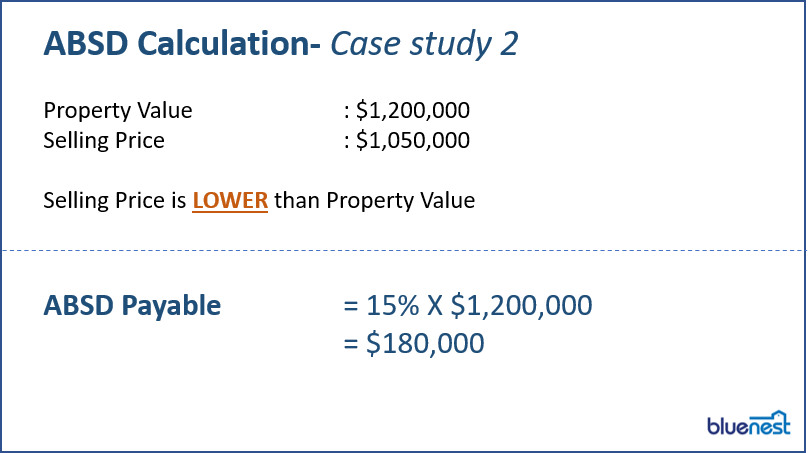

Can use cpf for additional buyer stamp duty. ABSD and BSD are computed on the purchase price as stated in the dutiable document or the market value of the property whichever is the higher amount. From 2016 onwards members aged 55 and above get an additional 1 on the first 30000 as well. The answer to your question is YES.

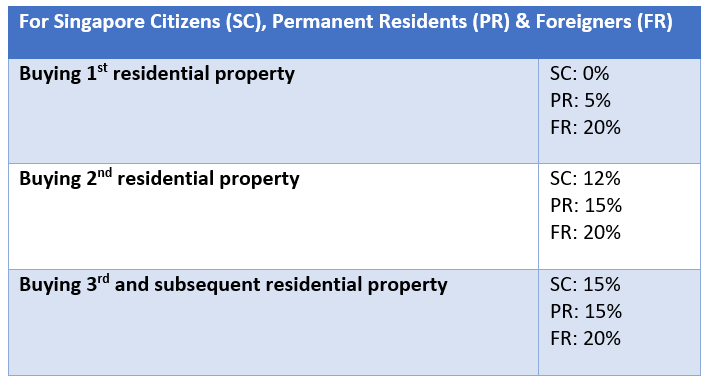

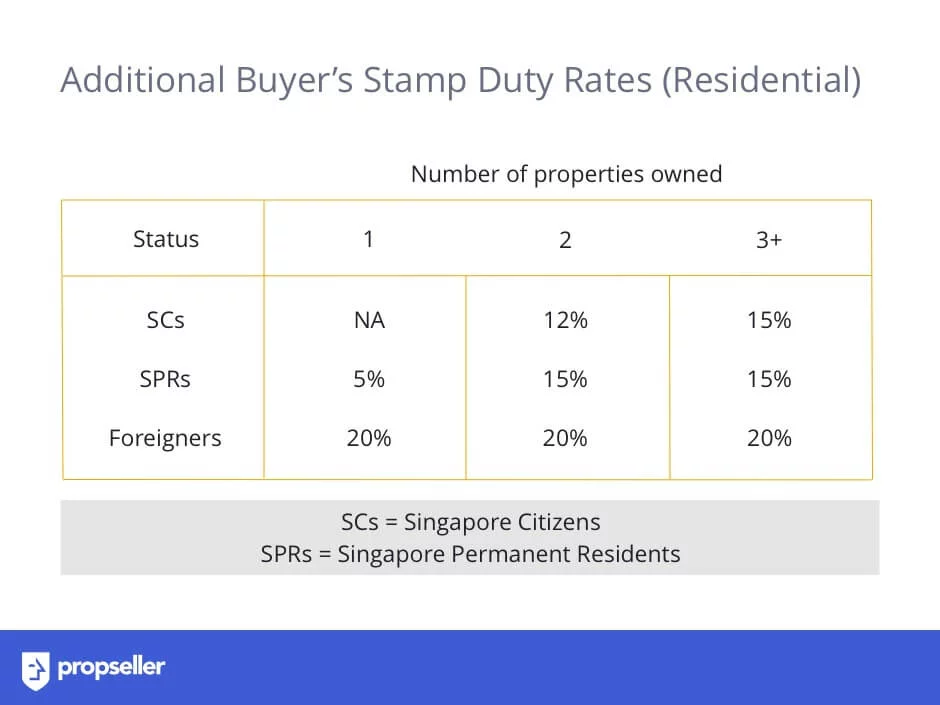

29042013 Both the ABSD and BSD can be reimbursed from the buyers CPF if you wish to do so. 27082019 Additional Buyers Stamp Duty ABSD is a tax levied on non-Singapore Citizen property-buyers as well as Singapore Citizens who already own a property on top of the Buyers Stamp Duty. Payment of Buyer Stamp Duty and Additional Buyer Stamp Duty is required within 14 days from.

CPF savings can be used to pay the stamp duty and survey fees. 03102020 Stamp duties such as Buyers Stamp Duty BSD and Additional Buyers Stamp Duty ABSD can be paid from your account. 22012020 Can you use CPF to make payment for Stamp Duty on Residential Property.

For more property news resources and useful content like this article check out PropertyGurus guides section. Buyer Stamp Duty BSD. Using CPF funds to pay Stamp Duty including ABSD is subject to the terms and conditions under the Private Properties and Public Housing Schemes.

However since ABSD is payable within 14 days you will need to pay cash first and seek reimbursement from your CPF account subsequently. 05012017 In accordance to Singapore Budget 2018 Buyers Stamp Duty has been increased from 3 to 4 on residential properties valued at 1 million or more. The first 5 downpayment must be cash.

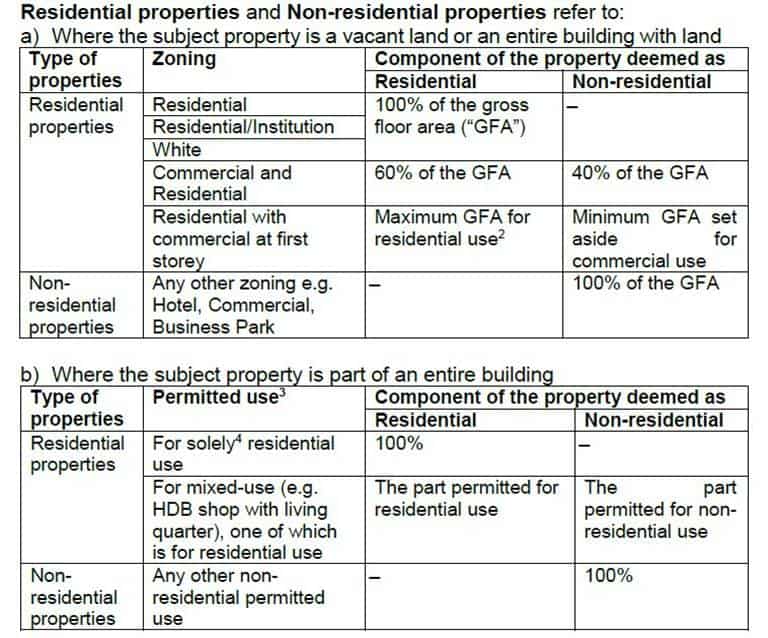

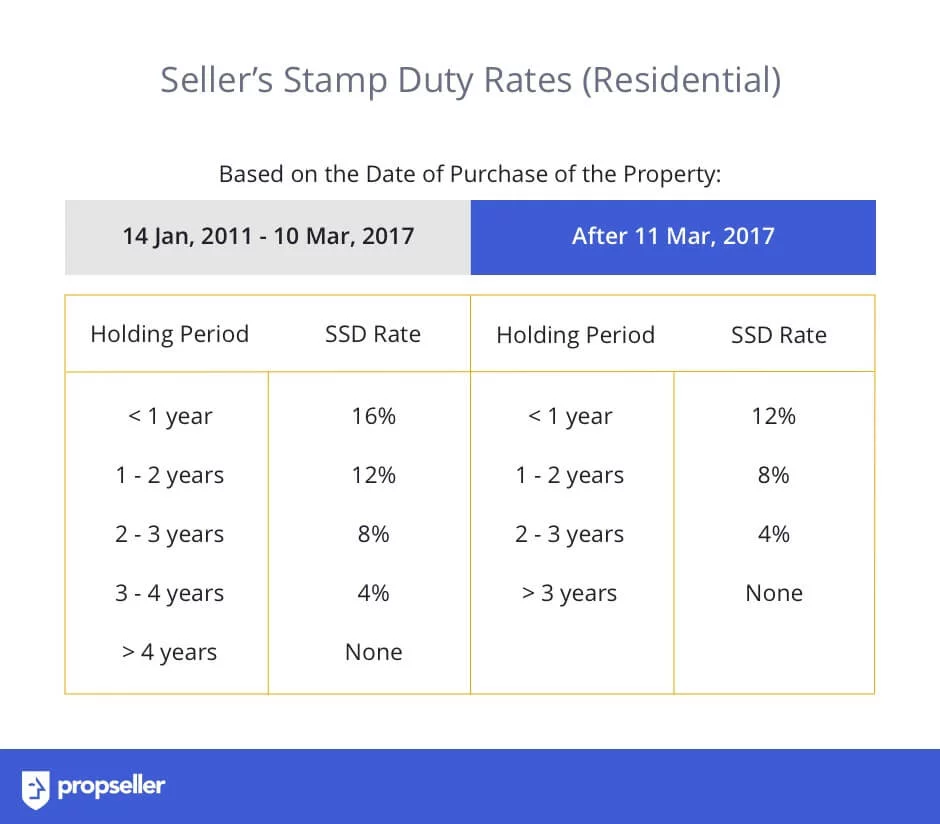

07102014 While there is no Additional Buyer Stamp Duty ABSD for commercial properties industrial properties a type of commercial properties attracts the Sellers Stamp Duty. For more information please refer to this link. A buyer CANNOT use his CPF to pay for the following.

You may also be able to use your Central Provident Fund funds to pay the BSD and ABSD. Individual owners can use their CPF savings to buy commercial. 4 is applied to the portion of the property that exceeds 1 million.

You can use your CPF money in the ordinary account to pay for the BSD as well as the ABSD. 03122020 Stamp duties are payable within 14 days of exercising the option to purchase. Simply apply for a one-time reimbursement from your CPF account together with your application to use your CPF savings to pay for stamp duty after having made the initial payment.

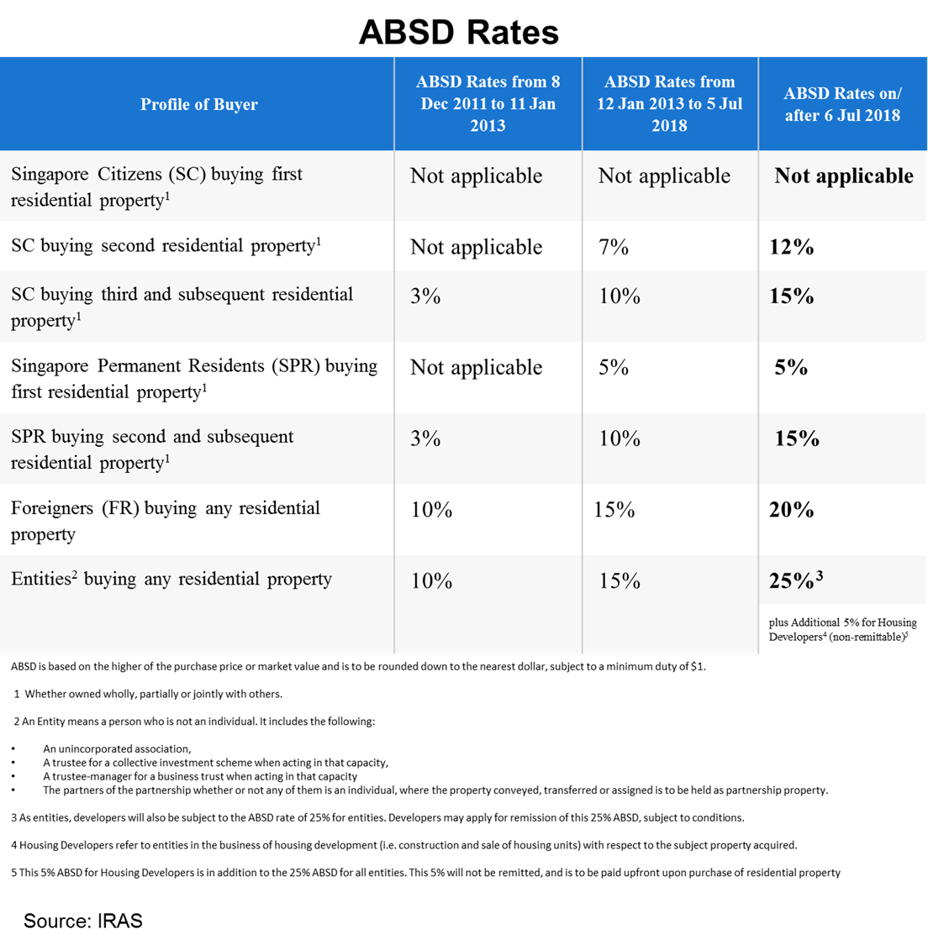

First pay via any of the methods above. If you are buying your second or subsequent property you will also be. The ABSD rates have been adjusted on 6 Jul 2018.

30042016 Yes you can. 23112020 BSD and ABSD have to be paid in full and cannot be paid in instalments. The following is how BSD is now computed.

This is 15 of the sale price if sold on the first year 10 for the second year and 5 for the third year. If you purchasing a second property using CPF you must set aside the prevailing Basic Retirement Sum BRS. This means that if you only approach your lawyers near the expiry date your CPF funds will not be released in time.

Yes and very happy lawyers too. Further information can be obtained from the IRAS website and the CPF website. 04102019 Can I Use CPF To Pay for The Stamp Duties.

However monthly service and conservancy charges and other charges related to the use of the property including taxes cannot be paid with your CPF savings. You can only use funds from you Ordinary Account for payment. Unless the property is under construction you have to pay the taxes from your pockets first and later get a reimbursement from your CPF account.

Additional Buyer Stamp Duty ABSD. However you will need to pay the BSD and ABSD first and then seek a reimbursement from your CPF account. USE CPF TO PAY FOR STAMP DUTIES AND LEGAL FEES When you purchase a house you will have to pay the Buyers Stamp Duty BSD.

Stamp Duties and Survey Fees. However you will have take note of the following. 17012018 Furthermore an additional 1 is paid on the first 60000 of a members combined CPF balance.

Can I use CPF savings to purchase a property. You can use CPF for the 20 downpayment. Yes you can use your CPF Ordinary Account CPF OA to make payment for Stamp Duty on Residential Property.

However the usual practice is to pay cash and then reimburse it with your CPF. However an application to the CPF Board to use your CPF funds to pay stamp duties directly may usually take 3 weeks to process. Additional Buyers Stamp Duty ABSD Liable buyers are required to pay ABSD on top of the existing Buyers Stamp Duty BSD.

24022021 Yes you can use CPF savings to pay the stamp duty and survey fees including ABSD.

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

Methods To Beat Absd And Own Multiple Properties In Singapore 2021

Methods To Beat Absd And Own Multiple Properties In Singapore 2021

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

New Property Cooling Measure Increase Absd Rates Tighten Loan Limits Singapore Property Top Review Latestnewlaunch Com

New Property Cooling Measure Increase Absd Rates Tighten Loan Limits Singapore Property Top Review Latestnewlaunch Com

Can I Use My Cpf For Stamp Duty And Other Questions By Patkoproperty Medium

Can I Use My Cpf For Stamp Duty And Other Questions By Patkoproperty Medium

Additional Buyer S Stamp Duty Absd What Are Your Options In 2019 Singapore Property News Resource All The Info You Need About Hdb Resale Singapore Condos New Launches And Landed Properties

Additional Buyer S Stamp Duty Absd What Are Your Options In 2019 Singapore Property News Resource All The Info You Need About Hdb Resale Singapore Condos New Launches And Landed Properties

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

How To Calculate Singapore Property Stamp Duties Bsd Absd And Ssd Sg Home Investment

How To Calculate Singapore Property Stamp Duties Bsd Absd And Ssd Sg Home Investment

Property Related Taxes When Buy And Own New Development

Property Related Taxes When Buy And Own New Development

Stamp Duty For Singapore Property Purchase Bsd Absd Requirementmy Fav Prop

Stamp Duty For Singapore Property Purchase Bsd Absd Requirementmy Fav Prop

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

Get The Sums Right Before Decoupling To Buy Property Business News Top Stories The Straits Times

Get The Sums Right Before Decoupling To Buy Property Business News Top Stories The Straits Times

Click Here Check Additional Buyer Stamp Duty Buyer Stamp Duty Seller Stamp Duty Etc Rose Tay

Click Here Check Additional Buyer Stamp Duty Buyer Stamp Duty Seller Stamp Duty Etc Rose Tay

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Post a Comment for "Can Use Cpf For Additional Buyer Stamp Duty"