Is There A Stamp Duty Holiday On Second Homes

08072020 A stamp duty holiday will start immediately the chancellor today confirmed in his summer statement. So a holiday home in Tuscany or a timeshare in Florida will mean you pay the stamp duty for second homes rate even if you are buying your first home in the UK.

Stamp Duty Calculator Planned Housing Developments In Devon Cornwall Somerset Dorset

Stamp Duty Calculator Planned Housing Developments In Devon Cornwall Somerset Dorset

11122020 There are other important costs to factor in when purchasing a second property Good Move says.

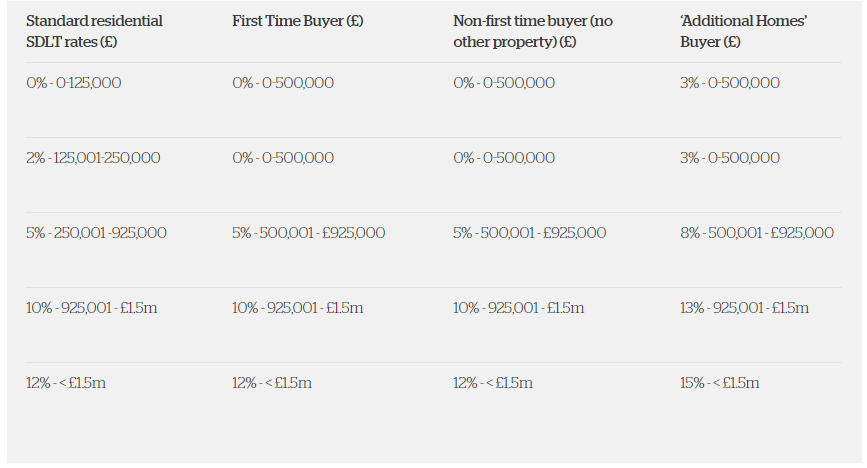

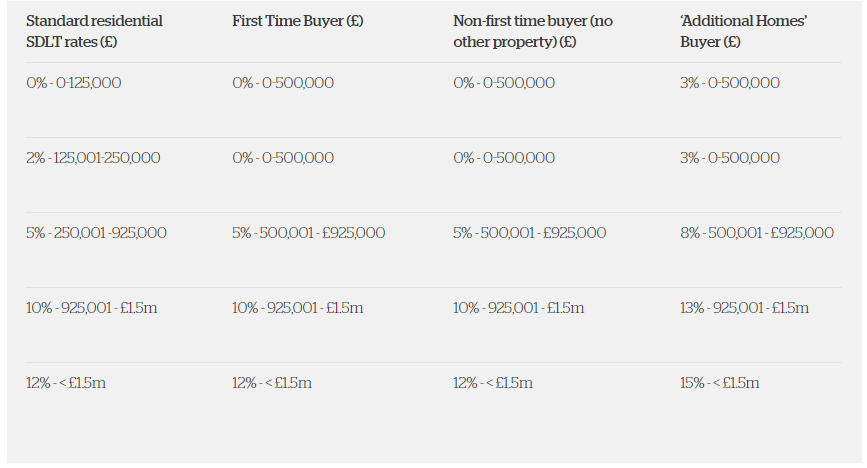

Is there a stamp duty holiday on second homes. 09072020 To get an overall Stamp Duty figure on a second property work out the regular cost first with our handy calculator. Yes the stamp duty holiday applies when purchasing a second home. 5 on purchases between 125001 and 250000.

02032021 Will the stamp duty holiday apply to second homes. If youre buying a second property or a property on a buy-to-let basis you will still benefit from the. 13 on purchases above.

Stamp duty for buy to let property has increased substantially from April 2016. Stamp duty for second homes also attracts a 3 percent surcharge from April. Ad Book in 85000 destinations across the world.

July 8 2020 The Chancellor announced a stamp duty holiday in July. 17022021 SDLT Holiday for second home buyers. How does the stamp duty holiday impact the surcharge.

Landlords and second-home buyers can also make use of the tax cut. Under the changes homebuyers will not pay any tax on main homes up to 500000 until 31 March 2021. But they still have to pay the extra 3 of stamp duty they were.

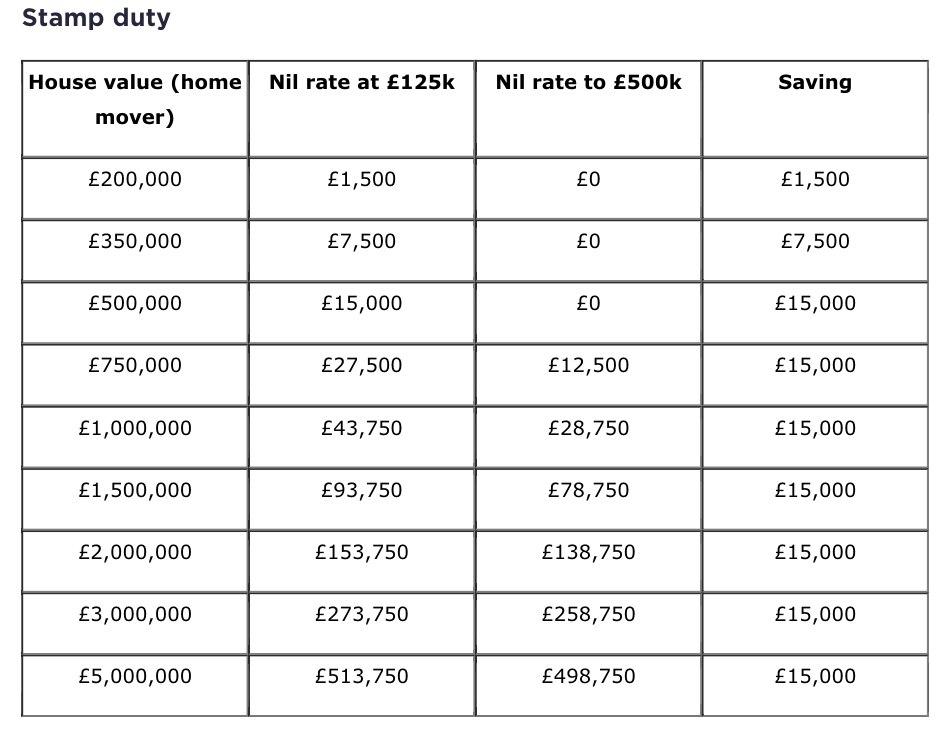

13072020 Does stamp duty holiday apply to a second home. 19042021 It has meant a saving of up to 15000 for people buying homes. 18112020 Outside of the stamp duty holiday if youre a landlord or otherwise buying a second home youre required to pay a 3 surcharge on top of the normal rates.

Stamp duty is not currently applicable on homes worth up to 500000 between now and the end of the stamp duty holiday in March next year the deadline is March 31 2021 although the pressure. Then calculate 3 of the purchase price and add the two figures together. Stamp duty refunds are available for home movers replacing their main residence.

The exemption of holiday homes from stamp duty makes them an attractive prospect for those wishing to invest in a second property for holidaying think a peaceful country. 8 on purchases above 250001 and 925000. The average stamp duty saving will be 4500 with nine out of ten buyers this year now paying no stamp duty at all on purchases.

Landlords and those purchasing additional dwellings still get the tax cut but. Heres how much you can save what it means for second homes and everything else you need to know about the change. 04032021 Buy-to-let landlords and second home buyers are eligible for the tax cut but must pay an additional three per cent tax Does the stamp duty holiday apply for a second home.

04092019 Thats right no stamp duty calculators or big wads of cash needed. You purchase a property valued under 40000 or the share of the property you buy is valued under 40000 You buy a caravan mobile home or house boat Even if youre not exempt from paying Stamp Duty on a second property you can sometimes claim back the Stamp Duty surcharge. 08072020 For second homes or buy to let properties.

08032021 Home movers who bought the average property for 248000 would save 2460 on stamp duty while Brits buying a second home for the average price tag would save a whopping 9900. 3 on purchases up to 125000. 01042021 You are liable for the 3 additional stamp duty even if the only other property you own is abroad.

This includes stamp duty as normal plus a 3 surcharge. Mobile homes caravans and houseboats are exempt. Ad Book in 85000 destinations across the world.

08072020 The Chancellor today announced a stamp duty holiday. The original home must be sold within 3 years. Some second-home purchases are exempt from stamp duty altogether however.

11122020 Youre only exempt from the Stamp Duty on a second home if. In July 2020 the Chancellor announced that the stamp duty tax threshold was being temporarily raised from 125000 standard rate to 500000 until 31 March 2021 and this date was later extended to 30 June 2021.

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

How Does The Stamp Duty Holiday Work For Second Homes And Buy To Let Purchases

How Does The Stamp Duty Holiday Work For Second Homes And Buy To Let Purchases

Wales Raises Stamp Duty By 1 On Second Homes Propertywire

Wales Raises Stamp Duty By 1 On Second Homes Propertywire

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Does The Stamp Duty Holiday Apply To Second Homes Mywallethero

Does The Stamp Duty Holiday Apply To Second Homes Mywallethero

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday 2020 London Property News 1newhomes

Stamp Duty Holiday 2020 London Property News 1newhomes

Does The Stamp Duty Holiday Apply For A Second Home Or Buy To Let Property How The Tax Break Extension Works

Does The Stamp Duty Holiday Apply For A Second Home Or Buy To Let Property How The Tax Break Extension Works

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Post a Comment for "Is There A Stamp Duty Holiday On Second Homes"