How Does The Stamp Duty Holiday Work For Second Homes

The amount you pay depends on whether you live in England and N Ireland Wales or Scotland which stamp duty band your property price falls into whether you are a first time buyer and whether you are buying your primary residency or a second home. 08072020 Second homes are taxed at higher rates of stamp duty its 3 per cent on purchases up to 125000 5 per cent on the portion worth between 125001 and 250000 and 8 per cent on the bit worth between 250001 and 925000.

Uk Homebuyers Told To Act Fast To Beat Stamp Duty Holiday Deadline Stamp Duty The Guardian

Uk Homebuyers Told To Act Fast To Beat Stamp Duty Holiday Deadline Stamp Duty The Guardian

08072020 First home movers who bought a home for the average property price at 248000 would save 2460 on stamp duty if the threshold is raised.

How does the stamp duty holiday work for second homes. Yes the stamp duty holiday applies when purchasing a second home. The move was aimed. Outside of the stamp duty holiday if youre a landlord or otherwise buying a second home youre required to pay a 3 surcharge on top of the normal rates.

19042021 What is the stamp duty holiday. 04032021 How does the stamp duty holiday work. The charge applies above the.

08072020 Stamp duty is a tax paid by people when they buy a property. So a holiday home in Tuscany or a timeshare in Florida will mean you pay the stamp duty for second homes rate even if you are buying your first home in the UK. It allows people to save up to.

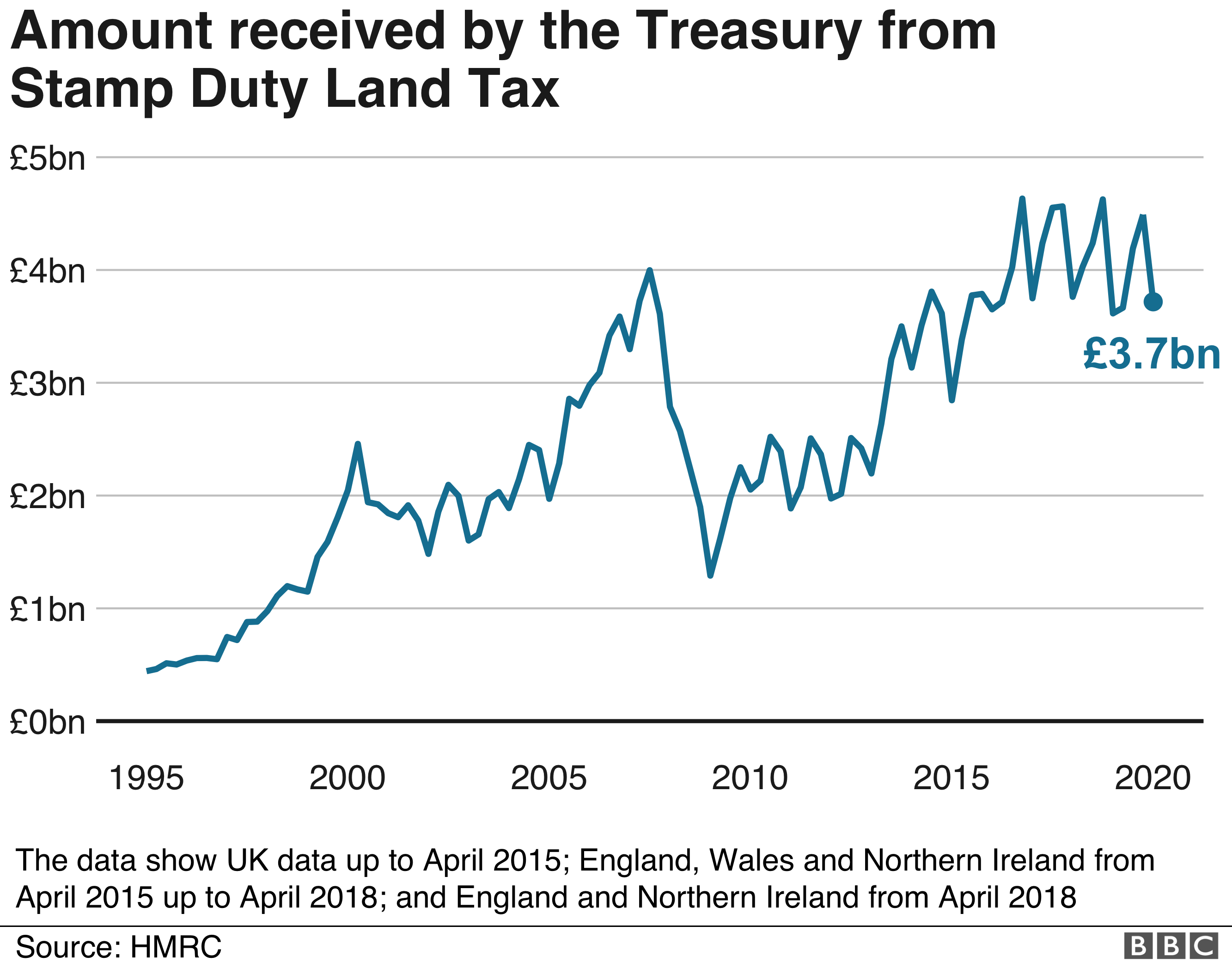

22072020 Prior to the introduction of the stamp duty holiday anyone purchasing a second home would have to pay stamp duty at the usual rate plus a 3 charge. 13072020 Does stamp duty holiday apply to a second home. 08032021 The Treasury announced the stamp duty holiday in a bid to breathe life into the property market after it effectively froze during the first lockdown with viewings sales and.

The stamp duty holiday means that only the 3 charge is payable on property purchases of 500000 or less. 24022021 The stamp duty bands or slices will remain otherwise unchanged. Landlords and those purchasing additional dwellings still.

09072020 Stamp duty is a damaging tax in normal times and acts to reduce the number of transactions. If a property is in my spouses name can we dodge the additional stamp duty rate. Stamp duty is a tax paid on property purchases.

Some second-home purchases are exempt from stamp duty. 11122020 If you buy a second home or a buy-to-let property youll pay Stamp Duty at the standard rates plus a 3 surcharge on each band. The Stamp Duty Tax rates for second homes and buy-to-let properties are the same because they both qualify as second residences.

The holiday will boost transactions and provide a stimulus through the additional spending that is. You pay 12 on anything over 15million. 02032021 Chancellor Rishi Sunak announced a stamp duty holiday for anyone buying new homes up to the value of 500000 in July last year.

Then calculate 3 of the purchase price and add the two figures together. You pay 10 if it is between 925001 and 15million. How much can you save with the stamp duty holiday.

01102020 The good news is that yes the stamp duty holiday does apply to second homes. Mr Sunak confirmed that the policy would come into effect. The main driving force behind the change was to stimulate the housing market following the coronavirus pandemic.

18112020 Does stamp duty apply to second homes. Efforts are being made to persuade Mr Sunak to extend the stamp duty holiday which is worth up to 15000 per property. 08072020 You pay 5 if between 250001 and up to 925000.

Sean Randall If this does not work buyers worried about completing on or after 1 April 2021 could take the keys or pay 90 of the price before 1 April 2021 which would then give them the benefit. Under the current scheme buyers do not have to pay stamp duty on the value of a property up to 500000 rather than 125000. First home movers who bought a home for the average property price at 248000 would save 2460 on stamp duty.

For second homes or buy to let properties. 09072020 To get an overall Stamp Duty figure on a second property work out the regular cost first with our handy calculator. But for those buying a second home for the average price tag would save a whopping 9900.

The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020. 22032021 Since April 2016 anyone buying an additional property essentially second homes and buy-to-lets has had to pay an additional three percentage points in stamp duty. Instead stamp duty will jump straight to 5 for the slice from 500000 to 925000 and then to 10 for the slice up to 15 million.

01042021 You are liable for the 3 additional stamp duty even if the only other property you own is abroad. How does the stamp duty holiday impact the surcharge. So for the duration of the holiday there will be no 2 stamp duty band.

There are a number of free calculators online that you can use to work out how much stamp duty you currently have.

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

Sunak S Stamp Duty Holiday Extension Has Merely Inflamed The Housing Market Nils Pratley The Guardian

Sunak S Stamp Duty Holiday Extension Has Merely Inflamed The Housing Market Nils Pratley The Guardian

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extended Homeowners Alliance

Stamp Duty Holiday Extended Homeowners Alliance

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Is The Stamp Duty Holiday The Best Time To Buy A House Expert Answers Your Questions Mirror Online

Is The Stamp Duty Holiday The Best Time To Buy A House Expert Answers Your Questions Mirror Online

Does The Stamp Duty Holiday Apply To Second Homes Mywallethero

Does The Stamp Duty Holiday Apply To Second Homes Mywallethero

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

Does The Stamp Duty Holiday Apply For A Second Home Or Buy To Let Property How The Tax Break Extension Works

Does The Stamp Duty Holiday Apply For A Second Home Or Buy To Let Property How The Tax Break Extension Works

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Holiday The Winners And The Losers Bbc News

Everything You Need To Know About The Higher Stamp Duty Charges That Came Into Effect On 1 April 2016 For Anyone Buyi Stamp Duty Buying A New Home Holiday Home

Everything You Need To Know About The Higher Stamp Duty Charges That Came Into Effect On 1 April 2016 For Anyone Buyi Stamp Duty Buying A New Home Holiday Home

Post a Comment for "How Does The Stamp Duty Holiday Work For Second Homes"