Does Stamp Duty Exemption Apply To Second Homes

Yes the stamp duty holiday applies when purchasing a second home. Minimum property purchase price.

Cover Story Secondary Market Seeing More Interest The Edge Markets

Cover Story Secondary Market Seeing More Interest The Edge Markets

But they still have to pay the extra 3 of stamp duty they were charged under the previous rules.

Does stamp duty exemption apply to second homes. Some second properties are exempt from stamp duty these include the following. You purchase a property valued under 40000 or the share of the property you buy is valued under 40000 You buy a caravan mobile home or house boat Even if youre not exempt from paying Stamp Duty on a second property you can sometimes claim back the Stamp Duty surcharge. Thats because youll only own one property.

Properties where the purchase price is less than 40000. This applies to property purchases over 40000. 02032021 If youre buying a second property or a property on a buy-to-let basis you will still benefit from the increased 500000 threshold however you will still have to pay the Stamp Duty.

These rates apply. However the pre-existing 3 surcharge on such purchases will still apply. 08072020 The tax holiday will apply from July 8 2020 until March 31 2021 and cut the payments due for everyone who would have paid stamp duty.

However they still have to pay the additional three per cent rate that has always been in place for second home. 01042021 If you dont own any property but decide to purchase a buy-to-let property then you wont pay the stamp duty for second homes. 04032021 Buy-to-let landlords and second home buyers are eligible for the tax cut.

Dailymotion Video Player - Rishi Sunak says 500000 stamp duty threshold. 01102020 The good news is that yes the stamp duty holiday does apply to second homes. It doesnt apply to caravans mobile homes or houseboats.

The main driving force behind the change was to stimulate the housing market following the coronavirus pandemic. 07012016 According to the consultation document Higher rates of Stamp Duty Land Tax SDLT on purchases of additional residential properties recently published by. 04032021 Buy-to-let landlords and second home buyers are eligible for the tax cut but must pay an additional three per cent tax.

If the value of your second home or the share of the property you buy is less than 40000 you dont need to pay the tax. The government has said that nearly nine out of ten people. 09072020 Those purchasing second homes or buy-to-let properties also benefit from the stamp duty holiday.

19042021 Landlords and second-home buyers can also make use of the tax cut. Property investors who purchase through limited companies will also be exempt up to 500000. 08072020 If you purchase a residential property between 8 July 2020 to 30 June 2021 you only start to pay SDLT on the amount that you pay for the property above 500000.

11122020 Youre only exempt from the Stamp Duty on a second home if. Landlords and those purchasing additional dwellings still. This means that if you purchase a new property after inheriting 50 or less share of a property then you will not be subject to the extra 3 stamp duty rate.

Caravans mobile homes or houseboats. 04092019 The exemption of holiday homes from stamp duty makes them an attractive prospect for those wishing to invest in a second property for holidaying think a peaceful country or coastal bolthole for limitless year-round trips. 13072020 Does stamp duty holiday apply to a second home.

06032020 However you may be exempted from the stamp duty on a second home if you only inherit a share of a property. 18112020 Some second-home purchases are exempt from stamp duty altogether however. But you will pay if you have a part-share in another property have inherited a property or are buying with someone else who already owns a property.

If youre buying an additional property such as a second home youll have to pay an extra 3 in Stamp Duty on top of the revised rates for each band up until 30 June 2021. 15062020 What properties are excluded from the stamp duty for second homes. 08072020 Second homes are taxed at higher rates of stamp duty its 3 per cent on purchases up to 125000 5 per cent on the portion worth between 125001 and 250000 and 8 per cent on the bit worth between 250001 and 925000.

The Most Anticipated Fintech Events In Asia 2016 Fintech Event Asia

The Most Anticipated Fintech Events In Asia 2016 Fintech Event Asia

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Home Ownership Campaign Hoc 2020 Projects The Pros And Cons Propertyguru Malaysia

Home Ownership Campaign Hoc 2020 Projects The Pros And Cons Propertyguru Malaysia

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

New Tax Regime Tax Slabs Income Tax Income Tax

New Tax Regime Tax Slabs Income Tax Income Tax

Rpgt Stamp Duty Exempted Will You Buy Or Sell Your House

Rpgt Stamp Duty Exempted Will You Buy Or Sell Your House

Self Assessment Tax Returns And The Uk Housing Market Brighton London Hove Capital Gains Tax Tax Advisor Tax Accountant

Self Assessment Tax Returns And The Uk Housing Market Brighton London Hove Capital Gains Tax Tax Advisor Tax Accountant

Where To Buy A Second Home And Pay Less Stamp Duty Stamp Duty New Home Developments House Prices

Where To Buy A Second Home And Pay Less Stamp Duty Stamp Duty New Home Developments House Prices

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

First Time Home Buyer Entitlements Privileges And Benefits Propsocial

First Time Home Buyer Entitlements Privileges And Benefits Propsocial

Excellent Things To Know Before Selling Your House In India Https Www Edocr Com V Jen1nvog Realestatei Selling Your House Things To Know Amazing Funny Facts

Excellent Things To Know Before Selling Your House In India Https Www Edocr Com V Jen1nvog Realestatei Selling Your House Things To Know Amazing Funny Facts

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty Exemption On Purchase Of Property Under Hoc 2020 2021 Ey Malaysia

Stamp Duty Exemption On Purchase Of Property Under Hoc 2020 2021 Ey Malaysia

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Section 8 Company Registration Company Company Id Section 8

Section 8 Company Registration Company Company Id Section 8

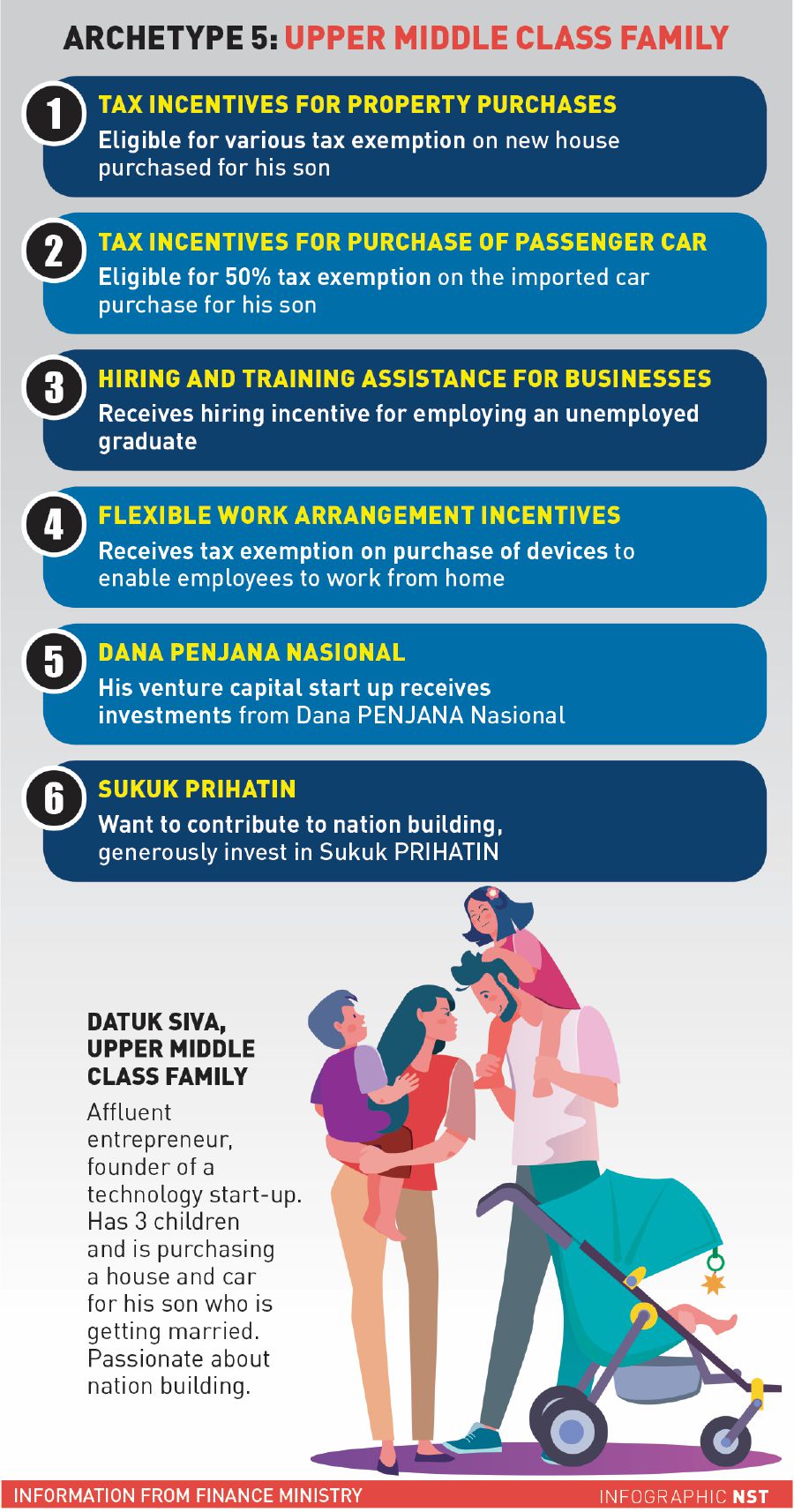

Penjana Economic Package New Property Incentives In 2020 Donovan Ho

Penjana Economic Package New Property Incentives In 2020 Donovan Ho

Post a Comment for "Does Stamp Duty Exemption Apply To Second Homes"