How To Count Stamp Duty In Malaysia

Always The Lowest Price Guarantee. Franking Machine and Revenue Stamp will be replaced by receiptstamp certificate which generate by STAMPS.

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Malaysia imposes stamp duty on chargeable instruments executed on certain transactions.

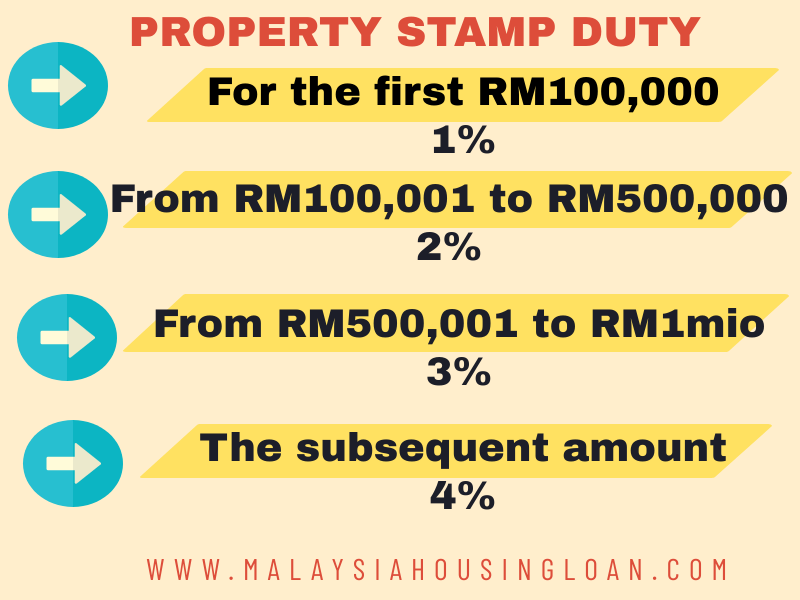

How to count stamp duty in malaysia. On the first RM 100000 RM 1 is collected per RM 100 which totals RM 1000. 18022021 Let us look into the rates of stamp duty in Malaysia. 16112020 Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid First RM100000 x 1 Next RM400000 x 2 05 of loan amount RM450000 RM1000 RM8000 05 x RM450000.

Purchase mortgage loan refinance in Malaysia. We want you to prepare for the Malaysia stamp duty information before you grab any property for the year of 2021. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949.

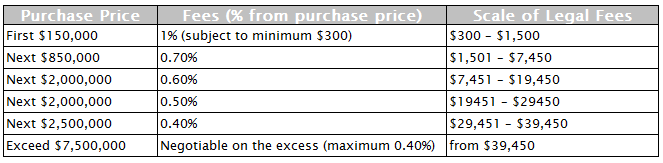

Calculate Stamp Duty Legal Fees for property sales. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the stamp duty is 1000 for each. For the ad valorem duty the amount payable will vary depending on type and.

However stamp duty relief is available for the following circumstances subject to meeting the pre-requisite. 01042020 The stamp duty for the transfer of the property to the beneficiary regardless of whether the deceased has left a will is RM10 Item 32i First Schedule Stamp Act 1949. 07012019 Ringgit Malaysia loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is available for RM loan agreements or RM loan instruments without security and repayable on demand or in single bullet repayment.

Stamp duty on foreign currency loan agreements is generally capped at RM2000. In summary the stamp duty is tabulated in the table below. The Sale and Purchase Agreement.

On the next RM 400000 as much as RM 8000 will then be paid. 21052015 As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Calculate now and get free quotation.

At least two documents will attract stamp duty in a conveyancing transaction. There are two types of stamp duties which are ad valorem duty and fixed duty. Save Big at Agoda.

Always The Lowest Price Guarantee. The transfer of shares will attract stamp duty at the rate of 03 on the consideration paid or market value of the shares whichever is the higher. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

25092018 STAMPS is an Electronic Stamp Duty Assessment and Payment System via internet. Ad Book Now. I got the following table from the LHDN Office.

The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 July or later. - Malaysia Housing Loan. Feel free to use our calculators below.

19032013 An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. The assessment and collection of stamp duties is governed by the Stamp Act 1949. Ad Book Now.

There are two types of Stamp Duty namely ad valorem duty and fixed duty. 24072019 Stamp duty is one of the unavoidable costs in property purchase in Malaysia. In general term stamp duty will be imposed to legal commercial and financial instruments.

Under the Stamp Act stamp duty is tax payable on the written documents during the sale andor transfer of a real property. How To Calculate Stamp Duty in 2021. Will replace the manual system in LHDNM s counter which use Franking Machine and Revenue Stamp.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Save Big at Agoda. Properties other than stocks or marketable securities.

06112019 Your tenancy agreement stamp duty fee is For 2-3 years agreement RM2 for every RM250 of the annual rent in excess of RM2400 if the monthly rental fee is RM and period of your tenancy agreement is number of months. Stamp duty is the amount of tax levied on your property documents such as the Sales and Purchase Agreements SPA the Memorandum of Transfer MOT and the loan agreement.

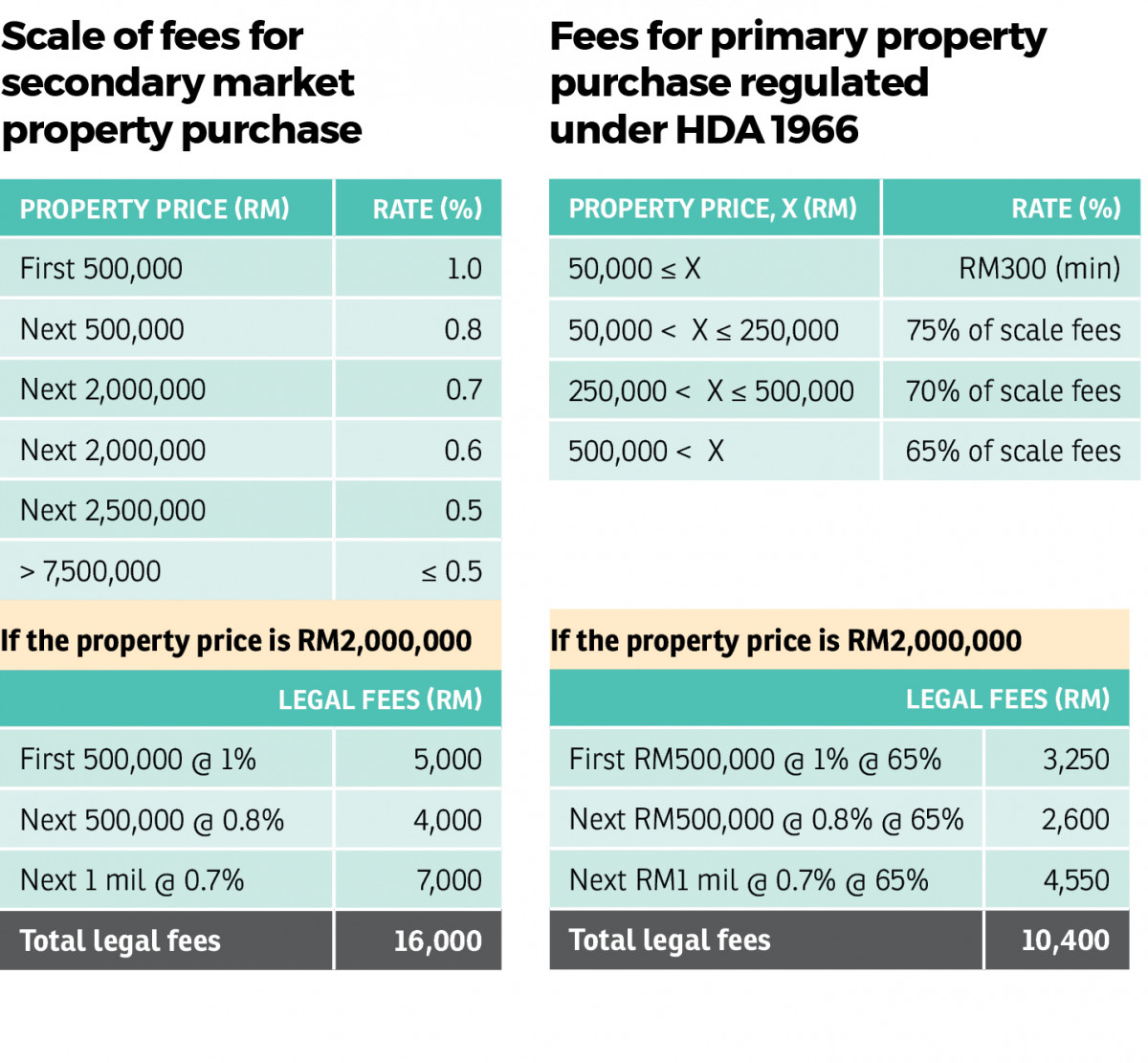

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Legal Fees Calculator Stamp Duty Malaysia 2017 Malaysia Housing Loan 2017 Legal Malaysia Calculator

Legal Fees Calculator Stamp Duty Malaysia 2017 Malaysia Housing Loan 2017 Legal Malaysia Calculator

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

How To Stamp The Tenancy Agreement Property Malaysia

How To Stamp The Tenancy Agreement Property Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

Count The Cost Of Buying A Property Edgeprop My

Count The Cost Of Buying A Property Edgeprop My

How Much Is The Cost Of Sale And Purchase Agreement And Stamp Duty In 2020 Malaysia Housing Loan

How Much Is The Cost Of Sale And Purchase Agreement And Stamp Duty In 2020 Malaysia Housing Loan

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Mot Calculation 2020 Property Paris Star

Mot Calculation 2020 Property Paris Star

Post a Comment for "How To Count Stamp Duty In Malaysia"