How Do You Avoid Stamp Duty On A Second Home

30122015 The HM Treasury paper also spells out under what circumstances it considers individuals are buying additional property - and who will be able to avoid the higher rate of stamp duty. 02032021 If youre buying a second property or a property on a buy-to-let basis you will still benefit from the increased 500000 threshold however you will still have to pay the Stamp Duty.

Rpgt Stamp Duty Exempted Will You Buy Or Sell Your House

Rpgt Stamp Duty Exempted Will You Buy Or Sell Your House

05052021 You can avoid paying stamp duty on a second home if its worth less than 40000.

How do you avoid stamp duty on a second home. This home has been sold or otherwise disposed of. You purchase a property valued under 40000 or the share of the property you buy is valued under 40000. 03032021 One common way to reduce Stamp Duty is to pay for the fixtures and fittings of your new home separately.

11062018 If you decide to do all this yourself rather than instruct a solicitor to do it for you youll also need to complete form ID1 but strangely this has to be done by a solicitor. It doesnt apply to caravans mobile homes or houseboats. 11122020 Youre only exempt from the Stamp Duty on a second home if.

28022021 Ive heard that there are ways to avoid the second home charge such as buying it and then selling our first one within three years if it is. 17022021 Should you be buying a second property as a Buy-to-Let investment for a holiday home as a commuter pied-a-terre or for any other purpose you will be classified as a second home buyer and will have to pay the additional stamp duty charge for second homes. 01042021 But there are a few ways you can avoid it.

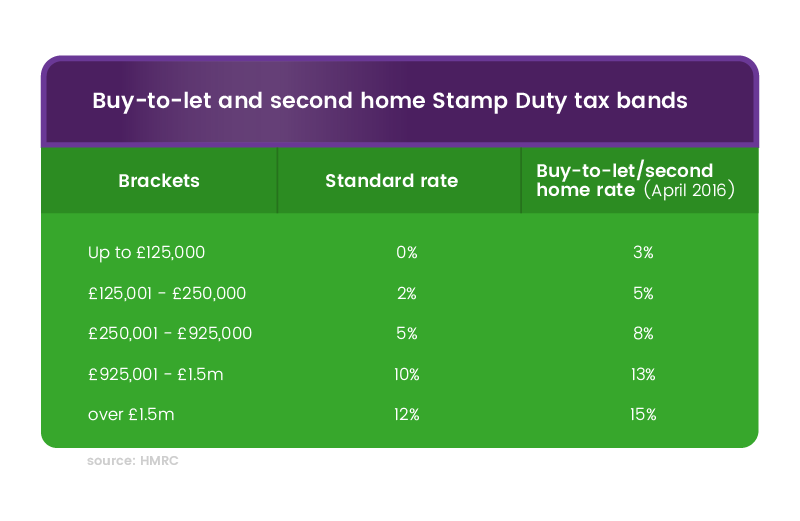

You buy a caravan mobile home or house boat. Even if youre not exempt from paying Stamp Duty on a second property you can sometimes claim back the Stamp Duty surcharge. This works out as an additional 3 on top of the standard Stamp Duty rate.

If youre buying a second home during the stamp duty holiday period youll pay stamp duty at the revised rates plus the 3 surcharge. 31082018 Avoid additional 3 stamp duty by buying a second property in a trust The additional 3 surcharge rate of stamp duty land tax that applies on the purchase of a second property is notoriously hard to avoid. You should not be tempted to inflate the.

10022017 Last year a new tax law came into force that affects anyone buying a second home. It also applies if you own a share in a property. If youre buying an additional property such as a second home youll have to pay an extra 3 in Stamp Duty on top of the revised rates for each band up until 30 June 2021.

You may also be exempt if you. It is important to note that the rules do not apply only to you as the buyer but also to anyone you. This reduces the price of the property which in turn reduces the amount of Stamp Duty you owe on it.

It is important that. Who will be exempt. 09072020 Would 3 extra Stamp Duty put you off buying a second home.

If you are buying a new house and at the same time selling the old one you can claim the extra paid. The buyer or sometimes a spouse previously owned a home which was the buyers only or main residence meaning they had actually lived there. So you will avoid the additional rate.

Zoopla Zoopla March 16 2016. 25112016 If the same person were to move somewhere else with the same amount of space as the two properties combined they would avoid paying the added duty but would probably pay more in total because. 15062020 In April 2016 the government imposed an extra 3 stamp duty surcharge on second property purchases.

This extra 3 is on the total purchase price of the house and no allowance was made on the initial 125000. As of March 2016 homeowners who purchase an additional property whether thats a buy-to-let or holiday home will need to pay a higher Stamp Duty charge. It then applies a sliding scale to properties valued between 600000 and 750000.

Even in the condition when you intend to sell the primary residence on a later date you can get the deal finalized in the three years of buying a new property to get a refund. Stamp Duty on second homes. This applies to property purchases over 40000.

Gift a deposit if you arent going to be a joint owner then the stamp duty for second homes wont apply. Act as a guarantor Guarantors arent classed as owning the property. You can read more about stamp duty concessions that apply to buying a first home here.

But good luck trying to find one of those. 09062020 How to avoid stamp duty for the second property. You have to pay the extra rate even if the property you already own is abroad.

In Victoria the State government has abolished stamp duty for first home owners if the home is valued at less than 600000 and the purchaser lives in the home for 12 months.

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

The Ultimate Guide On How To Buy A House In Malaysia Arif Hussin

The Ultimate Guide On How To Buy A House In Malaysia Arif Hussin

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

How To Avoid Stamp Duty On Second Home My Conveyancing Specialist

How To Avoid Stamp Duty On Second Home My Conveyancing Specialist

Https Blog Bluenest Sg Seller Stamp Duty

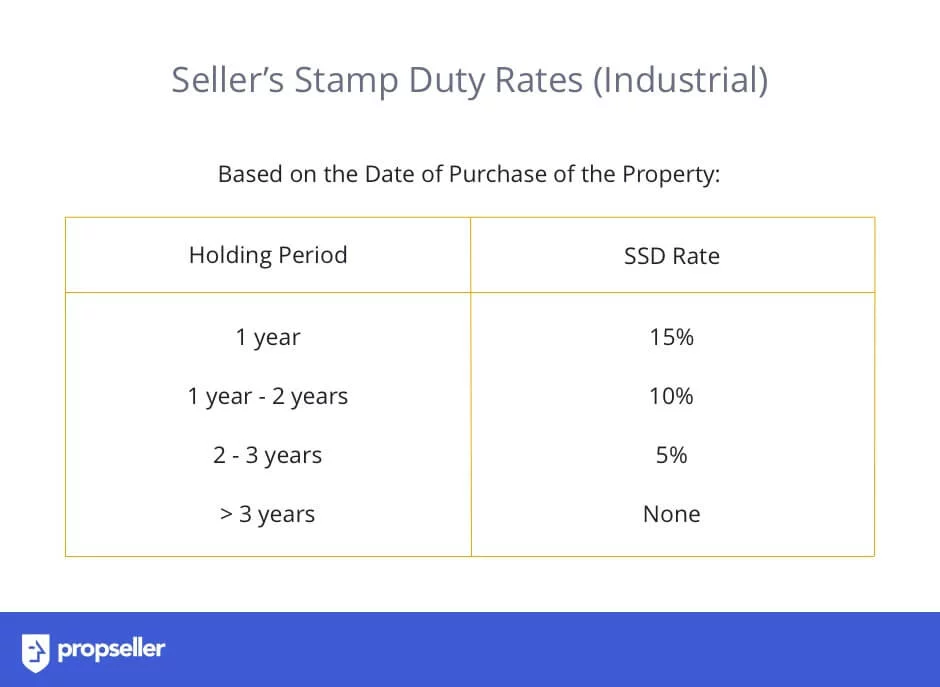

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

How To Avoid Stamp Duty On Second Home Sam Conveyancing

How To Avoid Stamp Duty On Second Home Sam Conveyancing

How To Beat The Stamp Duty Surge On Second Homes

How To Beat The Stamp Duty Surge On Second Homes

Get The Sums Right Before Decoupling To Buy Property Business News Top Stories The Straits Times

Get The Sums Right Before Decoupling To Buy Property Business News Top Stories The Straits Times

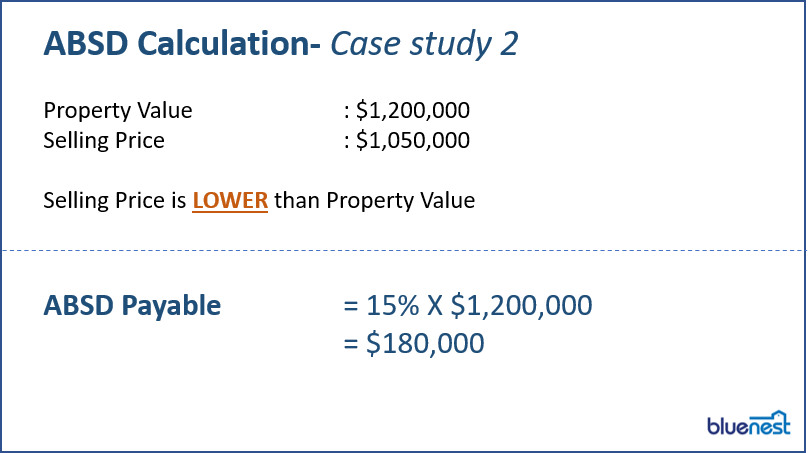

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

How To Buy A Second Home Your Questions Answered Sell House Fast

How To Buy A Second Home Your Questions Answered Sell House Fast

We Re Not Married So Can We Avoid Higher Stamp Duty On A Second Home Stamp Duty The Guardian

We Re Not Married So Can We Avoid Higher Stamp Duty On A Second Home Stamp Duty The Guardian

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Additional Buyer S Stamp Duty Absd Explained 99 Co

Additional Buyer S Stamp Duty Absd Explained 99 Co

How To Avoid Stamp Duty On Second Home

How To Avoid Stamp Duty On Second Home

Post a Comment for "How Do You Avoid Stamp Duty On A Second Home"