Stamp Duty Exemption 2020 Extension

The Exemption Order exempts from stamp duty for qualifying loan or financing agreements relating to the restructuring or rescheduling of existing business loans or financing. Incurred during the period of 1 March 2020 to 31 December 2020.

Government Extends Home Ownership Campaign Till Dec 31 The Edge Markets

Government Extends Home Ownership Campaign Till Dec 31 The Edge Markets

The temporary increase from 8 July 2020 to 31 March 2021 to the amount that a.

Stamp duty exemption 2020 extension. 3 Order 2020. A stamp duty exemption will be given for the purchase of residential property priced more than RM300000 but not more than RM25 million subject to a discount of at least 10 provided by the developer except for a residential property which is subject to. Stamp duty exemption for SMEs on any instrument executed for Mergers.

Year 2014 Stamp Duty Order Remittance PUA 360 PUA 361 Year 2016 Stamp Duty Order Remittance PUA 365 PUA 366 Year 2020 Stamp Duty Order Exemption PUA 152 Year 2020 Notification Of Authorized Person To Compound Instrument Under Subsection 91 PUB 142020. A 394 dated 26 Dec 2019 and 31 Dec 2019 respectively. 03082020 Stamp duty exemption for SMEs has now been extended on any instrument executed for Mergers.

09112020 PETALING JAYA Nov 9. TaXavvy Budget 2020 Edition - Part 1 5 Stamp duty Extension of stamp duty exemption for the purchase of first residential home Extension of stamp duty exemption for abandoned housing projects Extension of stamp duty exemption for Perlindungan Tenang products Extension of stamp duty exemption for Exchange Traded Fund 30. 5 2018 Amendment Order 2020 PUA 3972020 the Amendment Order was gazetted on 31 December 2020 to legislate the extension of Stamp Duty exemption for Perlindungan Tenang products proposed in Budget 2021 reported in Tax Espresso Special Edition Highlights of Budget 2021 Part I.

This exemption will resume at the end of the stamp duty holiday on June 30. The main SDLT legislation is at Part 4 of the Finance Act 2003. 07082020 1 Stamp Duty Exemption No.

2 Order 2020 PU. Circular No 0212020 Dated 23 Jan 2020 To Members of the Malaysian Bar Stamp Duty Remission No 2 Order 2019 and Stamp Duty Exemption No 4 Order 2019 Please take note of Stamp Duty Remission No 2 Order 2019 PU. Extension of period for deferment of tax instalment payment for tourism industry to 31st December 2020.

Stamp Duty Exemption No. FMM would like to further propose that the stamp duty exemption be extended to MAs and partnership agreements agreed or signed prior to the outbreak of the Covid-19 pandemic and were disrupted. 03082020 Stamp Duty Exemption No4 Order 2020 The exemption of stamp duty with effective on 1 June 2020 for the residential property price between RM300000 to RM25Million.

01032020 The Stamp Duty Exemption No. 05112019 Amendment and Extension of Stamp Duty Exemptions 5 November 2019 Indirect Tax - Other News LN 281 of 2019 has amended the following subsidiary legislation enacted under the Duty on Documents and Transfers Act implementing measures announced in the Budget for 2020. Extension of deferment of tax instalment payments for an additional three months to include the period 1 October 2020 to 31 December 2020 previous deferment was from 1 April 2020 to 30 September 2020.

A 165 gazetted on 21 May 2020 provides a stamp duty. 2 Order 2020 Exemption Order was gazetted on 21 May 2020 and came into operation retrospectively on 1 March 2020. 04032021 Chancellor Rishi Sunak has extended the stamp duty holiday in the Budget.

The extension of the stamp duty exemptions for instrument of transfer and loan agreement for first-time home purchase priced up to RM500000 to 2025 is only an extension of the stamp duty exemptions provided in Budget 2019-20 says Affin Hwang Capital senior associate director equity research Loong Chee Wei. Extension of stamp duty exemption on the instrument of loan or financing agreement relating to the restructuring or rescheduling of a business loan or financing executed between a borrower or customer and a financial institution FI The Stamp Duty Exemption No. Anyone buying a home worth up to 500000 before the end of June will now not pay the tax and could save up to 15000.

4 Order 2020 issued on 28-7-2020 with effect from 1-6-2020 until 31-5-2021 the stamp duty for the purchase of residential property by an individual under the Home Ownership Campaign 20202021 shall be exempted subject to the follows. This applies between 1 July 2020 and 30 June 2021. The purchase price shall be more than RM30000000 but not more than RM250000000.

The increased annual allowance rate of 40 will be extended to cover capital expenditure incurred until 31 December 2021. 04032021 First-time buyers were exempt from paying any stamp duty on the portion of a property purchase below 300000. A 369 and Stamp Duty Exemption No 4 Order 2019 PU.

Acquisitions MA between July 1 2020 and June 30 2021. The exemption on the instrument of transfer is limited to the first RM1Million of the property price and the stamp duty will be charged RM3 for every RM100 of the balance property. Stamp Duty Exemption No.

05062020 Stamp duty exemption for SMEs on any instruments executed for Mergers and Acquisitions MAs for period between 1st July 2020 to 30th June 2021. 30072020 Pursuant to Stamp Duty Exemption No.

Builders Get Extension To Complete Pending Projects In Noida Till Dec Next Year Property Marketing Construction Cost Property Prices

Builders Get Extension To Complete Pending Projects In Noida Till Dec Next Year Property Marketing Construction Cost Property Prices

Pin By Taxclue Consultancy Online P On Rbi In 2021 Corporate Law Taxact Engagement Strategies

Pin By Taxclue Consultancy Online P On Rbi In 2021 Corporate Law Taxact Engagement Strategies

Budget 2021 Stamp Duty Exemption 2021 And Other Benefits Malaysia Housing Loan

Budget 2021 Stamp Duty Exemption 2021 And Other Benefits Malaysia Housing Loan

Government Extends Home Ownership Campaign Till Dec 31 The Edge Markets

Government Extends Home Ownership Campaign Till Dec 31 The Edge Markets

Cover Story Secondary Market Seeing More Interest The Edge Markets

Cover Story Secondary Market Seeing More Interest The Edge Markets

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Property Market Expected To Remain In The Doldrums Free Malaysia Today Fmt

Property Market Expected To Remain In The Doldrums Free Malaysia Today Fmt

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

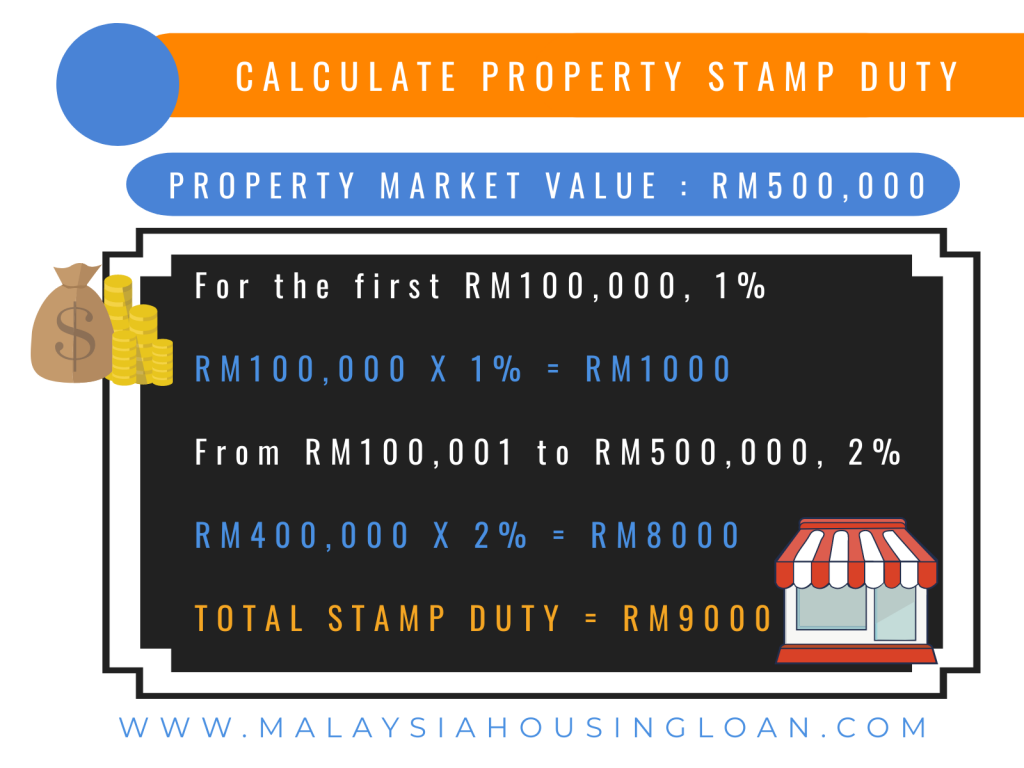

Year 2021 Stamp Duty Malaysia Exemption Malaysia Housing Loan

Year 2021 Stamp Duty Malaysia Exemption Malaysia Housing Loan

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Property Market Expected To Remain In The Doldrums Free Malaysia Today Fmt

Property Market Expected To Remain In The Doldrums Free Malaysia Today Fmt

Pin On Notifications And Updates

Pin On Notifications And Updates

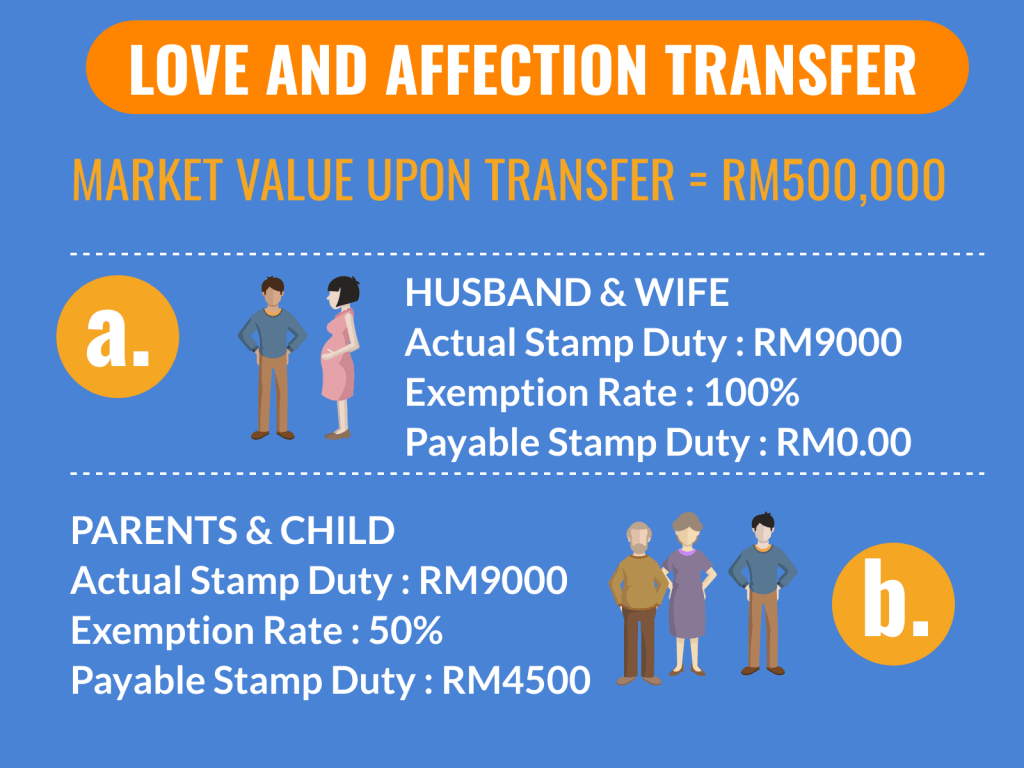

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Post a Comment for "Stamp Duty Exemption 2020 Extension"