How Does The New Stamp Duty Holiday Work

01032021 But keeping the holiday in place is controversial too. 08072020 The Chancellor today confirmed a cut to Stamp Duty with immediate effect increasing the Stamp Duty threshold at which buyers start to pay the levy from its current 125000 up to 500000.

Stamp Duty Holiday How Will It Work Itv News Youtube

Stamp Duty Holiday How Will It Work Itv News Youtube

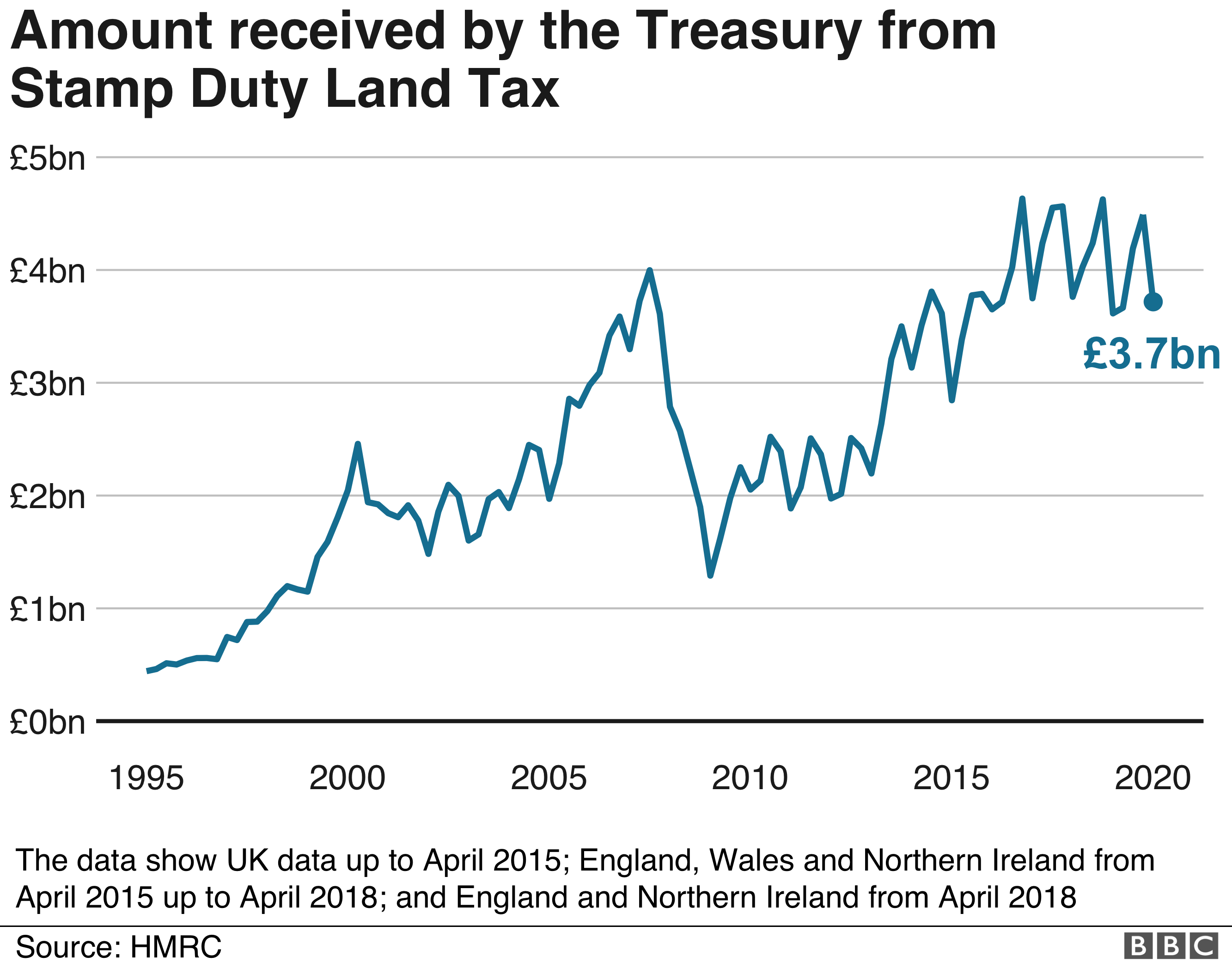

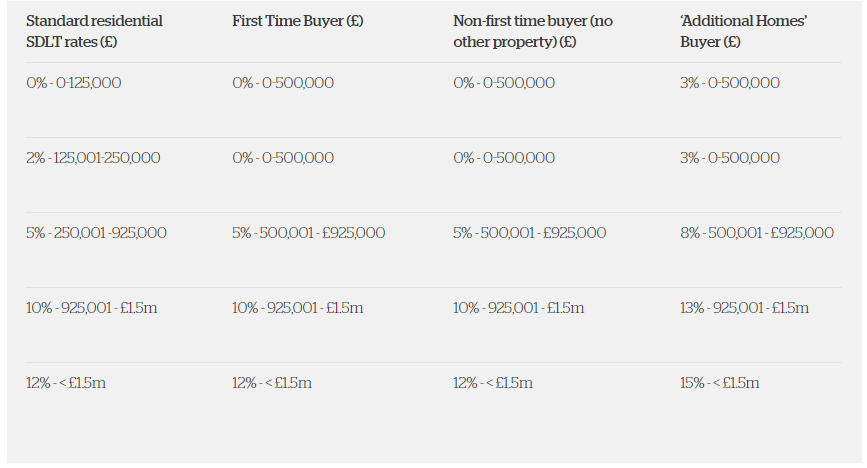

The stamp duty holiday is essentially a temporary increase to the nil-rate threshold increasing from 125000 or 300000 for first-time buyers to 500000.

How does the new stamp duty holiday work. 08072020 How will the stamp duty holiday work. 08032021 The Treasury announced the stamp duty holiday in a bid to breathe life into the property market after it effectively froze during the first lockdown with viewings sales and moves suspended. Stamp duty is a tax paid on property purchases.

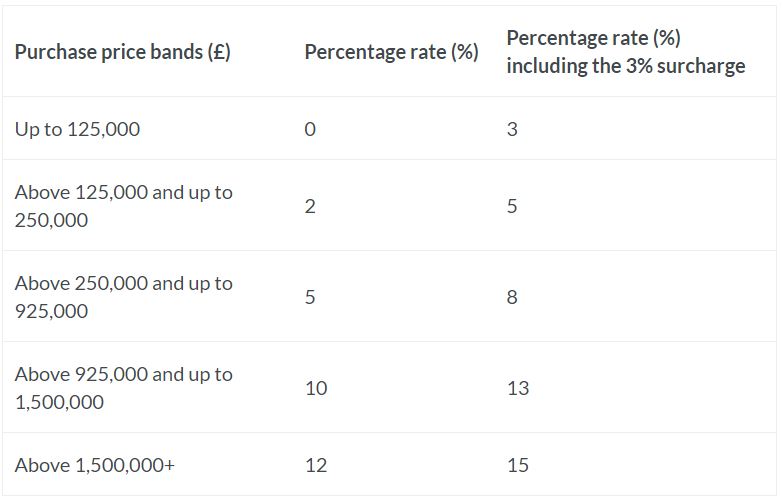

25 September 2020 The Governments Stamp Duty Land Tax SDLT holiday runs until 31st March 2021 and removes the standard rate of SDLT for transactions under 500000 in England. If youre a first-time buyer in England or Northern Ireland buying a property for up to 500000 you already dont pay stamp duty on the first 300000 and pay 5 per cent on any portion between. The newly introduced stamp duty holiday is valid on properties up to a value of 500000 and the more you pay the more you save on stamp duty.

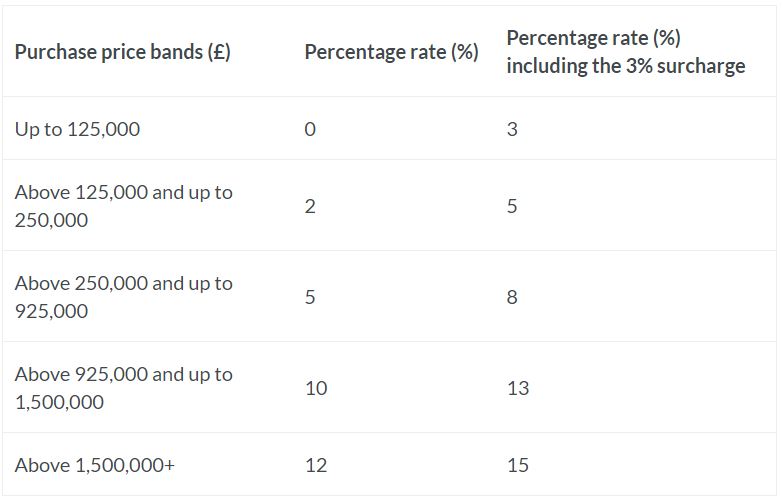

Thats roughly equivalent to 2 of the Treasurys total tax take. 08072020 What is a stamp duty holiday. The government has a stamp duty calculator here.

01102020 The stamp duty holiday was put in place to help buyers in a time when many are facing financial hardships as a result of the coronavirus. This means that any property sold at 500000 or less in England or Northern Ireland before 31st March 2021 will not attract any Stamp Duty. Martijn at Habito adds that the stamp duty holiday itself has had other consequences including pushing up.

16032021 How does the stamp duty holiday work. This could jump from 125000 to. The move was aimed.

21102020 As part of its Plan for Jobs the government introduced a temporary stamp duty holiday for residential properties worth up to 500000 effective from 8 July 2020 until 31 March 2021. But unlike the relief for purchases of more than one dwelling multiple dwellings relief or MDR you cannot do two calculations and choose the route that produces the lowest amount of tax. When is the Stamp Duty holiday effective from.

Transactions over this amount will have to pay SDLT on the additional sum. Under the current scheme buyers do not have to pay stamp duty on the value of a property up to 500000 rather than 125000. It was only when the lockdown started easing and estate agents were allowed to start showing people around again.

Moreover nearly nine out of ten home buyers this year will pay no stamp duty at all. 19042021 What is the stamp duty holiday. For a limited time the level at which stamp duty is charged on a residential property is being temporarily raised to 500000.

Stamp duty land tax is a lump-sum tax that anyone buying a property or land costing more than a set amount has to pay. 07072020 The governments annual take from stamp duty is around 12bn according to the latest figures released by HM Revenue and Customs HMRC. Before this announcement it is only if you buy a home under 125000 or 300000 for first-time buyers that you are exempt from paying any stamp duty.

The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020. 18012021 What is stamp duty and how much does it cost. 08072020 The Chancellor announced a stamp duty holiday in July.

25092020 Stamp Duty Holiday. Under the stamp duty holiday homebuyers in England and Northern Ireland dont have to pay stamp duty on the first 500000 of the property they buy. 04032021 How does the stamp duty holiday work.

22072020 How does the stamp duty holiday work. It allows people to save up to. The government is reportedly set to raise the threshold at which homebuyers start paying stamp duty in England and Northern Ireland.

How does it work and what does it mean for you. The new temporary rates mean that for purchases under 1215000 buyers will pay more Stamp Duty on mixed-use property. Chancellor Rishi Sunak has suggested that with the new policy the average saved on a stamp duty bill is 4500.

With the average price of an East London property last year selling at 481854 this means you could save 1409270 on stamp duty. The new stamp duty rates will apply immediately from the 8th June 2020 until 31 March 2021. 09072020 Under the new stamp duty rates you will therefore pay 28750 in stamp duty which represents a saving of 15000.

You can work out how much stamp duty you currently have to pay here.

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Who Benefits From The Stamp Duty Holiday

Who Benefits From The Stamp Duty Holiday

Uk Budget News Plans Summary And Updates Daily Mail Online

Uk Budget News Plans Summary And Updates Daily Mail Online

Stamp Duty Holiday Your Move Blog Homewise

Stamp Duty Holiday Your Move Blog Homewise

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

Uk S Sunak Could Extend Stamp Duty Holiday Until June End The Times Reuters

Uk S Sunak Could Extend Stamp Duty Holiday Until June End The Times Reuters

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Holiday Explained What Does It Mean For You

Budget Update Chancellor Announces Tapered Stamp Duty Holiday Extension And Mortgage Guarantee Scheme

Budget Update Chancellor Announces Tapered Stamp Duty Holiday Extension And Mortgage Guarantee Scheme

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Holiday The Winners And The Losers Bbc News

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Calls For Stamp Duty Holiday Extension Ftadviser Com

Calls For Stamp Duty Holiday Extension Ftadviser Com

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Post a Comment for "How Does The New Stamp Duty Holiday Work"