Can I Defer Stamp Duty

Depending on the price of the property stamp duty can cost tens of thousands of dollars. How Can I Avoid Stamp Duty Land Tax The only circumstances where SDLT does not need to be paid within 30 days of the property purchase are.

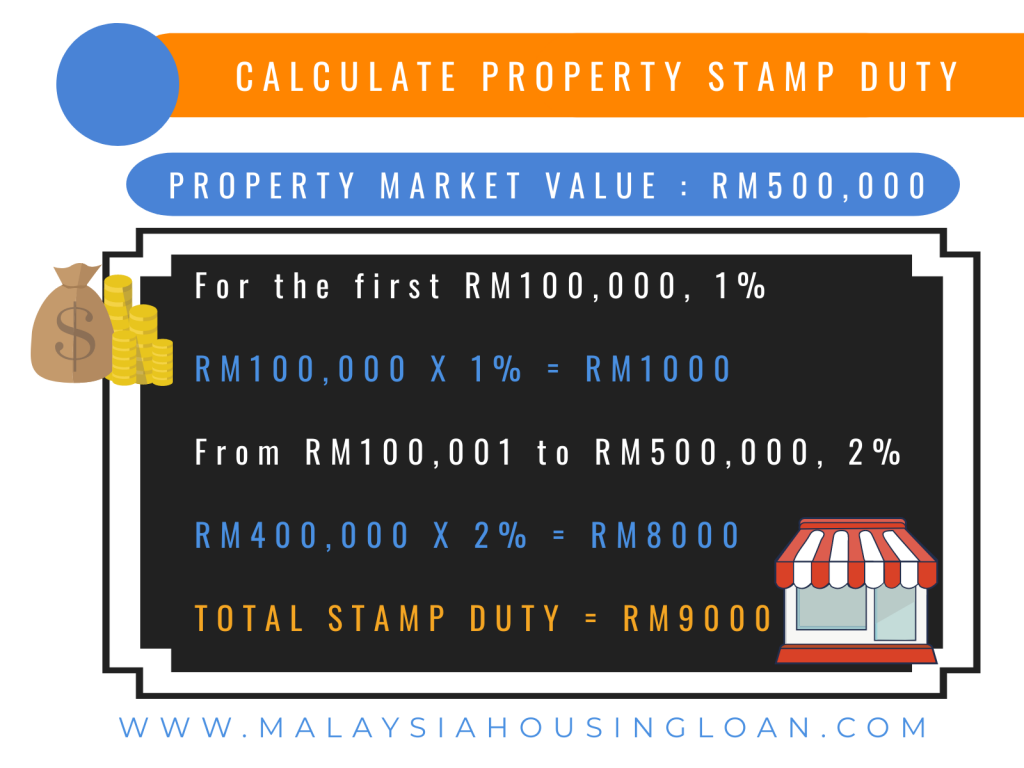

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

There is a higher rate of stamp duty on second homes at 3 added to all the normal SDLT rates but there are exemptions.

Can i defer stamp duty. Theyre also often unreliable. 02082019 The interest charged on late stamp duty payments will be required to be paid from the day after it should have been paid by up to the date when it is. Some governments offer a reduced rate of stamp duty on newly built homes regardless of whether youre buying your first home or your fifteenth.

Regarding this can you avoid stamp duty buy house swapping. For instance in Queensland you could be entitled to a reduced rate of stamp duty if you buy vacant land worth less than 400000 and you intend to build your own home on it. C RM10000 or 20 of the deficient duty whichever is the greater if stamped after 6 months from the time for stamping.

You may be lucky enough to qualify for certain exemptions. Looking for tips on how to avoid Stamp Duty isnt advisable. 05052021 You can avoid paying stamp duty on a second home if its worth less than 40000.

You may also be exempt if you inherit a 50 or less share of a property. 04052021 How Can I Avoid Paying Stamp Duty on a Second Home. Read this article to learn how to buy shares without paying stamp duty.

13112015 Even though stamp duty reform has halved the tax paid on the average 273000 property taking it from around 8200 to 3650 it is. If youre not remember that Stamp Duty avoidance schemes arent the same thing. 22102020 At the time the Chancellor said that nine out of 10 main home buyers would now be exempt from paying any Stamp Duty until the end of the deadline.

The lower rate of tax was applicable for properties up to 500000 and first-time buyers were expected to pay 5 on the difference. These include buying another home during a divorce or separation buying a mixed-use property or buying a second or additional home to be used as your main residence in. Click to see full answer.

On 8th July 2020 Chancellor Rishi Sunak announced a temporary holiday on Stamp Duty Land Tax on the first 500000 of all homes sold in England and Northern Ireland. However if a mortgage is involved there could be a stamp duty bill. But good luck trying to find one of those.

These cases include the following. 02012019 It is possible to defer stamp duty payment when purchasing off the plan. 07012021 Making a decision to downsize your home should mean you have extra cash in your pocket.

Sarah Moore explains what they mean and how you can. When you are purchasing a second home worth any amount below 40000. Its a tax you simply have to pay.

Stamp duty which is sometimes called Stamp Duty Reserve Tax of 05 percent is payable whenever you buy shares. 24022021 The short answer to this is yes you can. But there are certain criteria that needs to be met in order for you to be eligible to claim a Stamp Duty refund.

That means its always a good idea to try where possible to avoid stamp duty a tax imposed by State government on the purchase or transfer of property. As a result of the stamp duty holiday Rightmove calculated that purchasers in London could save as much as 15000. When you are purchasing a houseboat caravan or any mobile home regardless of their value.

If youre not exempt from paying Stamp Duty on a second home then you can claim a refund. Under the usual circumstances after the March deadline the normal SDLT rules will apply meaning that Stamp Duty Land Tax will again be charged depending on the type of transfer marital status and other. Its known as an off the plan transfer duty liability deferral.

09062020 In the 2017 Autumn Budget SDLT was removed for the first time buyers for properties worth 300000. 25112016 How to avoid stamp duty The new rules on stamp duty have muddied the waters. 18032021 Can You Avoid Paying Stamp Duty.

19032013 b RM5000 or 10 of the deficient duty whichever is the greater if stamped after 3 months but not later than 6 months after the time for stamping. If the property is worth 125000 or less Transfer of a property in a separation divorce or in a will. It allows you to defer stamp duty for 12 months but only if your intention is to occupy the property as your principle place of residence.

23042008 As the costs of stamp duty can reduce the effectiveness of day trading finding ways to reduce this tax can make the difference between profit and loss. A Yes you could swap your property with your mother-in-laws and assuming no money changes hands there is no need to worry about stamp duty land tax. 06032020 However there are a few scenarios where homeowners are exempted from paying the additional stamp duty charge.

Covid 19 Tax Developments Raja Darryl Loh

Covid 19 Tax Developments Raja Darryl Loh

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

New Stamp Duty Charges From July 1 What Changes For Mutual Fund Investors Business Standard News

New Stamp Duty Charges From July 1 What Changes For Mutual Fund Investors Business Standard News

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

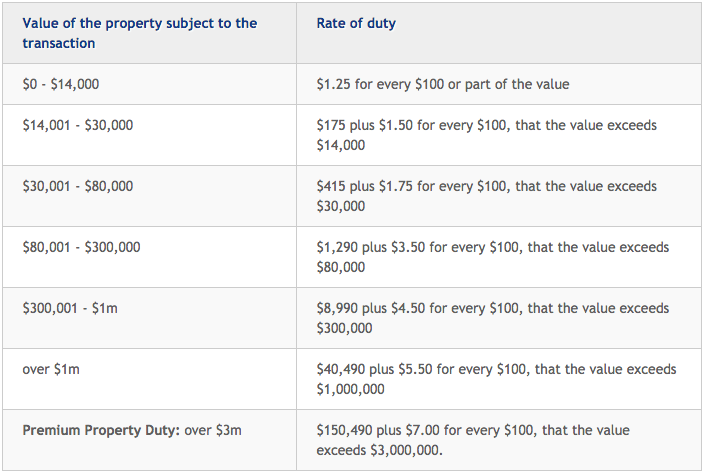

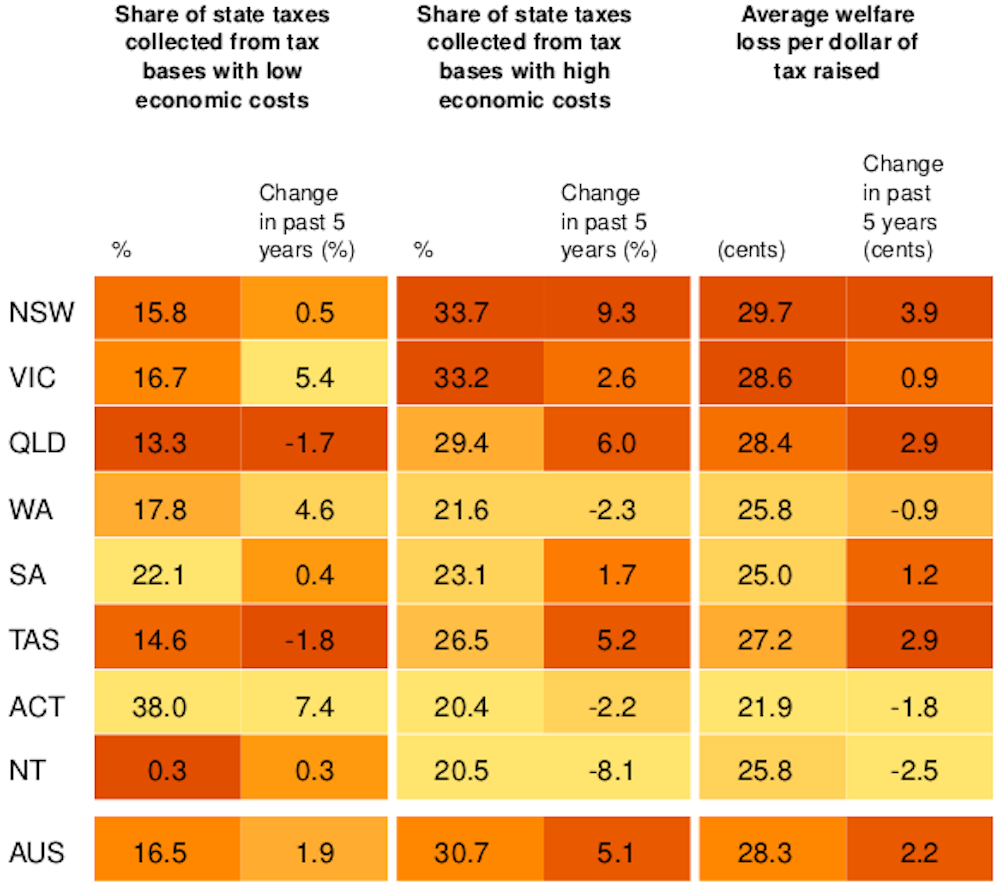

Abolish Stamp Duty The Act Shows The Rest Of Us How To Tax Property

Abolish Stamp Duty The Act Shows The Rest Of Us How To Tax Property

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Maharashtra To Waive Stamp Duty On Transfer Of Property To Kin Business Standard News

Maharashtra To Waive Stamp Duty On Transfer Of Property To Kin Business Standard News

A Quick Look Into Stamp Duties Land Taxes

A Quick Look Into Stamp Duties Land Taxes

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Stamp Duty In The United Kingdom Wikiwand

Stamp Duty In The United Kingdom Wikiwand

Abolish Stamp Duty The Act Shows The Rest Of Us How To Tax Property

Abolish Stamp Duty The Act Shows The Rest Of Us How To Tax Property

Budget 2020 Stamp Duty On Foreign Currency Loan Agreement To Be Increased Raja Darryl Loh

Budget 2020 Stamp Duty On Foreign Currency Loan Agreement To Be Increased Raja Darryl Loh

Pin On Loans Calculator Iphone Application

Pin On Loans Calculator Iphone Application

Cover Story Secondary Market Seeing More Interest The Edge Markets

Cover Story Secondary Market Seeing More Interest The Edge Markets

What Is Stamp Duty In Hong Kong And How Much Is It Zegal

What Is Stamp Duty In Hong Kong And How Much Is It Zegal

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Post a Comment for "Can I Defer Stamp Duty"