Budget 2021 Malaysia Stamp Duty Exemption

16112020 Budget 2021 Stamp Duty Exemption For First-Time Buyers Announced changes to stamp duty in Malaysia mean that first-time buyers are now exempt from certain stamp duty charges. Govt To Extend PRS Tax Relief ETF Stamp Duty Exemption.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

You are also welcome to join our.

Budget 2021 malaysia stamp duty exemption. 06112020 KUALA LUMPUR Nov 6. Stamp Duty Exemption 2021 And Other Benefits - Malaysia Housing Loan. 07112020 KUALA LUMPUR Nov 6.

27112020 The government is already running the Home Ownership Campaign HOC until May 2021 which provides a similar stamp duty exemption but limited to new launch properties. Save Big at Agoda. STAMP DUTY EXEMPTION FOR EXCHANGE TRADED FUND.

The Rakyats Well Being Contd For YA 2020 and 2021 the income tax exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for every full year of service. The Government outlined several measures in Budget 2021 targeted at increasing home ownership especially for first time buyers which include stamp duty exemptions allocations for public housing as well as a rent-to-own RTO scheme. Generally the stamp duty exemption is being extended to another five years for Perlindungan Tenang Products Exchange Trade Fund the revival of abandoned housing projects and the purchase of the first residential property.

A 54 both dated 10 Feb 2021that are deemed to have come into operation on 1 Jan 2021. The government has announced that the stamp duty exemption on loan agreements and instruments of transfer given to rescuing contractors and the original house purchasers will be extended for another five years. Press Citations 06 November 2020.

Always The Lowest Price Guarantee. 05032021 As part of the 2021 national budget Malaysia has issued various new incentives and measures in relation to indirect tax and stamp duty. Always The Lowest Price Guarantee.

2 Order 2021 PU. Stamp duty exemption is give on contract notes for trading of Exchange Trade Fund ETF This exemption is effective for the Trading of Exchange Trade Fund EFT executed from 1st January 2021 until 31st December 2025. 07112020 PropertyGuru Malaysia also lauded Budget 2021 especially the stamp duty exemption saying it would help first time house buyers.

16022021 Budget 2021 Stamp Duty Exemption For First-Time Buyers. Based on our survey 81 of Malaysians plan to buy a home by end of next year. First time homeowners are now exempt from certain stamp duty charges if the property is valued at no more than 500000 ringgit US123724 and from July 2021 a tourism tax of 10 ringgit US247 per night will be levied.

4 2021 Malaysia Budget Highlights Goal 1. Read other Budget 2021 news on EdgePropmyBudget2021. Budget 2021 under the property segment focuses more on homeownership for first-time house buyers by giving Stamp Duty exemption up to maximum RM9000 and RM2500 stamp duty for transfer and loan agreement instrument.

Announced changes to stamp duty in Malaysia mean that first-time buyers are now exempt from certain stamp duty charges. 28022021 The stamp duty exemption limit has been increased from RM300000 to RM500000 and it is applicable for Sale and Purchase Agreement dated from 1st January 2021 until 31st December 2025. For the tourism and retail sector there will be a target wage subsidy programme that will be.

Budget 2021for first-time house buyers Stamp Duty exemption up to maximum RM9000 and RM2500 stamp duty for transfer and loan agreement. This exemption was confirmed in Budget 2021 put forward by the Malaysian Government on 6 November 2020. Ad Book Now.

Download The Highlights of Budget 2021. 02122020 Another prominent measure in Malaysian Budget 2021 is the stamp duty exemption. Save Big at Agoda.

This exemption was confirmed in Budget 2021 put forward by the Malaysian Government on 6 November 2020. Ad Book Now. First introduced in 2019 the HOC initiative aims to support home seekers secure houses as well as encourage the sales of unsold properties in Malaysias housing market.

A 53 and Stamp Duty Exemption No. 06112020 Bernama - Budget 2021. 09112020 We also note that Budget 2021 is proposing a stamp duty exemption on Loan Agreements and Memorandum of Transfer where white knight contractors who are reviving abandoned projects with the original house buyers of said abandoned property projects be extended for a further 5-years to 31 December 2025.

We ha dpreviously sent a letter to urge the Ministry of Finance to look into th matter of e gazettement of the relevant Orders pursuant to the 2021 Budget speech made last year. KUALA LUMPUR Nov 6 - The government will extend the income tax relief period on Private Retirement Scheme PRS.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Year 2021 Stamp Duty Malaysia Exemption Malaysia Housing Loan

Year 2021 Stamp Duty Malaysia Exemption Malaysia Housing Loan

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

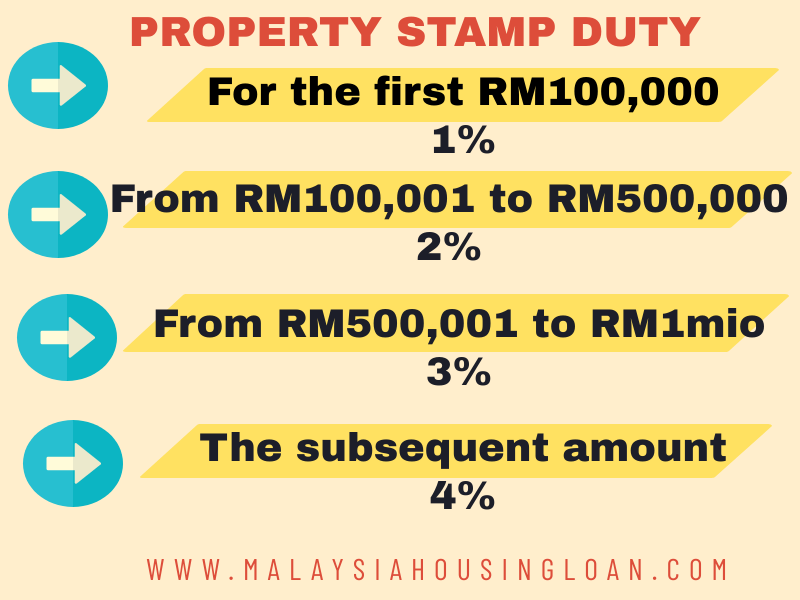

How To Calculate Stamp Duty 2021 Malaysia Housing Loan

How To Calculate Stamp Duty 2021 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Increase For Properties Exceeding Rm1 Million Now Effective July 1 2019 Iproperty Com My

Stamp Duty Increase For Properties Exceeding Rm1 Million Now Effective July 1 2019 Iproperty Com My

Budget 2021 Stamp Duty Exemption 2021 And Other Benefits Malaysia Housing Loan

Budget 2021 Stamp Duty Exemption 2021 And Other Benefits Malaysia Housing Loan

Updates On Stamp Duty For Year 2021 Malaysia Housing Loan

Updates On Stamp Duty For Year 2021 Malaysia Housing Loan

Budget 2021 Key Property Highlights Donovan Ho

Budget 2021 Key Property Highlights Donovan Ho

Stamp Duty In Malaysia 2021 Malaysia Housing Loan

Stamp Duty In Malaysia 2021 Malaysia Housing Loan

Property Stamp Duty Fee Malaysia For Rm500k And Rm550k Year 2021 Malaysia Housing Loan

Property Stamp Duty Fee Malaysia For Rm500k And Rm550k Year 2021 Malaysia Housing Loan

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Calculation Malaysia 2021 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

Stamp Duty Calculation Malaysia 2021 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

Post a Comment for "Budget 2021 Malaysia Stamp Duty Exemption"