Additional Buyer Stamp Duty Pay By Cpf

USE CPF TO PAY FOR STAMP DUTIES AND LEGAL FEES When you purchase a house you will have to pay the Buyers Stamp Duty BSD. If you are buying.

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Other Taxes Stamp Duty For Property Other Services How 20to 20apply 20for 20absd 20spouses 20remission 2021v1 20wef 2026 20mar 202021 Pdf

This can be in the form of reimbursement meaning that you first pay up in cash and receive the amount paid at a later date from your CPF.

Additional buyer stamp duty pay by cpf. Applicable to both HDB flats and Private Properties. For purchase of a property that is still under construction legal and stamp fees can be paid directly from CPF. The answer to your question is YES.

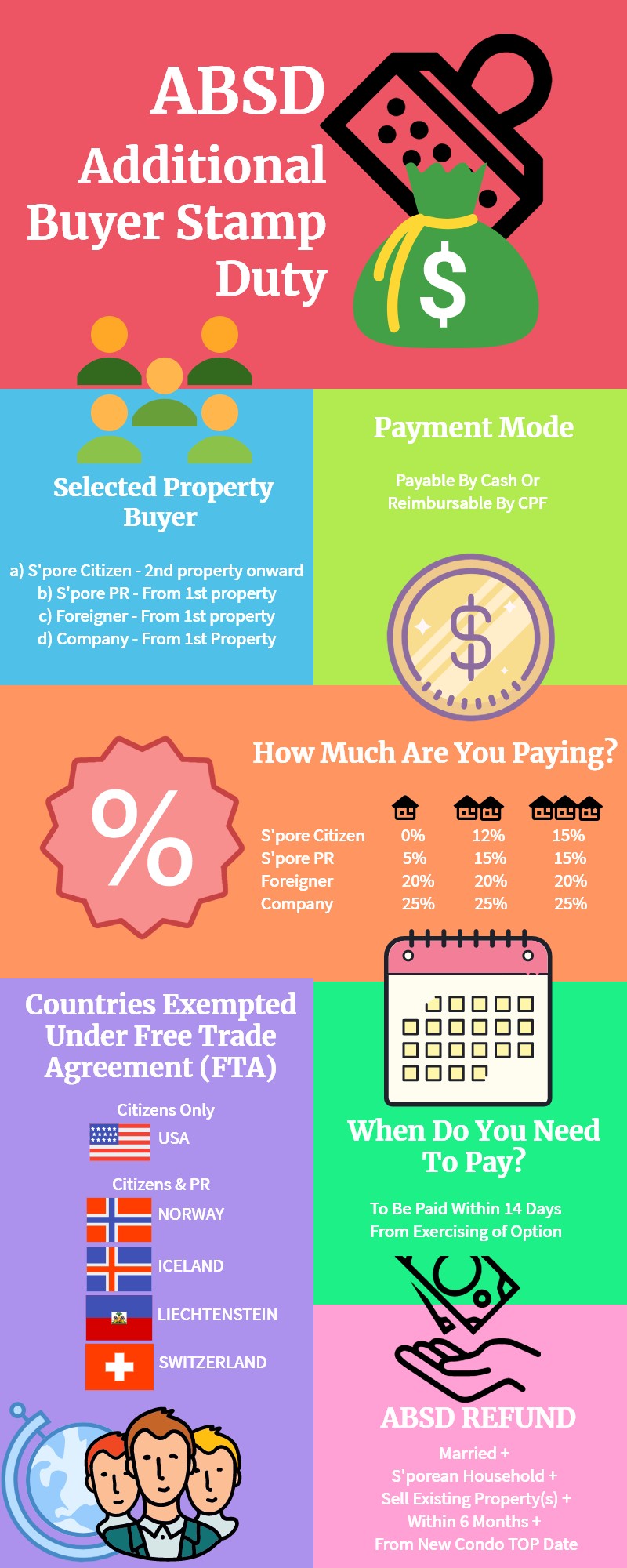

However since ABSD is payable within 14 days you will need to pay cash first and seek reimbursement from your CPF account subsequently. In this way the stamp duty only needs to be paid once and you could conceivably get a higher price of the property due to this tax savings. 03102020 Stamp duties such as Buyers Stamp Duty BSD and Additional Buyers Stamp Duty ABSD can be paid from your account.

03122020 Both legal fees and stamp duties can be paid from your CPF OA. 29042013 Additional Buyer Stamp Duty ABSD is an additional tax applicable to certain group of buyers. Ad Stamp buyer - You Wont Believe The Top 10 Results.

But there are costs. When you purchase a resale private property you are supposed to pay your Buyers Stamp Duty BSD and if relevant Additional Buyers Stamp Duty ABSD within 14 days of option exercise date. Ad Stamp buyer - You Wont Believe The Top 10 Results.

To find out if you can use your CPF to pay Stamp Duty please visit the CPF website or call CPF at 1800 227 1188 Monday to Friday 800 am. 23062020 Yep your CPF savings can also be used to make any stamp duty payments when you buy a property. Unless the property is under construction you have to pay the taxes from your pockets first and later get a reimbursement from your CPF account.

ABSD is not applicable to the following group of buyers. Exercising your Option to Purchase for resale private property. For more information please refer to this link.

23112020 Delay in payment exceeding 3 months. Singapore Citizens who does not own any Singapore residential properties at the. 24022021 Yes you can use CPF savings to pay the stamp duty and survey fees including ABSD.

Firstly you can only get a maximum 50 Loan to Value financing from the bank as a non-individual buyer. IRAS may also take legal action against you to recover the outstanding amount. Theres a slight twist to this though you first need to use your own cash for the payment then apply for reimbursement from your CPF account.

06072018 It is a tax payable on your second or subsequent property purchases. You can use your CPF money in the ordinary account to pay for the BSD as well as the ABSD. However the usual practice is to pay cash and then reimburse it with your CPF.

CPF savings can be used to pay the stamp duty and survey fees. Secondly you will not be able to use your CPF to buy the property. Using CPF funds to pay Stamp Duty including ABSD is subject to the terms and conditions under the Private Properties and Public Housing Schemes.

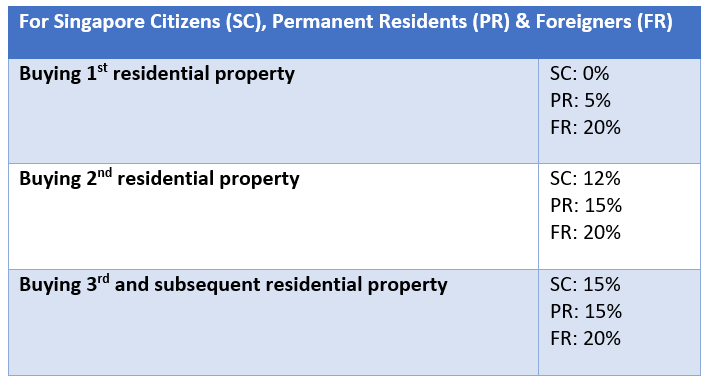

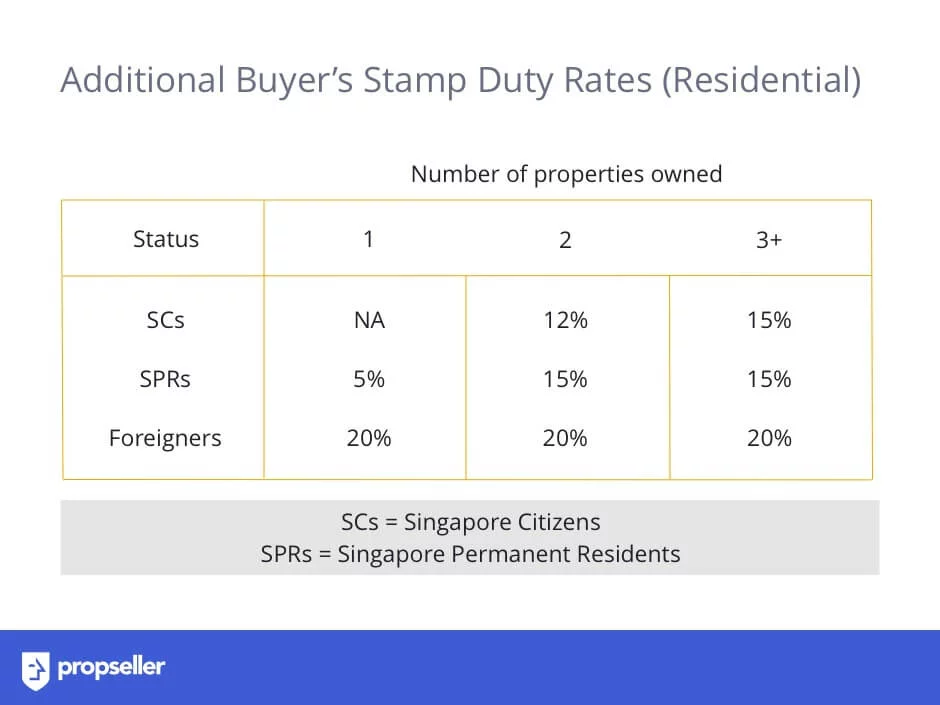

Additional Buyers Stamp Duty ABSD Liable buyers are required to pay ABSD on top of the existing Buyers Stamp Duty BSD. Payment of Buyer Stamp Duty and Additional Buyer Stamp Duty is required within 14 days from. The ABSD rates have been adjusted on 6 Jul 2018.

However monthly service and conservancy charges and other charges related to the use of the property including taxes cannot be paid with your CPF savings. For more property news resources and useful content like this article check out PropertyGurus guides section. 25 or an amount equal to 4 times the BSD and ABSD payable whichever is higher IRAS may recover the outstanding stamp duty by appointing your bank employer tenant or lawyer to pay the amount to it on your behalf.

This tax is payable in addition to the normal Buyers Stamp Duty payable when you purchase or acquire a residential property ie. 01052016 Yes you can. Commercial or industrial properties buyers.

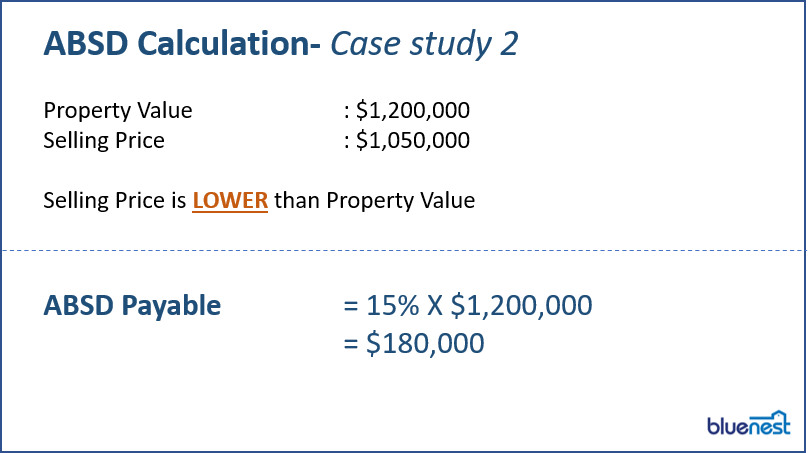

04102019 Can I Use CPF To Pay for The Stamp Duties. The absd rate that you need to pay depends on your nationality andor your PR status. ABSD and BSD are computed on the purchase price as stated in the dutiable document or the market value of the property whichever is the higher amount.

As stamp duty is payable within 14 days from the date of the sale and purchase agreement or the date of acceptance of the option to purchase you will need to use cash to pay the stamp.

Absd Singapore Methods To Beat Absd And Own Multiple Properties In 2021 Updated New Academy Of Finance

Absd Singapore Methods To Beat Absd And Own Multiple Properties In 2021 Updated New Academy Of Finance

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

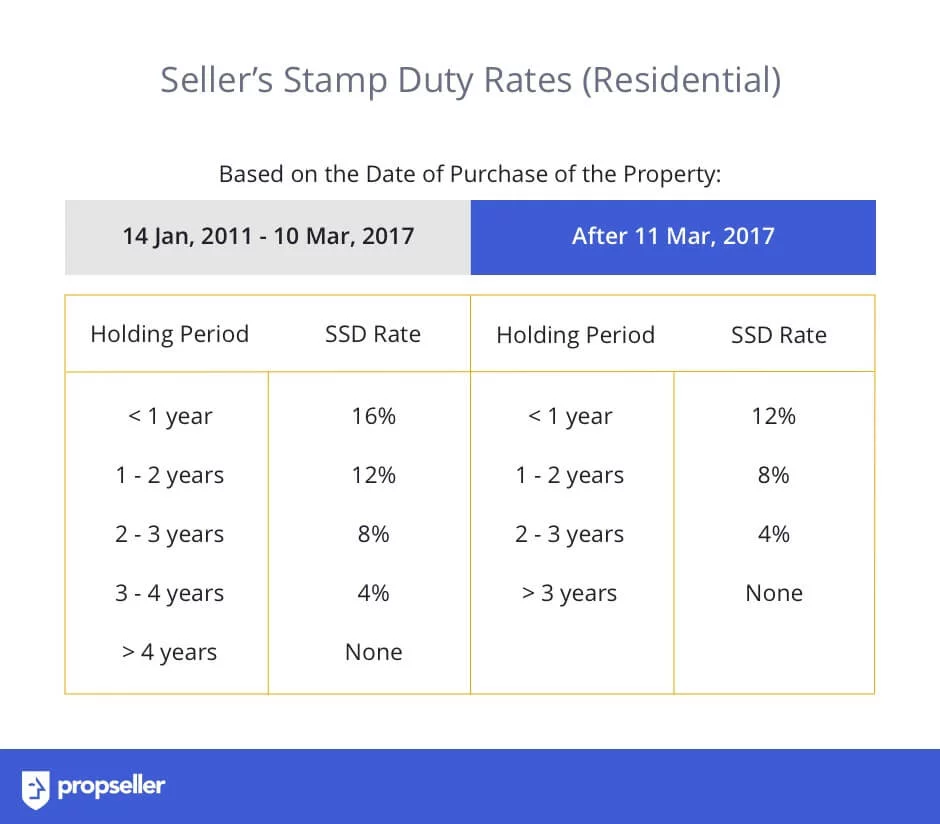

How To Calculate Singapore Property Stamp Duties Bsd Absd And Ssd Sg Home Investment

How To Calculate Singapore Property Stamp Duties Bsd Absd And Ssd Sg Home Investment

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Get The Sums Right Before Decoupling To Buy Property Business News Top Stories The Straits Times

Get The Sums Right Before Decoupling To Buy Property Business News Top Stories The Straits Times

100questions Res Guide To Absd

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

Additional Buyer S Stamp Duty Absd What Are Your Options In 2019 Singapore Property News Resource All The Info You Need About Hdb Resale Singapore Condos New Launches And Landed Properties

Additional Buyer S Stamp Duty Absd What Are Your Options In 2019 Singapore Property News Resource All The Info You Need About Hdb Resale Singapore Condos New Launches And Landed Properties

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Singapore Executive Condominium Ec Regulatory Measures

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Additional Buyer S Stamp Duty Absd Explained 99 Co

Additional Buyer S Stamp Duty Absd Explained 99 Co

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Click Here Check Additional Buyer Stamp Duty Buyer Stamp Duty Seller Stamp Duty Etc Rose Tay

Click Here Check Additional Buyer Stamp Duty Buyer Stamp Duty Seller Stamp Duty Etc Rose Tay

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

Stamp Duty On Property In Singapore Buy Stamps

Stamp Duty On Property In Singapore Buy Stamps

Methods To Beat Absd And Own Multiple Properties In Singapore 2021

Methods To Beat Absd And Own Multiple Properties In Singapore 2021

Post a Comment for "Additional Buyer Stamp Duty Pay By Cpf"