Stamp Duty Rate Malaysia 2019

06022020 The following exemptions are available in respect of Malaysia Japanese Yen Bonds Series A 2019 guaranteed by Japan Bank for International Cooperation for qualified institutional investor only Tekikaku Kikan Toshika Gentei issued by the Government of Malaysia Bonds. RPGTRPGT Calculation Chargeable Gain Disposal Price.

Stamp Duty A History And What Is It For Propertyguru Malaysia

Stamp Duty A History And What Is It For Propertyguru Malaysia

On the First 2500.

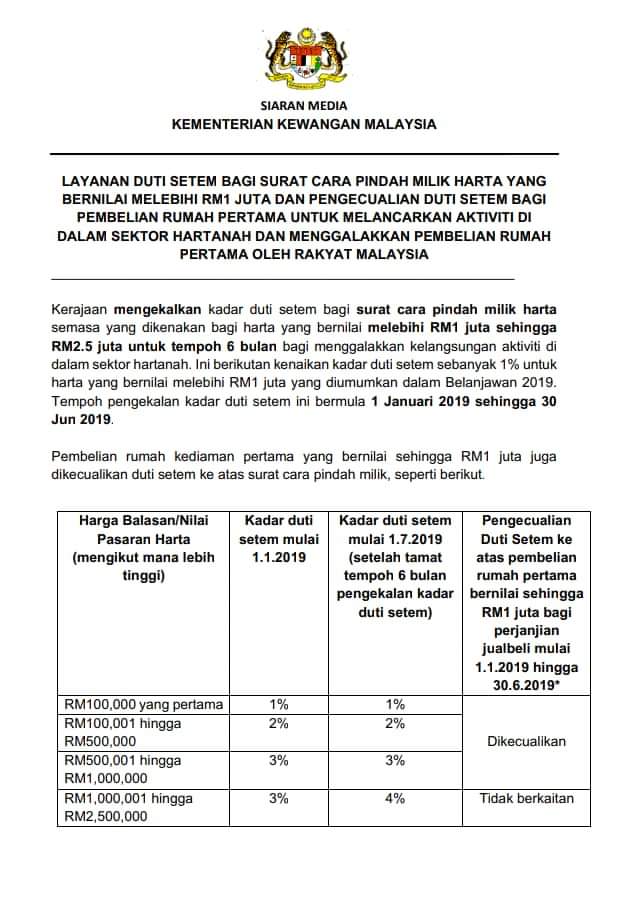

Stamp duty rate malaysia 2019. The loans are given at an interest rate of 2. Value of property Stamp duty rates Instrument of transfer stamped from 1 January 2019 to 30 June 2019 Instrument of transfer stamped from 1 July 2019 First RM100000 1 1 RM100001 to RM500000 2 2 RM50001 to RM1000000 3 3 RM1000001 to RM25000003 rate is maintained4 rate shall apply. Save Big at Agoda.

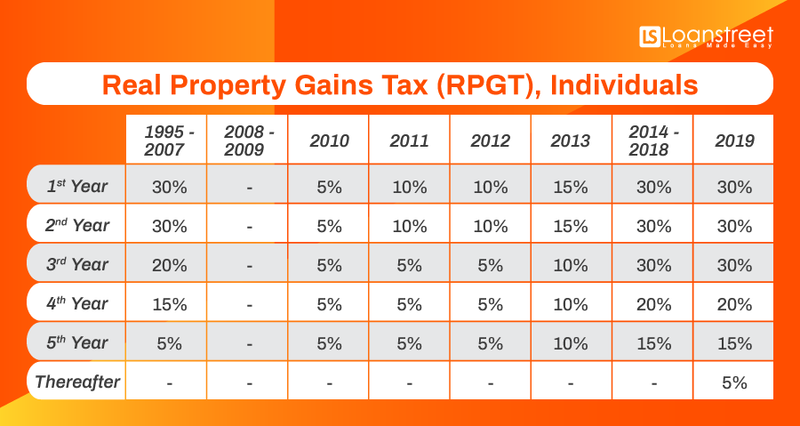

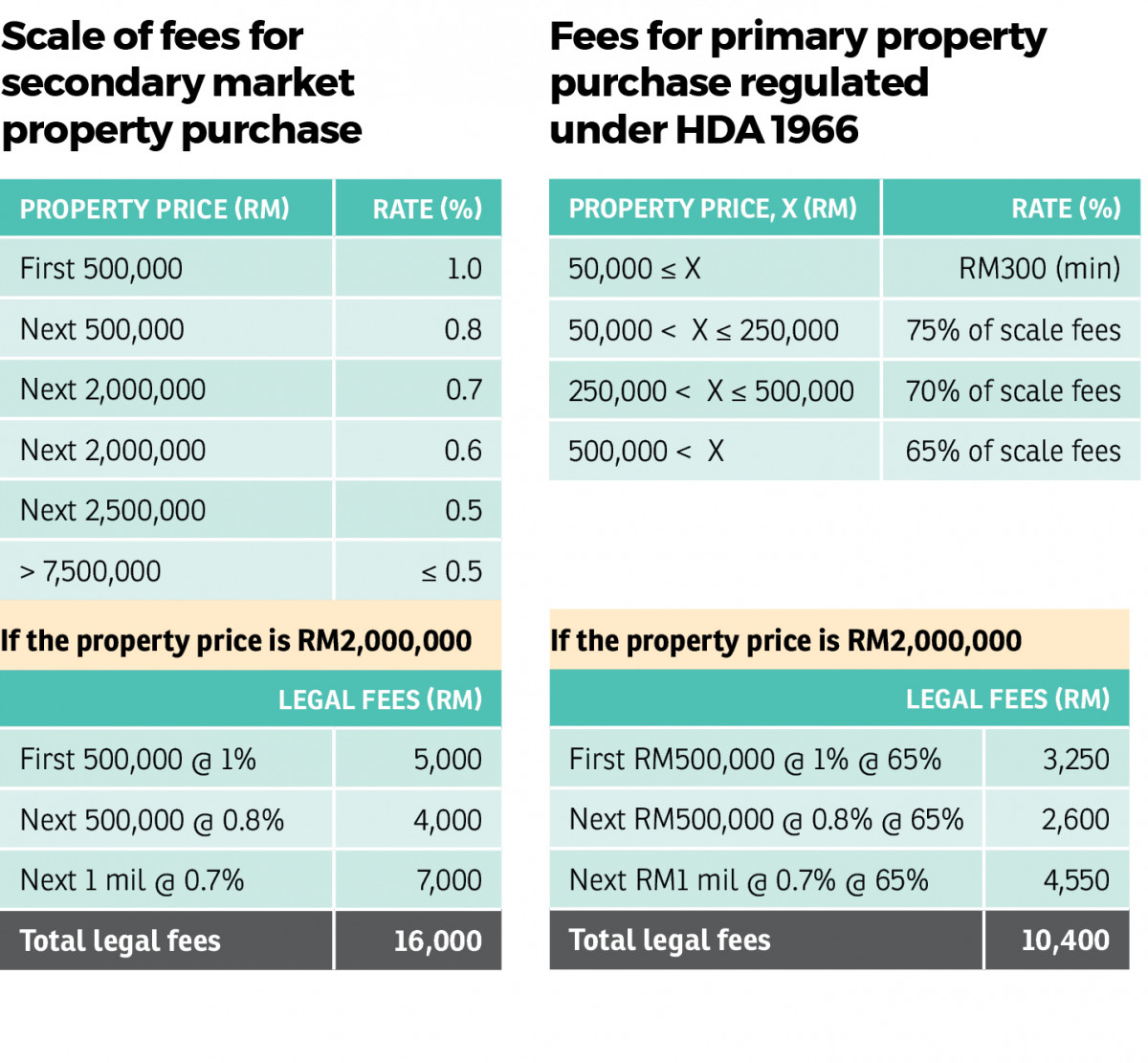

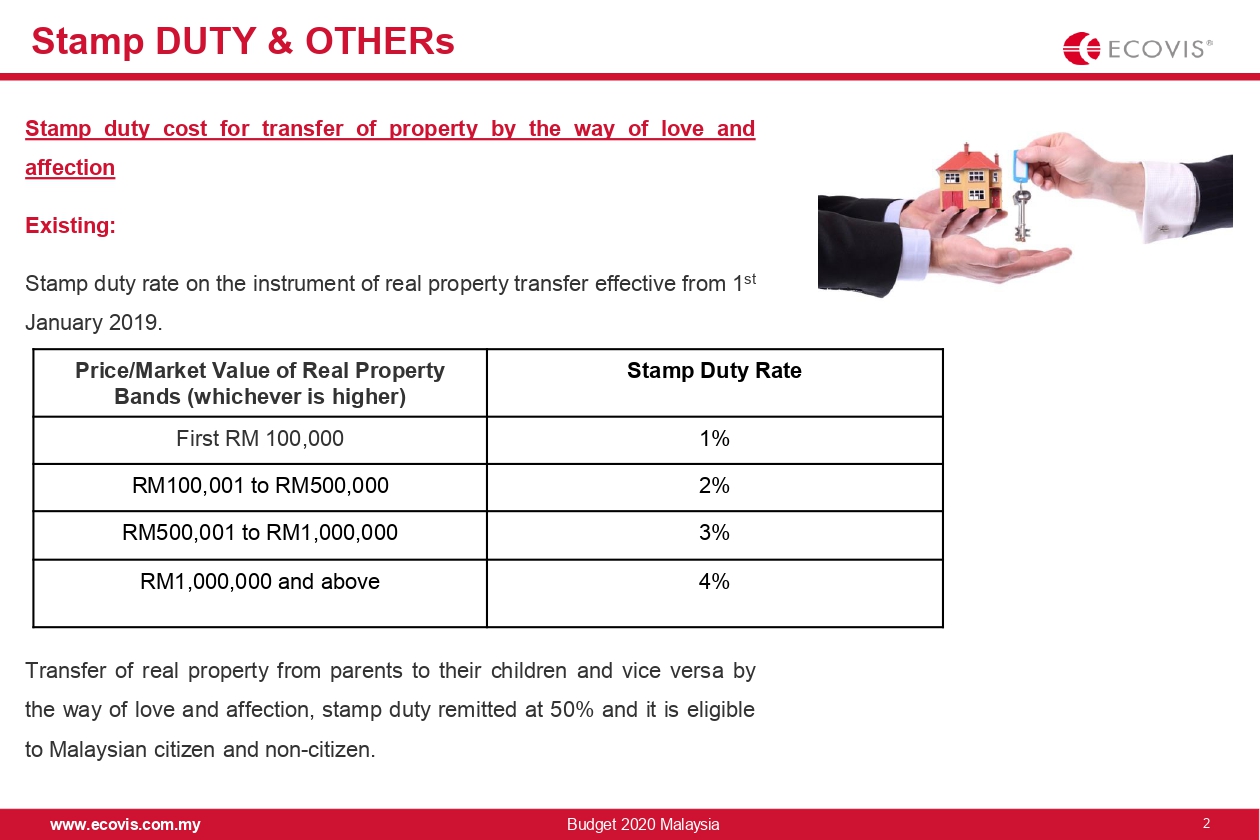

07012019 Loan agreement loan instrument Ringgit Malaysia loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is available for RM loan agreements or RM loan instruments without security and. Learn about Malaysias property stamp duty and Real Property Gains Tax RPGT in 2019. In 2019 the government announced a stamp duty hike for properties costing more than RM1 million where the rate was increased from 3 to 4 refer to the table below.

Fixed Duty Duty. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. There are two types of duty Ad Valorem Duty and Fixed Duty.

Tax RM 0 - 5000. 21052015 In summary the stamp duty is tabulated in the table below. 20042021 The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

19032013 Lembaga Hasil Dalam Negeri. The Stamp Duty Exemption No. Ad Book Now.

Always The Lowest Price Guarantee. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the stamp duty is 1000.

Ad Book Now. Ad Valorem Duty is the rate of duty varies according to the nature of the instruments and the consideration stipulated in the instruments or the market value of the property. 05052020 Malaysian Institute Of Accountants MIA The Malaysian Institute of Certified Public Accountants MICPA - Memorandum on Issues Arising from Labuan Business Activity Tax Act LBATA Amendment Bill 2019.

In 2019 the Government announced that RM550 million had been allocated for the Oil Palm Smallholders Replanting TSPKS and the Oil Palm Smallholders Agriculture Input IPPKS soft loan schemes. 04012019 How will the recent changes in RPGT and stamp duty begin to affect you. 10112020 The sale or transfer of properties in Malaysia which are chargeable with stamp duty must be stamped within 30 days from the date of the execution property transaction.

In the recent Budget 2019 the government announced a stamp duty hike for properties costing more than RM1 million where the rate was increased from 3. Stamp duty exemption on any instrument in respect of the issuance guarantee and services in. Budget Speech Touchpoints.

Stamp duties are imposed on instruments and not transactions. Calculations RM Rate. Who is required to use STAMPS.

Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Maximize your returns and minimize costsrisks when selling property in Malaysia. 25092018 STAMPS is an Electronic Stamp Duty Assessment and Payment System via internet.

You will also need to pay the stamp duty on your loan agreement based on a flat rate of 05 of the total loan. This method will replace the manual system in LHDNM s counter which use Franking Machine and Revenue Stamp. Always The Lowest Price Guarantee.

I got the following table from the LHDN Office. Save Big at Agoda. Jadual Average Lending Rate Bank Negara Malaysia Seksyen 140B Sekatan ke atas Kebolehpotongan Faedah Seksyen 140C Akta Cukai Pendapatan 1967 - Edisi Bahasa Inggeris Sahaja Study Group on Asian Tax Administration and ResearchSGATAR.

Franking Machine and Revenue Stamp will be replaced by receiptstamp certificate which generate by STAMPS. UPDATES ON STAMP DUTY MALAYSIA FOR YEAR 2020 - Malaysia Housing Loan 2020.

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

How Much Is The Cost Of Sale And Purchase Agreement And Stamp Duty In 2020 Malaysia Housing Loan

How Much Is The Cost Of Sale And Purchase Agreement And Stamp Duty In 2020 Malaysia Housing Loan

Updates On Stamp Duty Malaysia For Year 2021 Malaysia Housing Loan

Updates On Stamp Duty Malaysia For Year 2021 Malaysia Housing Loan

Property Insight Stamp Duty 2019

Mot Calculation 2020 Property Paris Star

Mot Calculation 2020 Property Paris Star

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2021

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Malaysia What Is Mot And Stamp Duty Childfasr

Malaysia What Is Mot And Stamp Duty Childfasr

2019 Golden Period Buy Property Waive Mot And Loan Stamp Duty

2019 Golden Period Buy Property Waive Mot And Loan Stamp Duty

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Count The Cost Of Buying A Property Edgeprop My

Count The Cost Of Buying A Property Edgeprop My

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Review Budget 2020 Stamp Duty Real Property Gain Tax Ecovis Malaysia

Review Budget 2020 Stamp Duty Real Property Gain Tax Ecovis Malaysia

Post a Comment for "Stamp Duty Rate Malaysia 2019"