Stamp Duty Exemption 2021 Uk

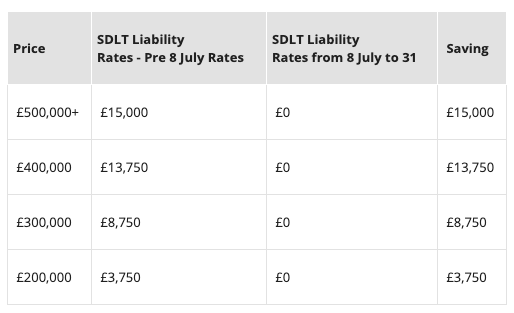

From July the tax-free threshold will drop for home buyers to 250000 until September. 08032021 From 1 April 2021 different rates of Stamp Duty Land Tax SDLT will apply to purchasers of residential property in England and Northern Ireland who are not resident in the UK.

Property Master Academy Will The Stamp Duty Exemption Be Extended Beyond 31st March 2021

Property Master Academy Will The Stamp Duty Exemption Be Extended Beyond 31st March 2021

From 1 July to 30 September 2021 youll pay no Stamp Duty on residential properties costing up to 250000.

Stamp duty exemption 2021 uk. 19042021 It means you wont pay any stamp duty on the first 250000 of the purchase price. You may be eligible for Stamp Duty Land Tax SDLT reliefs if youre buying your first home and in certain other situations. Stamp Duty from 1 July 2021.

The stamp duty holiday was originally due to end in March. A 27 was gazetted on 25 January 2021. 16032021 When is the stamp duty holiday deadline.

From 1 October 2021 rates are due to return to normal. A 53 and Stamp Duty Exemption No. Stamp Duty Exemption Order 2021 and Stamp Duty Exemption No.

Year 2003 Stamp Duty Order Exemption PUA 58 Year 2007 Stamp Duty Order Exemption PUA 420 Year 2008 Stamp Duty Order Remittance PUA 211 PUA 311 Year 2009 Stamp Duty Order Remittance PUA 409 Year 2010 Stamp Duty Order Remittance PUA 376 PUA 423 PUA 475 PU. The rates are 2. Example In March 2021 you buy a house for 625000.

2 Order 2021 Please take note of Stamp Duty Exemption Order 2021 PU. 0 on the first 500000 0 5 on the remaining 125000 6250. A 54 both dated 10 Feb 2021that are deemed to have come into operation on 1 Jan 2021.

2 Order 2021 PU. 2 2020 Amendment Order 2021 PU. 08032021 The stamp duty holiday is due to come to an end on June 30 2021 as announced by Rishi Sunak in the Budget.

The Amendment Order provides that. 0-125000 0 125001-250000 2. 04032021 Property website Zoopla has estimated that 46 of house sales in England to the end of September will benefit from full or partial stamp duty exemption.

These reliefs can reduce the amount of tax. It means that international buyers of second homes could pay up to 17 tax on expensive properties. This changes on 1 July 2021.

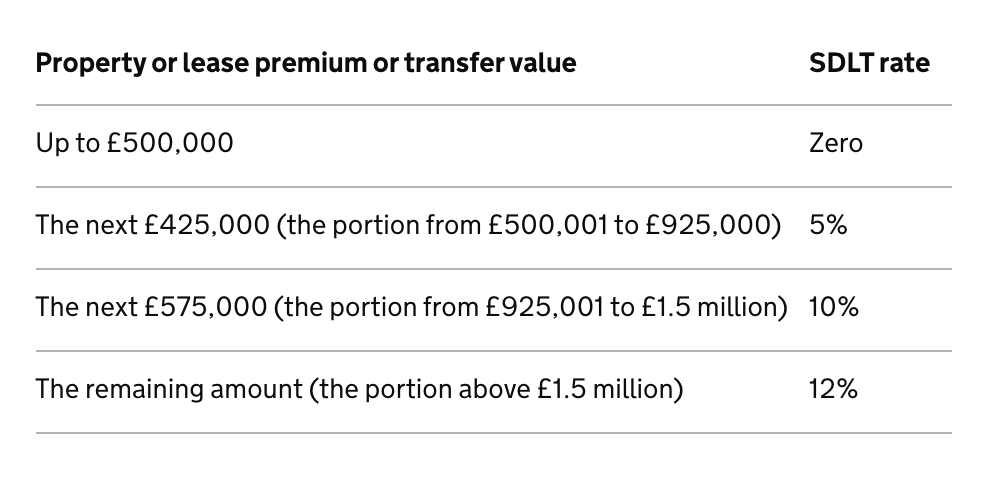

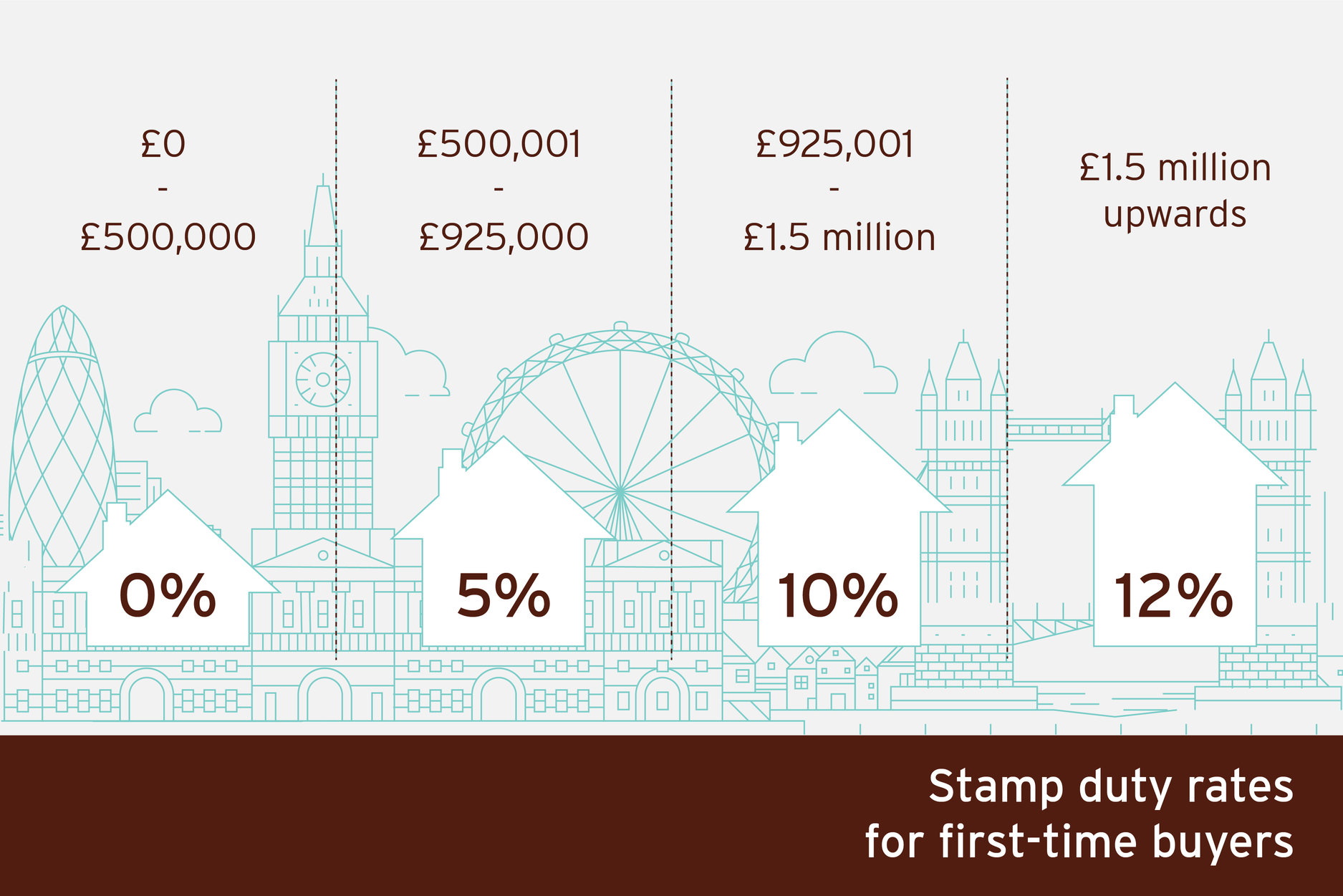

08072020 If you purchase a residential property between 1 July 2021 to 30 September 2021 you only start to pay SDLT on the amount that you pay for the property above 250000. 05052015 The current SDLT threshold for residential properties is 500000. The threshold for non-residential land and.

03032021 From 1 July 2021 onwards the normal rules for first-time buyers will return these are that you dont have to pay any stamp duty on the first 300000 of a purchase. 11122018 In England and Northern Ireland its known as Stamp Duty Land Tax and is usually payable on purchases above 125000 however from the 8th July 2020 through to the 31st March 2021 a Stamp Duty holiday applies meaning properties up to 500000 are exempt as long as the transaction completes by 31st March 2021. The SDLT you owe will be calculated as follows.

Following the above the Stamp Duty Exemption No. 03032021 extending to 30 June 2021 the nil rate band of 500000 which was due to end on 31 March 2021 introducing a nil rate band of 250000 for the period 1. However when announcing the Budget Chancellor Rishi.

If youre a first-time buyer youll pay no Stamp Duty on properties costing up to 300000 and a discount rate up to 500000. Its also worth noting that if you already own a home and buy an additional property worth more than 40000 a 3 levy applies both currently and when the stamp duty holiday ends. A The exemption will be extended to instruments of loan or financing agreements executed by 30 June 2021 previously 31 December 2020.

Budget 2021 under the property segment focuses more on homeownership for first-time house buyers by giving Stamp Duty exemption up to maximum RM9000 and RM2500 stamp duty for transfer and loan agreement instrument. 03032021 From April 2021 an additional 2 stamp duty levy will be imposed on non-UK residents who buy property in England and Northern Ireland.

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Housing Market Open Amid Calls To Extend Stamp Duty Holiday Forbes Advisor Uk

Housing Market Open Amid Calls To Extend Stamp Duty Holiday Forbes Advisor Uk

Uk Property Demand Surges To New High Amid Stamp Duty Stampede

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Stamp Duty Land Tax Update Lexology

Stamp Duty Land Tax Update Lexology

Property Master Academy Will The Stamp Duty Exemption Be Extended Beyond 31st March 2021

Property Master Academy Will The Stamp Duty Exemption Be Extended Beyond 31st March 2021

The New Sdlt Surcharge Stamping On Foreign Buyers

The New Sdlt Surcharge Stamping On Foreign Buyers

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Uk Budget 2021 More Brits Favour Scrapping Stamp Duty

What Stamp Duty Holiday Extension Could Mean For House Prices In 2021 Business Live

What Stamp Duty Holiday Extension Could Mean For House Prices In 2021 Business Live

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Stamp Duty For Investment Property An Overview Select Property Group

Stamp Duty For Investment Property An Overview Select Property Group

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Stamp Duty What You Need To Know About The New Temporary Changes Webbers

Stamp Duty What You Need To Know About The New Temporary Changes Webbers

Stamp Duty Buying Advice For London Properties Marsh Parsons

Stamp Duty Buying Advice For London Properties Marsh Parsons

Stamp Duty Exemption For Smes On Any Instrument Executed For M A Ey Malaysia

Stamp Duty Exemption For Smes On Any Instrument Executed For M A Ey Malaysia

Property Duty Holidays Extended In England N Ireland Wales Forbes Advisor Uk

Property Duty Holidays Extended In England N Ireland Wales Forbes Advisor Uk

Stamp Duty Exemption London Stock Exchange

Stamp Duty Exemption London Stock Exchange

Mandmproperty Co Uk Wp Content Uploads 2020 06

Mandmproperty Co Uk Wp Content Uploads 2020 06

Post a Comment for "Stamp Duty Exemption 2021 Uk"