Stamp Duty Exemption 2021 Gazette

1 Subject to subparagraphs 2 3 and 4 stamp duty shall be exempted in respect of any loan agreement to finance the purchase of residential property under the Home Ownership Campaign 20202021 the value of which is more than three hundred. From 1st June 2020 to 31st December 2021 the gains arising from disposing of residential property are now exempted for all Malaysian citizens.

Https Mahwengkwai Com Wp Content Uploads 2020 08 2020 08 17 Gazettes Of Penjana Initiative P U A 216 2020 217 2020 218 2020 Pdf

A minimum of 10 discount from property price applicable to all units that are not subjected to.

Stamp duty exemption 2021 gazette. The approval is obtained on or after 1 June 2020. Budget 2021 under the property segment focuses more on homeownership for first-time house buyers by giving Stamp Duty exemption up to maximum RM9000 and RM2500 stamp duty for transfer and loan agreement instrument. 1 The Minister exempts all instrument of transfer for the purchase.

Please take note of Stamp Duty Exemption Order 2021 PU. This exemption is limited to the disposal of three units of residential homes per individual. Of the Stamp Act 1949 Act 378 the Minister makes the following order.

Stamp duty exemption will be provided to residential properties which were acquired under the following conditions. Purchase Agreement executed between 1 June 2020 to 31 May 2021. For our detailed comments on the Finance Bill 2020 please click on the following link.

A 54 both dated 10 Feb 2021that are deemed to have come into operation on 1 Jan 2021. 2 2020 Amendment Order 2021 has now been issued to amend the Stamp Duty Exemption No. The Stamp Duty Exemption No.

A 53 and Stamp Duty Exemption No. It will return to the normal level on 1 October 2021. 01062020 The stamp duty exemptions are applicable for the purchase of residential units for Sale.

A 54 both dated 10 Feb 2021 that are deemed to have come into operation on 1 Jan 2021. Stamp Duty Exemption Order 2021. 2 This Order is deemed to have come into operation on 1 January 2021.

The Stamp Duty Exemption No. 05032021 Following the Budget 2021 proposal in relation to stamp duty exemption for the purchase of a first residential home the relevant gazette orders have been issued. Tax Espresso - January 2021 02 1.

03032021 Then after this time there would be no stamp duty on purchases up to 250000 until the end of September. Stamp Duty Exemption Order 2021 PUA 532021 PUA 532021 the Order was gazetted on 10 February 2021 and is deemed to have come into operation on 1 January 2021 to legislate the full stamp duty exemption on instrument of transfer for the purchase of the first residential property. 1 This order may be cited as the Stamp Duty Exemption Order 2021.

The following Orders were gazetted on 10 February 2021 to exempt the stamp duty payable on an instrument of transfer and a loan agreement relating to the purchase of a residential property by a first-time home buyer. 2 Order 2021 PU. 2 Order 2021 PU.

17082020 the contract of disposal of a residential property is executed on or after 1 June 2020 but not later than 31 December 2021 and is duly stamped not later than 31 January 2022. PUA 532021 exempts stamp duty from all instrument of transfer for the purchase of only one 1 unit of residential property which is worth market value not more than five hundred thousand ringgit RM500000 executed by a Malaysian citizen individual. A 53 and Stamp Duty Exemption No.

Finance Act 2020 The Finance Bill 2020 has been gazetted as the Finance Act 2020 on 31 December 2020 which has come into operation on 1 January 2021. 01102020 Stamp Duty Exemption for Home Ownership Campaign. 2 The stamp duty exemption under subparagraph 1 shall only apply if a the sale and purchase agreement for the purchase of the residential property is executed on or after 1 January 2021 but not later than 31 December 2025.

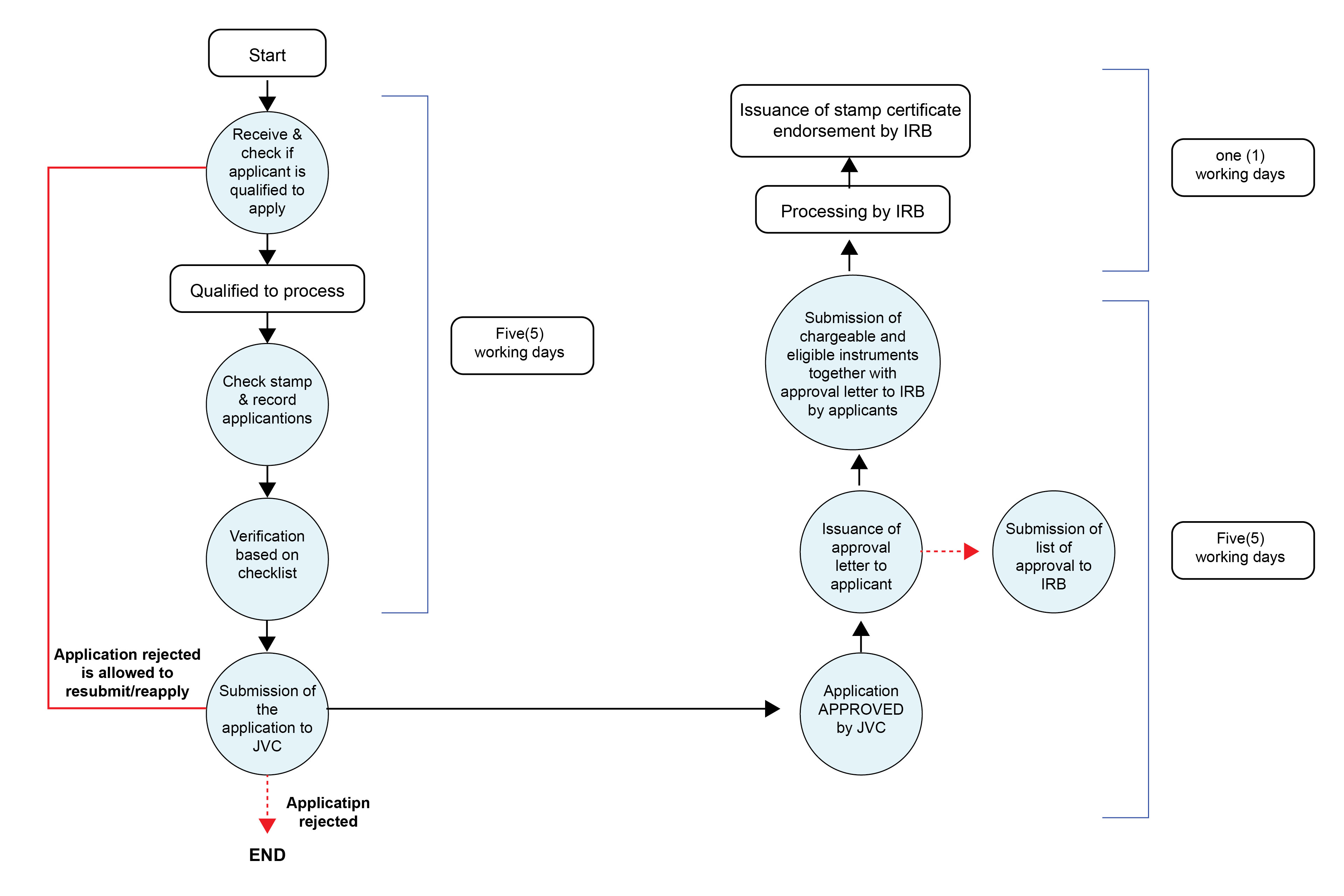

Other tax developments. 22032021 Gazette Order PUA532021 Stamp Duty Exemption Order 2021. Similar to the stamp duty exemptions under HOC it appears that the RPGT Exemption is only given to Malaysian citizens.

Stamp Duty Exemption No. We ha dpreviously sent a letter to urge the Ministry of Finance to look into th matter of e gazettement of the relevant Orders pursuant to the 2021 Budget. There are some exemptions allowed for RPGT with the following condition.

While the news of the full extension to 30 June will come as no surprise to the mortgage and property industry the more tapered ending to 30 September has provided relief to those who were concerned about an. Please click here to view the Finance Act 2020. We had previously sent a letter to urge the Ministry of Finance to look into the matter of gazettement of the relevant Orders pursuant to the 2021 Budget speech made last year.

1Sales and Purchase Agreement dated 1 June 2020 to 31 May 2021 signed between owner and developer registered with REHDA SHAREDA and SHEDA. Stamp Duty Exemption Order 2021 Stamp Duty Exemption No. We recommend that you re-visit.

Gazette Order PUA542021 Stamp. 03082020 Real Property Gains Tax RPGT Exemption. And b the individual has never owned any residential property including.

Tightened condition for Real Property Gains Tax RPGT exemption on disposals other than Real Property Company RPC. 2 Order 2020 was gazetted in May 2020 providing stamp duty exemption of an instrument for the restructuring or rescheduling of a business loan or financing refer to TaXavvy 392020. Citation and commencement 1.

Year 2002 Stamp Duty Order Remittance PUA 434 Year 2003 Stamp Duty Order Exemption PUA 58 Year 2007 Stamp Duty Order Exemption.

Stamp Duty Calculation Malaysia 2021 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

Stamp Duty Calculation Malaysia 2021 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

Stamp Duty Calculation Malaysia 2021 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

Stamp Duty Calculation Malaysia 2021 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

Top Hospitals In Rawalpindi Top Hospitals Best Hospitals Pediatric Surgery

Top Hospitals In Rawalpindi Top Hospitals Best Hospitals Pediatric Surgery

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

New Exemptions On Stamp Duty And Real Property Gains Tax To Boost Malaysian Property Market Zico Law

Budget 2021 Key Property Highlights Donovan Ho

Budget 2021 Key Property Highlights Donovan Ho

Pin On Notifications And Updates

Pin On Notifications And Updates

Real Property Gains Tax Exemption Is Now Gazetted Penang Property Talk

Real Property Gains Tax Exemption Is Now Gazetted Penang Property Talk

Https Www Skrine Com Skrine Media Assets Alert 260620 Taxes Buy Sell Prty 1 Pdf

Stamp Duty Exemption For Smes On Any Instrument Executed For M A Ey Malaysia

Stamp Duty Exemption For Smes On Any Instrument Executed For M A Ey Malaysia

Updates On Stamp Duty For Year 2021 Malaysia Housing Loan

Updates On Stamp Duty For Year 2021 Malaysia Housing Loan

Penjana Economic Package New Property Incentives In 2020 Donovan Ho

Penjana Economic Package New Property Incentives In 2020 Donovan Ho

Https Www Kuekong Com Wp Content Uploads 2021 02 Pua 20210210 Pua53 Pdf

Exemption On Instrument Of Loan Or Financing Agreement Ey Malaysia

Exemption On Instrument Of Loan Or Financing Agreement Ey Malaysia

Taxplanning Rpgt Exemption The Edge Markets

Taxplanning Rpgt Exemption The Edge Markets

How To Check Electricity Bill Online Graana Com Blog Electricity Bill Electricity Bills

How To Check Electricity Bill Online Graana Com Blog Electricity Bill Electricity Bills

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

Budget 2021 Stamp Duty Extensions Rto Scheme To Promote Home Ownership The Edge Markets

Post a Comment for "Stamp Duty Exemption 2021 Gazette"