Stamp Duty Act Malaysia 2020

21062011 PENALTY STAMP DUTY An instrument may be stamped within 30 days of its execution if executed within Malaysia or within 30 days after it has been first received in Malaysia if it has been executed outside Malaysia. There are two types of Stamp Duty namely ad valorem duty and fixed duty.

Temporary Measures For Reducing The Impact Of Coronavirus Disease 2019 Covid 19 Act 2020

Temporary Measures For Reducing The Impact Of Coronavirus Disease 2019 Covid 19 Act 2020

06022020 The stamp duty shall only apply for sale and purchase agreement executed from 1 July 2019 to 31 December 2020 by an eligible Malaysian citizen.

Stamp duty act malaysia 2020. 07072020 The 2020 Guidelines clarify that stamp duty is to be imposed on the value of the shares rounded up to the nearest thousand as Item 32 b of the First Schedule of the Stamp Act 1949 provides that stamp duty of RM3 is to be imposed for. The fixed income tax rate for non-residents shall be increased by 2 from 28 to 30. To Members of the Malaysian Bar.

Circular No 2392020 Dated 30 July 2020. 20122019 Presently the maximum amount of stamp duty payable under item 27 a ii is RM500. 07012019 Stamp duty exemption on loan or financing agreements executed from 27 February 2020 to 31 December 2020 in respect of financing facility approved by Bank Negara Malaysia for small and medium enterprises SME ie.

3 Order 2020. Stamp duties are imposed on instruments and not transactions. 03082020 The exemption of stamp duty with effective on 1 June 2020 for the residential property price between RM300000 to RM25Million.

The increase in stamp duty under item 27 a ii of the Stamp Act 1949 was one of the measures announced during the 2020 Malaysian Budget. Circular No 0212020 Dated 23 Jan 2020. For the ad valorem duty the amount payable will vary depending on type and value of the.

Circular No 2392020 Orders Relating to Stamp Duty Exemption and Real Property Gains Tax Exemption. To Members of the Malaysian Bar. Malaysia Budget 2020 Personal Tax It is proposed that the income tax for resident individuals with chargeable income of more than RM2000000 be increased by 2 to 30.

Special Relief Facility All Economic Sectors Facility SME Automation and Digitalisation Facility Agrofood Facility and Micro Enterprises Facility. 07082020 To effect the proposals announced under the National Economic Recovery Plan on 5 June 2020 the following Exemption Orders have been gazetted on 28 July 2020 and are effective from 1 June 2020. 1 This Act may be cited as the Stamp Act 1949.

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. A 369 and Stamp Duty Exemption No 4 Order 2019 PU. Stamp Duty Remission No 2 Order 2019 and Stamp Duty Exemption No 4 Order 2019.

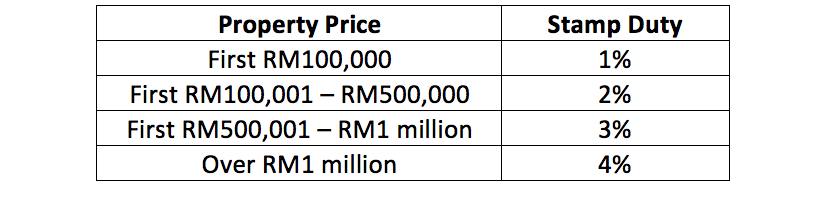

Stamp Duty Exemption 2021 And Other Benefits Property Stamp Duty Malaysia 2021 Property stamp duty fee Malaysia for RM500k and RM550k year 2021. 19032013 Lembaga Hasil Dalam Negeri. According to Clause 27 of the Bill the above-referred amendment will come into operation on 1 January 2020.

Orders Relating to Stamp Duty Exemption and Real Property Gains Tax Exemption. Income Tax and Stamp Duty Exemptions in relation to Malaysia Japanese Yen Bonds Series A 2019. 24112020 Lembaga Hasil Dalam Negeri LHDNM issued Garis Panduan 2020 replacing Garis Panduan 2019 issued on 6 November 2019 and Guidelines on the Stamping of Share Transfer Instruments for Shares that are not quoted on the Kuala Lumpur Stock Exchange Garis Panduan 2001 to be effective from 1 March 2020.

In general term stamp duty will be imposed to legal commercial and financial instruments. A 394 dated 26 Dec 2019 and 31 Dec 2019 respectively. 1 Stamp Duty Exemption No.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. If it is not stamped within the period stipulated a penalty of. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949.

Stamp Duty Exemption No. Pursuant to the announcement of the PENJANA initiative by the Prime Minister on 5 June 2020. In this Act unless the context otherwise requires banker means any person licensed under the Islamic Banking Act 1983 Act 276 or the Banking and Financial Institutions Act 1989 Act 372 to carry on the business of banking in Malaysia.

2 This Act shall apply throughout Malaysia. Please take note of Stamp Duty Remission No 2 Order 2019 PU. The exemption on the instrument of transfer is limited to the first RM1Million of the property price and the stamp duty will be charged RM3 for every RM100 of the balance property price which is more than RM1Million.

05062020 The government will provide stamp duty exemption on the instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 and. Here are some of the most common Stamp Duty questions along with the best way to answer the questions about stamp duty Malaysia 2021.

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Sme Corporation Malaysia Slides

Sme Corporation Malaysia Slides

Spa Stamp Duty Mot Calculator Legal Fees Calculator Properly

Spa Stamp Duty Mot Calculator Legal Fees Calculator Properly

Here S How To Expand Your Industrial Property Portfolio In Selangor Malaysia Industrialspace2u

Here S How To Expand Your Industrial Property Portfolio In Selangor Malaysia Industrialspace2u

Announcement For Stamp Duty And Rpgt Exemption 2020 Studocu

Announcement For Stamp Duty And Rpgt Exemption 2020 Studocu

Https Www Skrine Com Skrine Media Assets Alert 260620 Taxes Buy Sell Prty Pdf

Budget 2020 Stamp Duty On Foreign Currency Loan Agreement To Be Increased Raja Darryl Loh

Budget 2020 Stamp Duty On Foreign Currency Loan Agreement To Be Increased Raja Darryl Loh

Revenue Loss From Uncollected Strata Titles The Star

Revenue Loss From Uncollected Strata Titles The Star

Best Time To Buy A First Hand Home Malaysian Institute Of Estate Agents

Best Time To Buy A First Hand Home Malaysian Institute Of Estate Agents

Https Www Malaysianbar Org My Cms Upload Files Document Circular 20no 20021 2020 Pdf

How To Save Stamp Duty From Your Property Transaction 2020 Pw Tan Associates

Malaysian Stamp Duty Handbook 6th Edition Marsden Professional Law Book

Malaysian Stamp Duty Handbook 6th Edition Marsden Professional Law Book

Https Hhq Com My Wp Content Uploads 2020 03 5 Stamping Of Documents Hhq Empower Mac 2020 Pdf

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Post a Comment for "Stamp Duty Act Malaysia 2020"