How Does Stamp Duty Holiday Work For A Second Property

18112020 Does stamp duty apply to second homes. Yes the stamp duty holiday applies when purchasing a second home.

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

09072020 The rate a buyer has to pay varies depending on the price and type of property - usually you would expect to pay more stamp duty if the property is worth more.

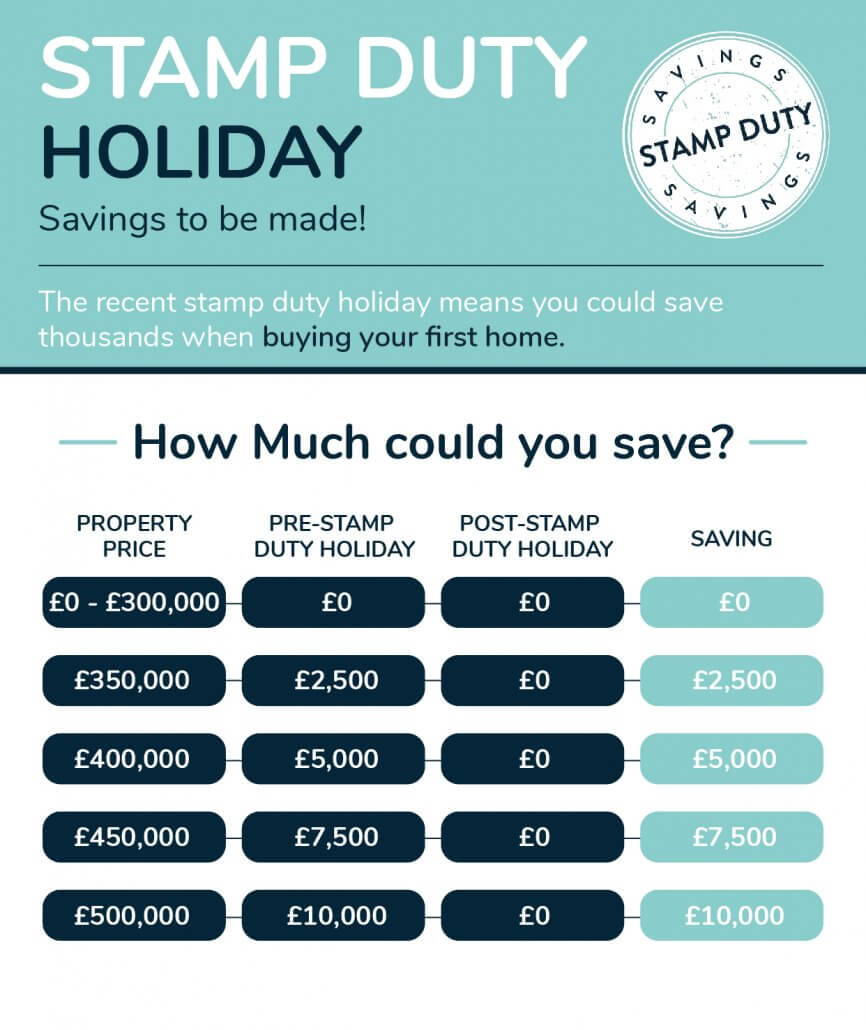

How does stamp duty holiday work for a second property. 04032021 How does the stamp duty holiday work. The stamp duty holiday is essentially a temporary increase to the nil-rate threshold increasing from 125000 or 300000 for first-time buyers to 500000. The main driving force behind the change was to stimulate the housing market following the coronavirus pandemic.

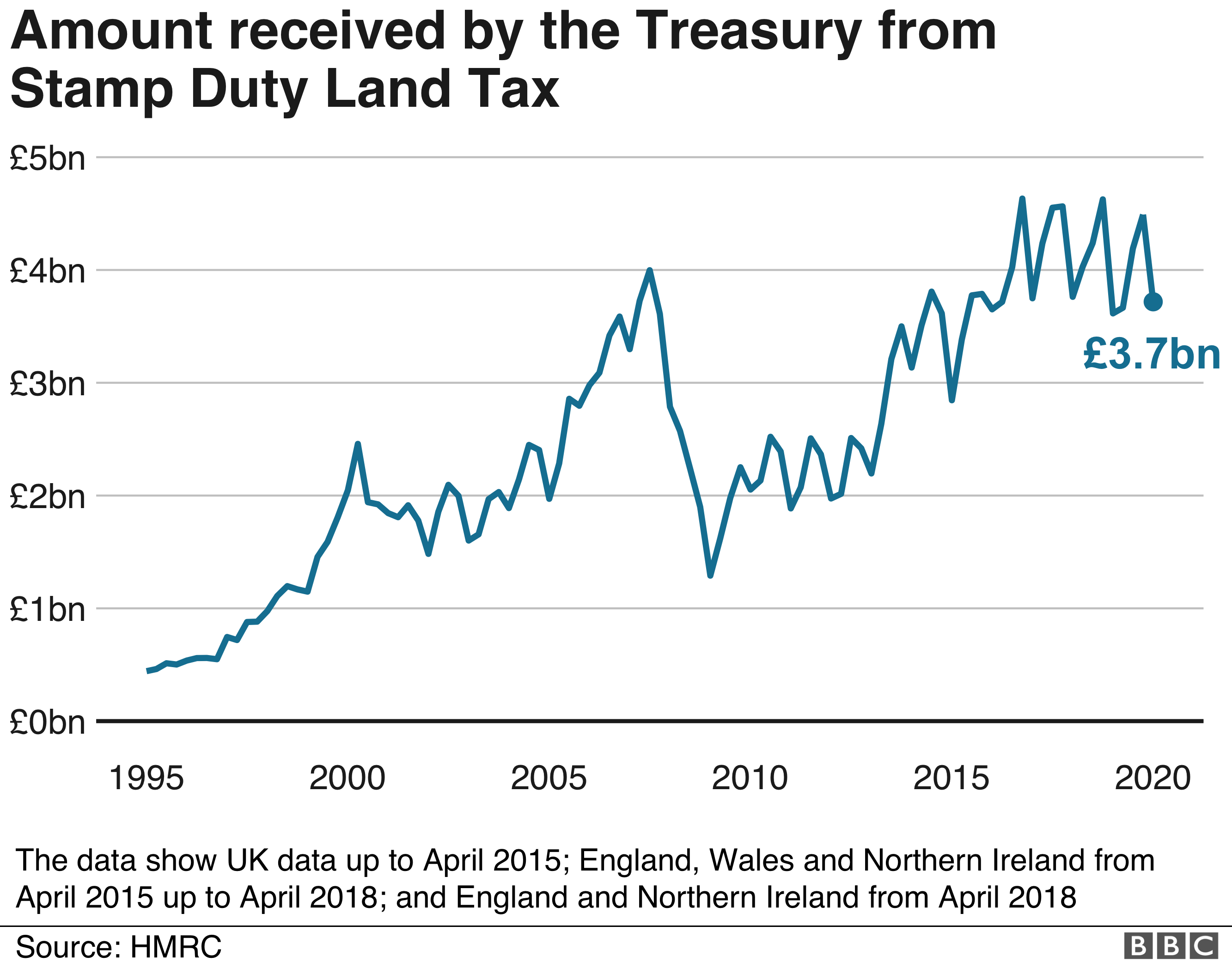

The Stamp Duty Tax rates for second homes and buy-to-let properties are the same because they both qualify as second residences. Landlords and those purchasing additional dwellings still get the tax cut but. 08072020 Stamp duty is a tax paid by people when they buy a property.

24022021 When you buy any property in addition to your main residence be it a second home a holiday home or a buy-to-let there is an additional stamp duty charge. 02032021 Will the stamp duty holiday apply to second homes. How does the stamp duty holiday work.

However the stamp duty holiday does not affect the 3 stamp duty surcharge for additional residential properties or. Experts say that a stamp. Landlords pay an extra 3 of stamp.

Some second-home purchases are exempt from stamp duty. This applies whether youre buying a second home as an investment buy-to-let for a holiday home or any other purpose. 21012016 2nd Property Stamp Duty Stamp Duty Questions January 21 2016 The introduction of the new stamp duty of 3 on second properties that will be introduced on 1st April 2016 has brought up a number of questions about how exactly the scheme will work and what situations would give rise to the payment of the additional stamp duty.

Then calculate 3 of. If youre buying a second property or a property on a buy-to-let basis you will still benefit from the increased 500000 threshold however. 08072020 The Treasury hopes that the possible stamp duty holiday will reboot the property market after it effectively froze during lockdown with viewings sales and moves suspended.

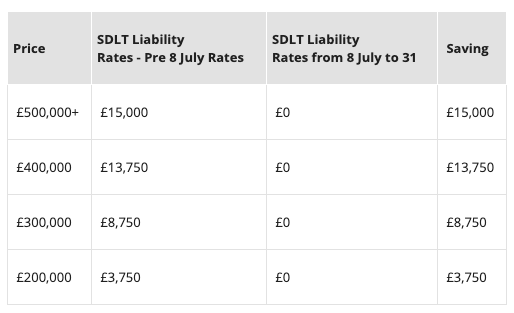

08072020 Second homes are taxed at higher rates of stamp duty its 3 per cent on purchases up to 125000 5 per cent on the portion worth between 125001 and 250000 and 8 per cent on the bit worth between 250001 and 925000. 09072020 To get an overall Stamp Duty figure on a second property work out the regular cost first with our handy calculator. Outside of the stamp duty holiday if youre a landlord or otherwise buying a second home youre required to pay a 3 surcharge on top of the normal rates.

Under the current scheme buyers do not have to pay stamp duty on the value of a property up to 500000 rather than 125000. The charge applies above the. This starts at 3 and then rises in bands climbing to 15 for the most expensive properties.

The stamp duty holiday affects second homes. The amount you pay depends on whether you live in England and N Ireland Wales or Scotland which stamp duty band your property price falls into whether you are a first time buyer and whether you are buying your primary residency or a second home. 22072020 Stamp duty is payable on all properties including commercial buy to let and second property purchases.

First home movers who bought a home for the average property price at 248000 would save 2460 on stamp duty. This is because the stamp duty land tax holiday applies the 500000 nil rate band to purchases of second homes so that the first 500000 of the price of an additional dwelling is exempt from ordinary rates of stamp duty. 22032021 Since April 2016 anyone buying an additional property essentially second homes and buy-to-lets has had to pay an additional three percentage points in stamp duty.

13072020 Does stamp duty holiday apply to a second home. You have to pay the extra rate even if the property you already own is abroad. 01042021 Anyone buying an additional residential property will usually have to pay the additional stamp duty for second homes.

01102020 The good news is that yes the stamp duty holiday does apply to second homes. 08032021 The Treasury announced the stamp duty holiday in a bid to breathe life into the property market after it effectively froze during the first lockdown with viewings sales and moves suspended. It allows people to save up to.

11122020 If you buy a second home or a buy-to-let property youll pay Stamp Duty at the standard rates plus a 3 surcharge on each band.

Stamp Duty Rate Calculator Property Land Tax Calculator

Stamp Duty Rate Calculator Property Land Tax Calculator

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Stamp Duty Holiday Should I Buy A Property Now Hill Abbott Solicitors Chelmsford

Stamp Duty Holiday Should I Buy A Property Now Hill Abbott Solicitors Chelmsford

Is The Stamp Duty Holiday The Best Time To Buy A House Expert Answers Your Questions Mirror Online

Is The Stamp Duty Holiday The Best Time To Buy A House Expert Answers Your Questions Mirror Online

Stamp Duty Holiday Extended Homeowners Alliance

Stamp Duty Holiday Extended Homeowners Alliance

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Holiday The Winners And The Losers Bbc News

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Stamp Duty Calculator Planned Housing Developments In Devon Cornwall Somerset Dorset

Stamp Duty Calculator Planned Housing Developments In Devon Cornwall Somerset Dorset

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

London Property Developer Extends Stamp Duty Holiday By Six Months

Uk Homebuyers Told To Act Fast To Beat Stamp Duty Holiday Deadline Stamp Duty The Guardian

Uk Homebuyers Told To Act Fast To Beat Stamp Duty Holiday Deadline Stamp Duty The Guardian

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Stamp Duty Land Tax Update Lexology

Stamp Duty Land Tax Update Lexology

Post a Comment for "How Does Stamp Duty Holiday Work For A Second Property"