How Does Government Stamp Duty Holiday Work

How does it work and what does it mean for you. The holiday was first introduced on 8 July last year which meant that most buyers are exempt from paying any Stamp Duty provided they completed their purchase before 31 March 2021.

Uk S Sunak Could Extend Stamp Duty Holiday Until June End The Times Reuters

Uk S Sunak Could Extend Stamp Duty Holiday Until June End The Times Reuters

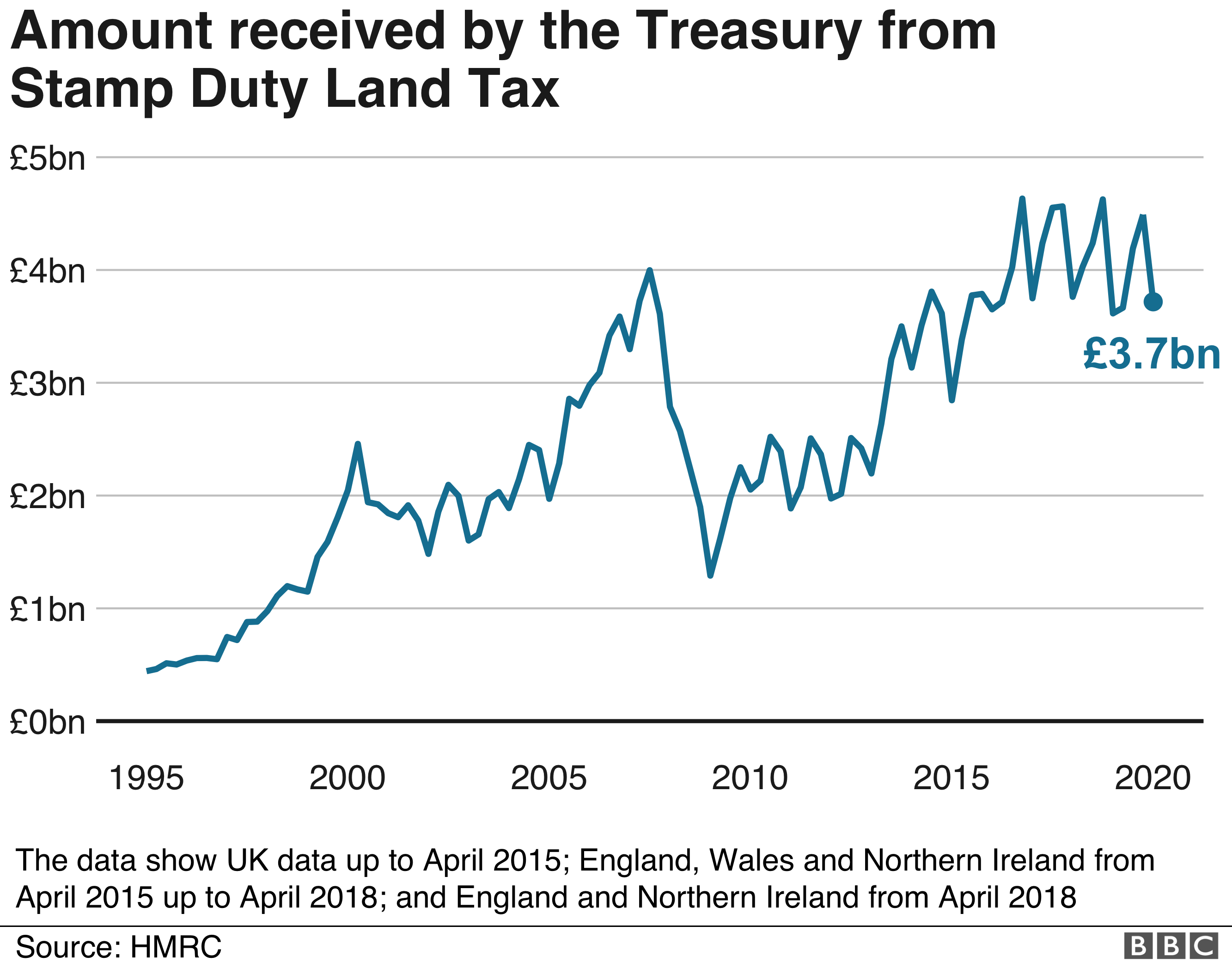

Stamp Duty Land Tax SDLT is a lump sum payment which buyers of property or land over a certain price have to pay.

How does government stamp duty holiday work. It allows people to save up to. How much can you save with the stamp duty holiday. Under the current scheme buyers do not have to pay stamp duty on the value of a property up to 500000 rather than 125000.

So for the duration of the holiday there will be no 2 stamp duty band. The stamp duty. The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020.

This can result in savings of up to 15000. 01102020 The stamp duty holiday was put in place to help buyers in a time when many are facing financial hardships as a result of the coronavirus. Instead stamp duty will jump straight to 5 for the slice from 500000 to 925000 and then to 10 for the slice up to 15 million.

04032021 How does the stamp duty holiday work. 16032021 How does the stamp duty holiday work. Prior to the Governments announcement house buyers in England had to pay stamp duty on properties over 125000 or if you were a First-Time Buyer you paid no stamp duty up to 300000 and then 5 on any portion between.

08072020 The Chancellor today confirmed a cut to Stamp Duty with immediate effect increasing the Stamp Duty threshold at which buyers start to pay the levy from its current 125000 up to 500000. 24022021 The stamp duty bands or slices will remain otherwise unchanged. Under the current scheme buyers do not have to pay stamp duty on the value of a property up to 500000 rather than 125000.

10032021 He raised the threshold at which buyers start paying stamp duty with immediate effect from 125000 to 500000 in England and Northern Ireland. 09072020 Chancellor Rishi Sunak has announced a stamp duty holiday which will run until 31 March 2021 in a bid to boost the struggling housing market which has taken a hit due to the coronavirus pandemic. 25092020 Stamp Duty Holiday.

From July the tax-free threshold will drop for home buyers to 250000 until September. 03032021 From October stamp duty will return to normal with the point at which you start paying set at 125000. Chancellor Rishi Sunak has suggested that with the new policy the average saved on a stamp duty bill is 4500.

It allows people to save up to. In Scotland it is Land and Buildings Transaction Tax while in Wales buyers pay Land Transaction Tax. The amount handed to the government depends on where you are in the UK and the price of the property.

08032021 The stamp duty holiday is due to come to an end on June 30 2021 as announced by Rishi Sunak in the Budget. 04032021 How does the stamp duty holiday work. 25 September 2020 The Governments Stamp Duty Land Tax SDLT holiday runs until 31st March 2021 and removes the standard rate of SDLT for transactions under 500000 in England.

Transactions over this amount will have to pay SDLT on the additional sum. 08072020 The Chancellor announced a stamp duty holiday in July. It means that nearly nine out of 10 transactions are no longer subject to stamp duty with the average bill falling by 4500.

Stamp duty is a tax paid on property purchases. Moreover nearly nine out of ten home buyers this year will pay no stamp duty at all. Under the stamp duty holiday homebuyers in England and Northern Ireland dont have to pay stamp duty on the first 500000 of the property they buy.

21102020 As part of its Plan for Jobs the government introduced a temporary stamp duty holiday for residential properties worth up to 500000 effective from 8 July 2020 until 31 March 2021. Before this announcement it is only if you buy a home under 125000 or 300000 for first-time buyers that you are exempt from paying any stamp duty. 03032021 How does the Stamp Duty Holiday work.

For more on how stamp duty works and what the current holiday means for you see our Stamp Duty Calculator. This means that any property sold at 500000 or less in England or Northern Ireland before 31st March 2021 will not attract any Stamp Duty. 22072020 How does the stamp duty holiday work.

For a limited time the level at which stamp duty is charged on a residential property is being temporarily raised to 500000. 19042021 What is the stamp duty holiday. The stamp duty holiday was set to run until 31 March 2021.

06082020 In England and Northern Ireland buyers pay Stamp Duty Land Tax. The stamp duty holiday is essentially a temporary increase to the nil-rate threshold increasing from 125000 or 300000 for first-time buyers to 500000. The move was aimed.

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Stamp Duty Holiday Your Move Blog Homewise

Stamp Duty Holiday Your Move Blog Homewise

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

What Stamp Duty Holiday Extension Could Mean For House Prices In 2021 Business Live

What Stamp Duty Holiday Extension Could Mean For House Prices In 2021 Business Live

When Does The Stamp Duty Holiday End Manchester Evening News

When Does The Stamp Duty Holiday End Manchester Evening News

Calls For Stamp Duty Holiday Extension Ftadviser Com

Calls For Stamp Duty Holiday Extension Ftadviser Com

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Housing Market Open Amid Calls To Extend Stamp Duty Holiday Forbes Advisor Uk

Housing Market Open Amid Calls To Extend Stamp Duty Holiday Forbes Advisor Uk

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Holiday The Winners And The Losers Bbc News

Who Benefits From The Stamp Duty Holiday

Who Benefits From The Stamp Duty Holiday

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

Stamp Duty 2020 What Are The Changes To Stamp Duty In 2020

Stamp Duty 2020 What Are The Changes To Stamp Duty In 2020

Post a Comment for "How Does Government Stamp Duty Holiday Work"