How Can You Avoid Stamp Duty On A Second Home

01042021 But there are a few ways you can avoid it. 24032016 M r Frankish said.

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

24022021 How to avoid Stamp Duty on a second home.

How can you avoid stamp duty on a second home. Our solicitor can help draft a loan agreement for a Joint Mortgage Sole Proprietor arrangement. 02032021 If the property you are buying is worth up to 500000 youll have to pay a 3 surcharge while the amount increases depending on the value of the property. If the property is worth between.

11062018 If you decide to do all this yourself rather than instruct a solicitor to do it for you youll also need to complete form ID1 but strangely this has to be done by a solicitor. Stamp Duty on second homes means you pay more in tax. Act as a guarantor Guarantors arent classed as owning the property.

For instance in Queensland you could be entitled to a reduced rate of stamp duty if you buy vacant land worth less than 400000 and you intend to build your own home on it. Ad House selling - You Wont Believe The Top 10 Results. 10022017 Last year a new tax law came into force that affects anyone buying a second home.

Get a loan agreement quote. 13032020 Get a loan agreement to avoid second home stamp duty. If the value of your second home or the share of the property you buy is less than 40000 you dont need to pay the tax.

You may also be exempt if. The upcoming surcharge on stamp duty for landlords and second homeowners could possibly be avoided if you already own a plot of land and intend to build a property on it. Gift a deposit if you arent going to be a joint owner then the stamp duty for second homes wont apply.

As of March 2016 homeowners who purchase an additional property whether thats a buy-to-let or holiday home will need to pay a higher Stamp Duty charge. Buy a freehold property below 40000 we know these are probably quite hard to come by Buy a caravan mobile home or houseboat as your second home. 19042016 Well if youre in a comfortable enough financial position that you can afford to pay for the majority of your childs property outright doing so could help them get on the first rung of the property ladder.

05052021 You can avoid paying stamp duty on a second home if its worth less than 40000. But second home buyers currently benefit from stamp duty relief as well. As per the stamp duty changes imposed in April 2016 one has to pay it even in case of leasehold agreement extensions where the new leases run for over 7 years.

18112020 Some second-home purchases are exempt from stamp duty altogether however. 31082018 The 3 second property stamp duty land tax surcharge rate is notoriously hard to avoid It also applies to all residential properties bought in a limited company even the first Using an interest in possession trust can avoid the charge if for the benefit of adult children A discretionary trust will also usually escape the 3 surcharge. This works out as an additional 3 on top of the standard Stamp Duty rate.

But good luck trying to find one of those. 15092016 We arent married yet so to avoid the extra 3 stamp duty on second properties we are thinking that it be worth taking one of our names off the property we live in and buying the second property. Similarly the Victorian government provides an off-the-plan concession to eligible buyers of a land and building package or a refurbished lot.

The loan agreement takes 24 hours to draft and can include interest terms and when to repay. 09062020 If the stamp duty for a second property is not paid one may be charged a 100 penalty plus interest. There are limited reliefs to avoid paying SDLT on a second home.

Purchases of caravans mobile homes or houseboats are also exempt. 22022021 If the same property was bought after the stamp duty holiday is over from 1 April 2021 they would face a 30000 tax bill. 28022021 We live in England and I am approaching retirement and want to buy a second home near the beach for my wife and I.

Ad House selling - You Wont Believe The Top 10 Results. It seems like a good time because we see that the stamp duty holiday is likely to be. However if you do decide to do this theres an extra cost to be aware of.

Avoid SDLT on Second Home. The transaction must be completed by 31 March 2021 to qualify for the reduced SDLT standard rates. So you will avoid the additional rate.

Paying Stamp Duty On Property Not As Easy As 1 2 3 Business News Top Stories The Straits Times

Paying Stamp Duty On Property Not As Easy As 1 2 3 Business News Top Stories The Straits Times

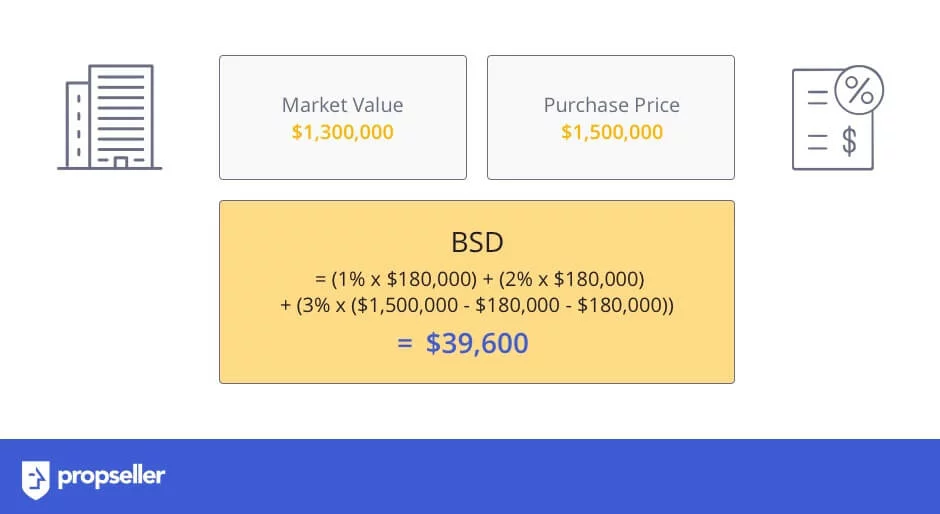

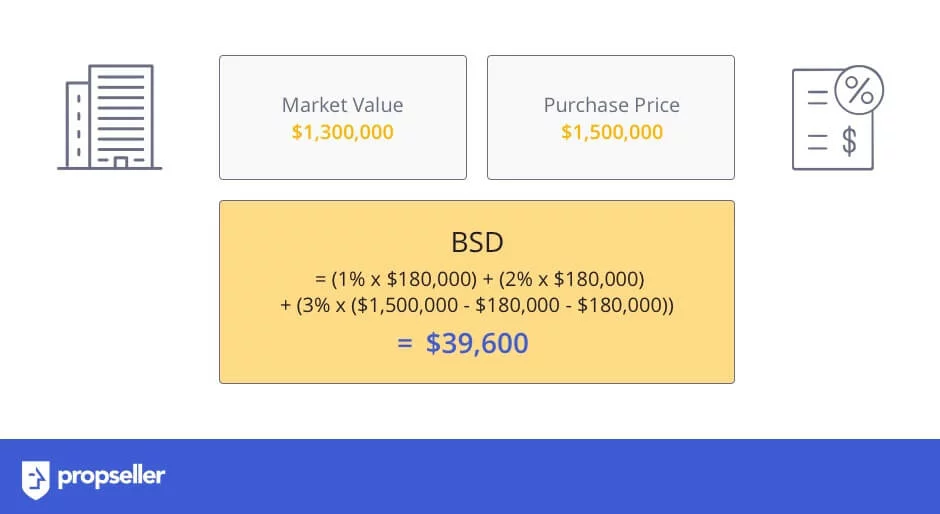

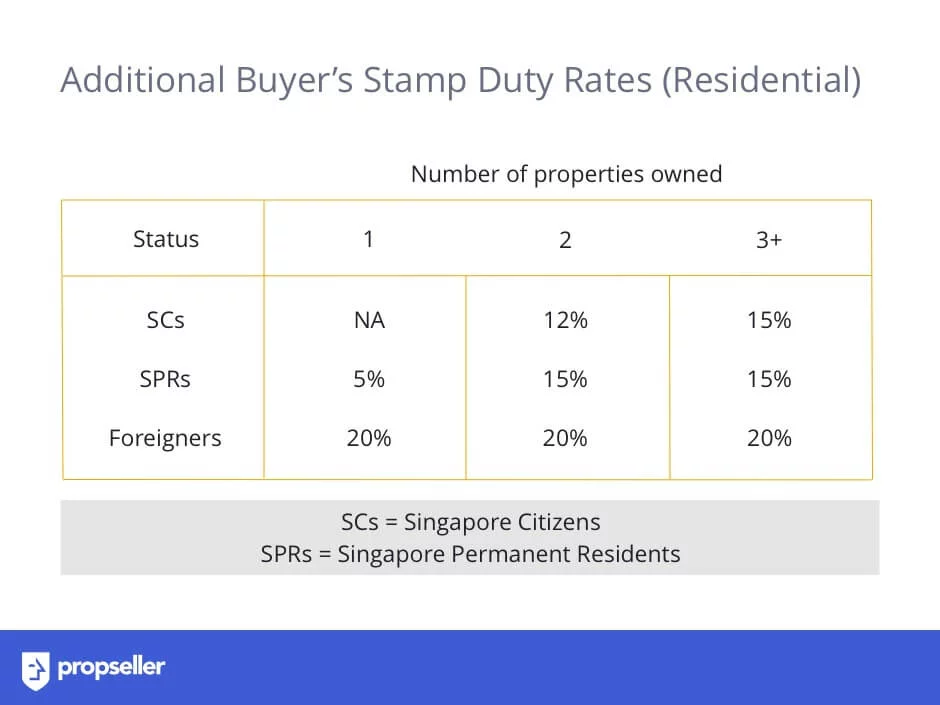

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

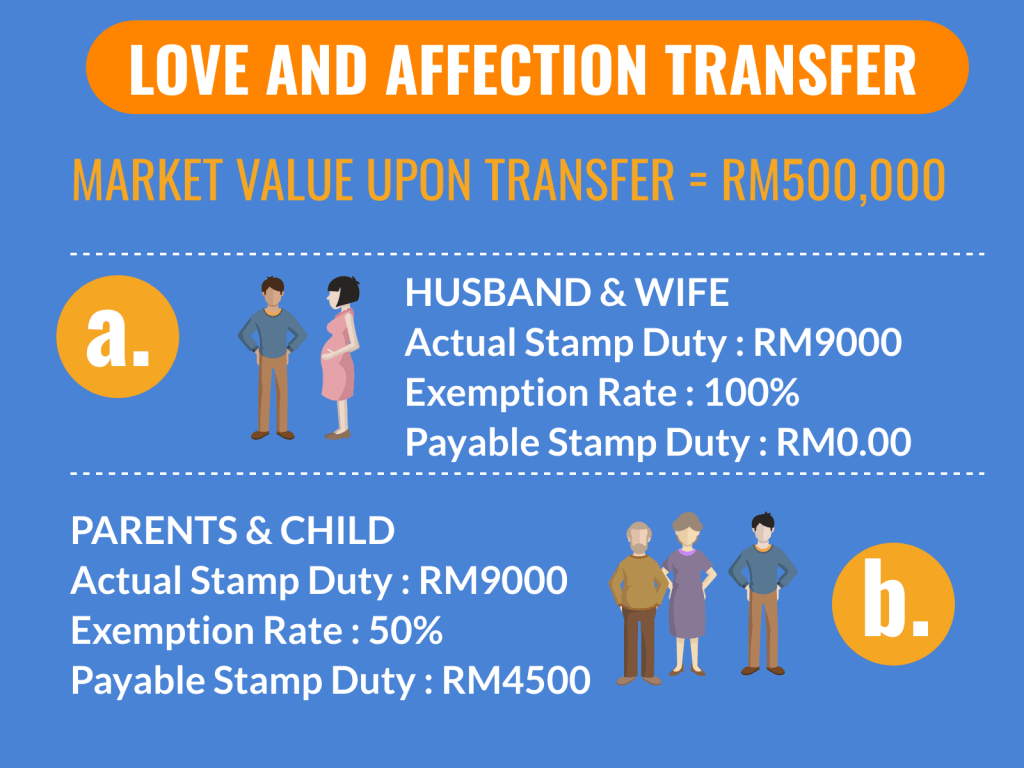

Transfer Of Property Between Family Members In Malaysia 2020 Love And Affection Property Transfer Malaysia Housing Loan

Transfer Of Property Between Family Members In Malaysia 2020 Love And Affection Property Transfer Malaysia Housing Loan

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

How To Beat The Stamp Duty Surge On Second Homes

How To Beat The Stamp Duty Surge On Second Homes

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Additional Buyer S Stamp Duty Absd Explained 99 Co

Additional Buyer S Stamp Duty Absd Explained 99 Co

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

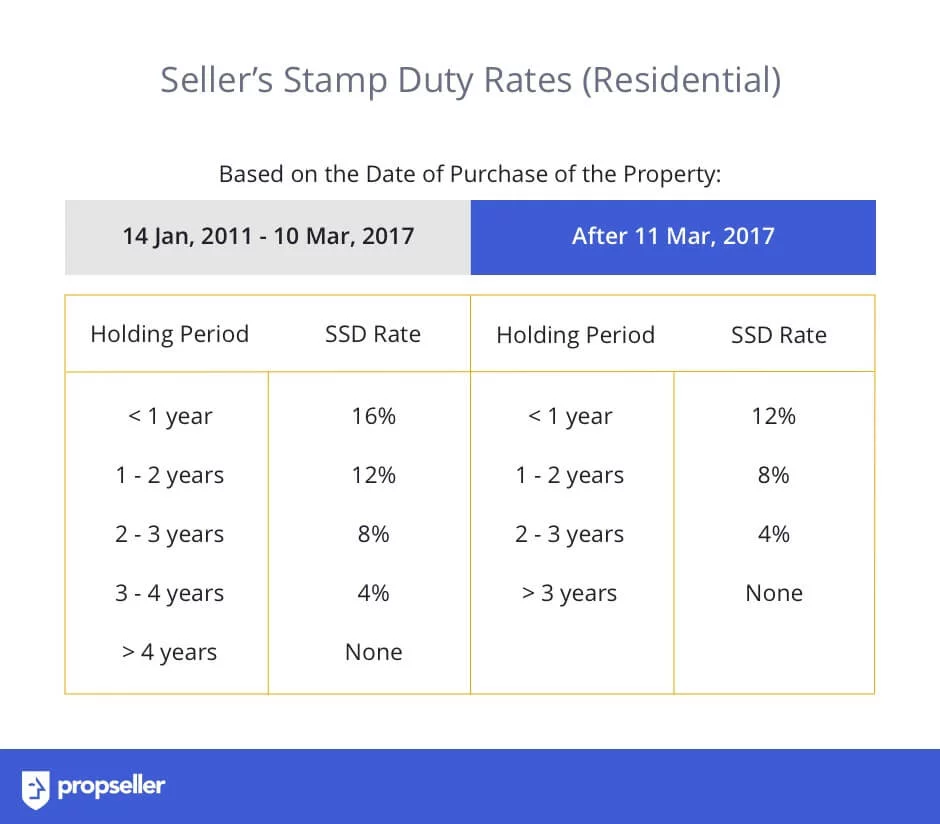

Https Blog Bluenest Sg Seller Stamp Duty

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Https Blog Bluenest Sg Seller Stamp Duty

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Post a Comment for "How Can You Avoid Stamp Duty On A Second Home"