Can Buyer Stamp Duty Be Paid By Cpf

Buying overseas property using your CPF is not allowed. Yes and very happy lawyers too.

Ec Buyer S Guide Dave S Property

Ec Buyer S Guide Dave S Property

Thanks and look forward.

Can buyer stamp duty be paid by cpf. 03122020 This is especially so if you are looking to pay your stamp duties directly from your CPF funds for purchase of a property under construction. You can use your CPF money in the ordinary account to pay for the BSD as well as the ABSD. You may also be able to use your Central Provident Fund funds to pay the BSD and ABSD.

If you are buying. 29042013 For purchase of a property that is still under construction stamp duties can be paid directly from CPF. But typically you need to pay in cash first and reimburse from your CPF later if sufficient monies.

22012020 Yes you can use your CPF Ordinary Account CPF OA to make payment for Stamp Duty on Residential Property. Stamp Duties and Survey Fees. However you will need to pay the BSD and ABSD first and then seek a reimbursement from your CPF account.

But as part due to the anti-speculation measures introduced by our government it is now required to be paid at the point of exercising the contract which is usually 2 weeks time instead of the past 2-3mths. A buyer CANNOT use his CPF to pay for the following. Stamp duties are payable within 14 days of exercising the option to purchase.

Exercising your Option to Purchase for resale private property. CPF savings can be used to pay the stamp duty and survey fees. 03102020 Stamp duties such as Buyers Stamp Duty BSD and Additional Buyers Stamp Duty ABSD can be paid from your account.

Further information can be obtained from the IRAS website and the CPF website. May I know are you referring to under construction or resale projects. Using CPF funds to pay Stamp Duty including ABSD is subject to the terms and conditions under the Private Properties and Public Housing Schemes.

01052016 HiYes can use CPF to pay for stamp duties. Additional Buyer Stamp Duty ABSD. 07052019 The CPF Private Properties Scheme PPS sets out conditions under which Singaporeans can use their CPF monies for buying of private properties.

10062009 Stamp-duty can actually be paid by CPF. The Sales and Purchase Agreement between homebuyer and seller or the Tenancy Agreement between landlord and tenant if youre renting legally recognised. 05062017 Using CPF for downpayment Downpayment for your private residential property can be paid using a mix of cash and CPF with conditions dependent on number of existing housing loans loan tenure and borrower age.

However an application to the CPF Board to use your CPF funds to pay stamp duties directly may usually take 3 weeks to process. To be eligible for PPS you must be buying a property in Singapore with remaining lease of at least 30 years. The answer to your question is YES.

However monthly service and conservancy charges and other charges related to the use of the property including taxes cannot be paid with your CPF savings. 04102019 Can I Use CPF To Pay for The Stamp Duties. USE CPF TO PAY FOR STAMP DUTIES AND LEGAL FEES When you purchase a house you will have to pay the Buyers Stamp Duty BSD.

23112020 BSD and ABSD have to be paid in full and cannot be paid in instalments. Unless the property is under construction you have to pay the taxes from your pockets first and later get a reimbursement from your CPF account. 27082019 Stamp duty is a tax you have to pay in order to have your documents ie.

To find out if you can use your CPF to pay Stamp Duty please visit the CPF website or call CPF at 1800 227 1188 Monday to Friday 800 am. Monthly repayments of bank loan. Ad Stamp Buyer - This Is What Youre Searching For.

Besides Stamp Duties funds in the Ordinary Account can also be used to pay. Ad Stamp Buyer - This Is What Youre Searching For. Payment of Buyer Stamp Duty and Additional Buyer Stamp Duty is required within 14 days from.

Simply apply for a one-time reimbursement from your CPF account together with your application to use your CPF savings to pay for stamp duty after having made the initial payment with cash. Buyer Stamp Duty BSD.

Property Terms Guides Ping Luxury Homes

Property Terms Guides Ping Luxury Homes

Cost To Buy Your First Home In Singapore Singsaver

Cost To Buy Your First Home In Singapore Singsaver

Hdb Valuation How Do I Figure Out How Much An Hdb Flat Is Worth Home Buying Process Premium Calculator Cash Credit

Hdb Valuation How Do I Figure Out How Much An Hdb Flat Is Worth Home Buying Process Premium Calculator Cash Credit

100questions Res Guide To Absd

Property Jargon Of The Day Progressive Payment Scheme Pps 99 Co

Property Jargon Of The Day Progressive Payment Scheme Pps 99 Co

Here S The Reality Of Living In Singapore And Why Planning Ahead Is So Important Moneysmart Sg

Here S The Reality Of Living In Singapore And Why Planning Ahead Is So Important Moneysmart Sg

Property Jargon Of The Day Buyers Stamp Duty Bsd 99 Co

Property Jargon Of The Day Buyers Stamp Duty Bsd 99 Co

Singapore Permanent Resident Or Foreigner

Singapore Permanent Resident Or Foreigner

Upgrading From Hdb Flat To Condo In 2021 Buy First Or Sell First New Academy Of Finance

Upgrading From Hdb Flat To Condo In 2021 Buy First Or Sell First New Academy Of Finance

Property Jargon Of The Day Buyers Stamp Duty Bsd 99 Co

Property Jargon Of The Day Buyers Stamp Duty Bsd 99 Co

Total Debt Servicing Ratio Ping Luxury Homes

Total Debt Servicing Ratio Ping Luxury Homes

A Singaporean S Guide To Buying Your First Resale Hdb Flat Planner Bee

A Singaporean S Guide To Buying Your First Resale Hdb Flat Planner Bee

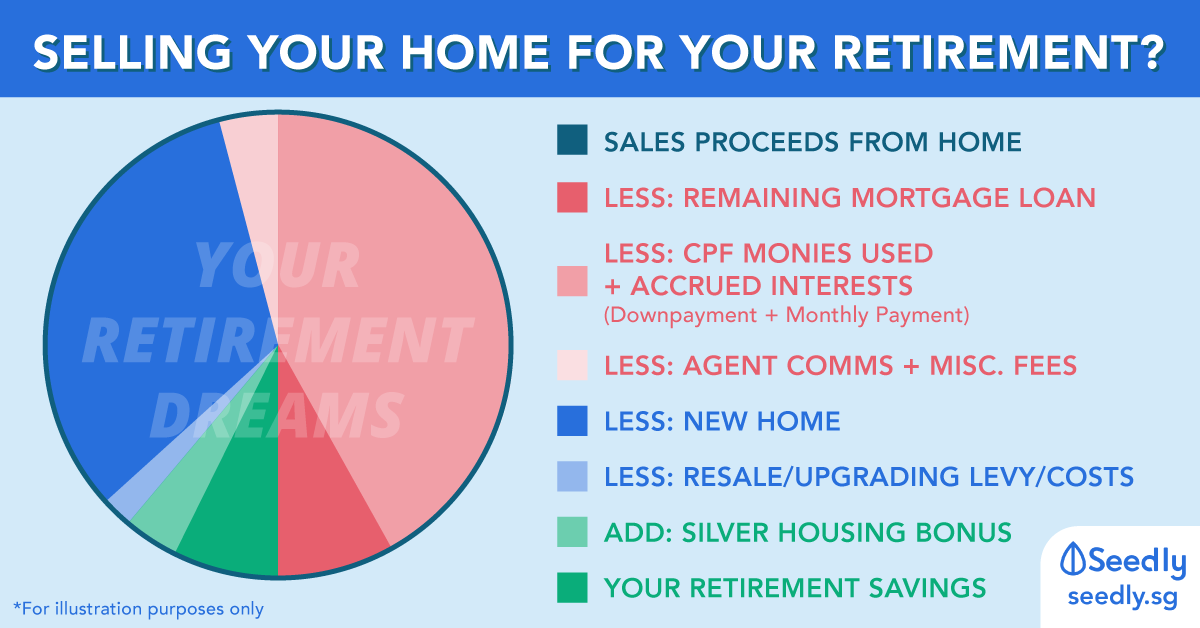

Do You Get All Your Money From Your Hdb Sales Proceeds For Your Retirement

Do You Get All Your Money From Your Hdb Sales Proceeds For Your Retirement

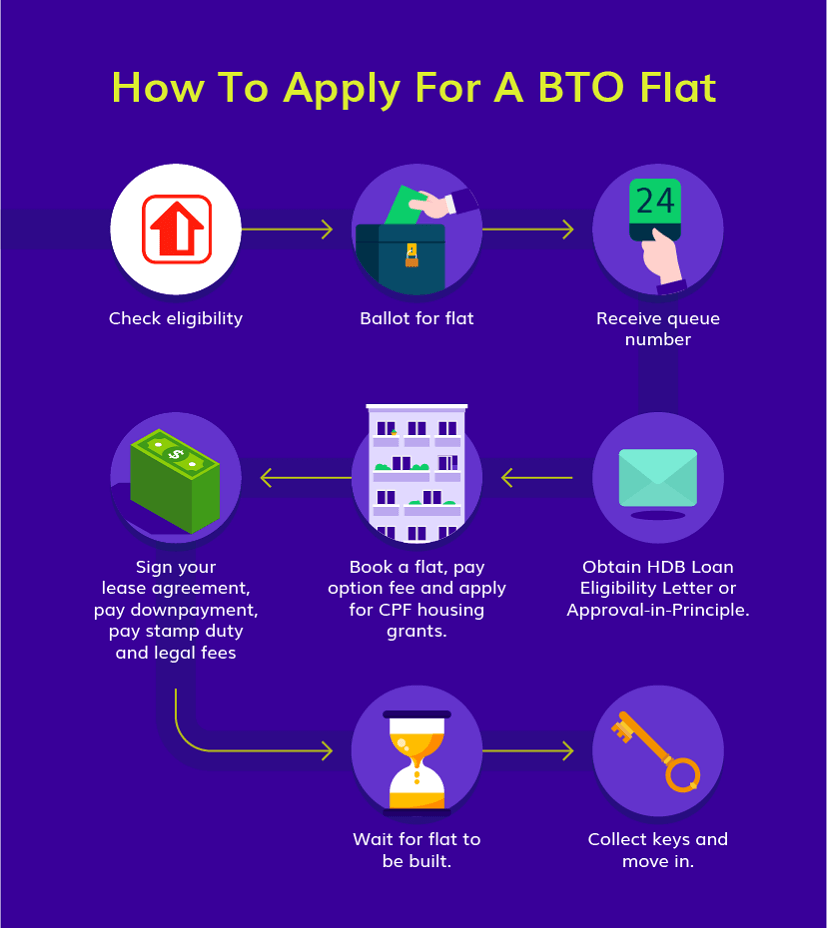

Newbies Guide To Buying Your First Bto Flat The Income Blog

Newbies Guide To Buying Your First Bto Flat The Income Blog

New Launch Sales Timeline Compare Singapore Property Prices In One Interactive Map

New Launch Sales Timeline Compare Singapore Property Prices In One Interactive Map

Singapore Property Guides Made In Sg Property

Singapore Property Guides Made In Sg Property

Image Credit Cpf Board First Time Home Buyers Lease Stamp Duty

Image Credit Cpf Board First Time Home Buyers Lease Stamp Duty

Post a Comment for "Can Buyer Stamp Duty Be Paid By Cpf"