Stamp Duty Rate Increase

19042021 Stamp duty is a tax paid on property purchases. 19042021 The Maharashtra government in its budget for 2021-22 announced a concession of 1 over the prevailing stamp duty rate on property transactions if the transfer of house property or registration of sale deed is done in the name of women.

Cover Story Secondary Market Seeing More Interest The Edge Markets

Cover Story Secondary Market Seeing More Interest The Edge Markets

10072020 This measure temporarily increases the amount that a purchaser can pay for residential property before they pay Stamp Duty Land Tax SDLT while maintaining the higher rate of 3 on additional.

Stamp duty rate increase. 03032021 The main SDLT legislation is at Part 4 of the Finance Act 2003. 10072020 Temporary increase to Stamp Duty Land Tax nil rate band for residential properties This tax information and impact note explains the temporary increase in the nil rate band for Stamp Duty Land Tax. This equals to 413 and will increase to 495 of property over 525000 but less than 3 million.

Real Property Gains Tax or RPGT is a form of tax imposed on the disposal of properties and the rate differs according to the number of years the owner has held on to the property. Stamp duties are imposed on instruments and not transactions. Stamp duty on the other hand is another tax payable upon.

Stamp duty made easy. The announcement was made by deputy chief minister Ajit Pawar on March 8 2021. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949.

Rather than ending on 31 March. The stamp duty on lease deed has been reduced to 2 from 5 till December 31 2020 and to 3 from January 1 2021 to March 31 2021. 19032013 Lembaga Hasil Dalam Negeri.

06022019 Rise of RPGT and Stamp Duty rate in Malaysia What to Expect. Welcome to the official firs stamp duty and levy portal. Certificate of Occupancy Partnership.

14042021 The state government on December 24 2020 announced a reduction in the stamp duty on lease agreements of immovable property. 30042021 House prices rose at their biggest monthly rate since 2004 in April after Rishi Sunak extended a holiday on stamp duty according to new figures from lender Nationwide. Oaths Affidavit-Affirmation Statutory Declaration Agreement Memo of Handwritten Ordinary.

The level at which it starts having to be paid was raised from 125000 to 500000 in. For homes in the 3 million and beyond category the stamp duty becomes 545 of. 1000 on every Rs5 Lakhs of amount of increase in authorised.

The temporary increase from 8 July 2020 to 31 March 2021 to the amount that a purchaser can pay for residential property before they. 05052015 You usually pay Stamp Duty Land Tax SDLT on increasing portions of the property price when you buy residential property for example. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments.

The chancellor announced that the up-to-500000 nil-rate band for stamp duty will finish at the end of June rather than the end of March as planned. There is no change in the rate of stamp duty on the rent component of a lease. The cut is applicable to lease agreements of over 29 years.

03032021 Rishi Sunak has confirmed that the stamp duty holiday will be extended until the end of September. 77 rows 02122020 Stamp duty shall be higher of i or ii i Rs. 112 rows Stamp duty shall be Rs.

18102019 Stamp duty payable by the lessee charged on the premium component of a lease of non-residential property also increased from 6 to 75 in Budget 2020. Prices climbed by 21 compared to March while they were up by 71 compared to. Header Image from BNM.

09122020 For example if purchasing a 400000 property the stamp duty would be 1651431. 08072020 The temporary increase to the nil rate band for Stamp Duty Land Tax SDLT which is the rate before you start paying SDLT on residential property has been extended. 1000- ii 015 of amount.

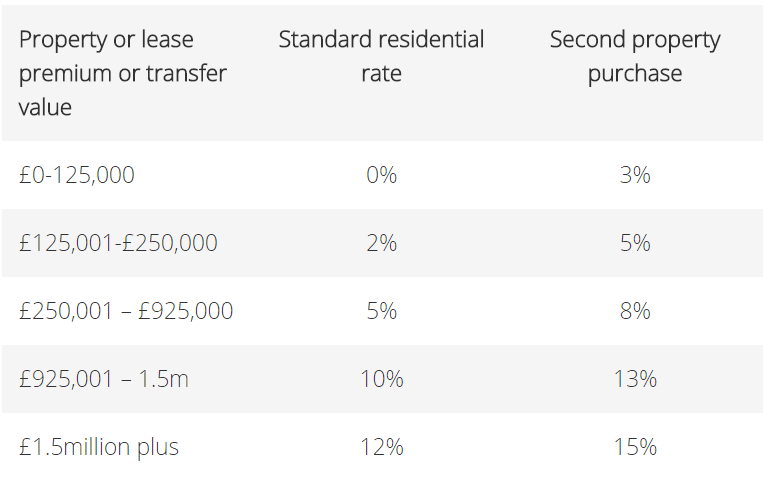

Stamp Duty For Second Homes Kempton Carr Croft

Stamp Duty For Second Homes Kempton Carr Croft

Cost Of Buying House In Malaysia

Cost Of Buying House In Malaysia

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Https Blog Bluenest Sg Seller Stamp Duty

Property Insight Stamp Duty 2019

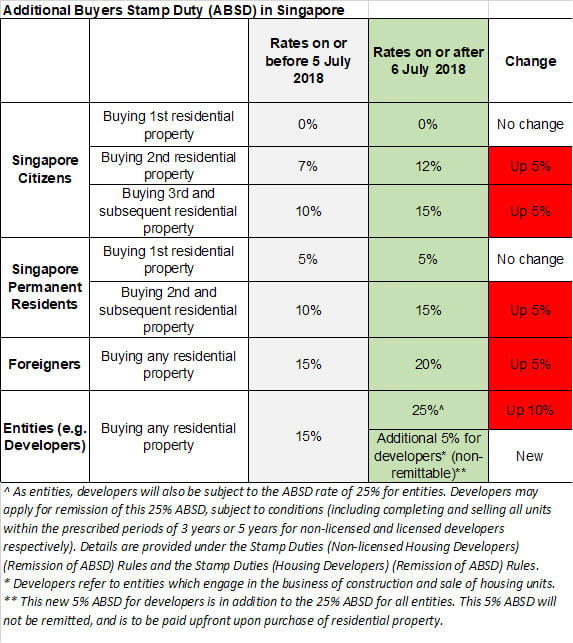

Absd Increase On 6 July 2018 Stuns Property Market 99 Co

Absd Increase On 6 July 2018 Stuns Property Market 99 Co

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Fresh Economic Thinking Bad Economics Of The Stamp Duty Discourse

Fresh Economic Thinking Bad Economics Of The Stamp Duty Discourse

Stamp Duty In Maharashtra 2021 Women Buyers To Get 1 Concession

Stamp Duty In Maharashtra 2021 Women Buyers To Get 1 Concession

Welcome Changes To Stamp Duty Rates

Welcome Changes To Stamp Duty Rates

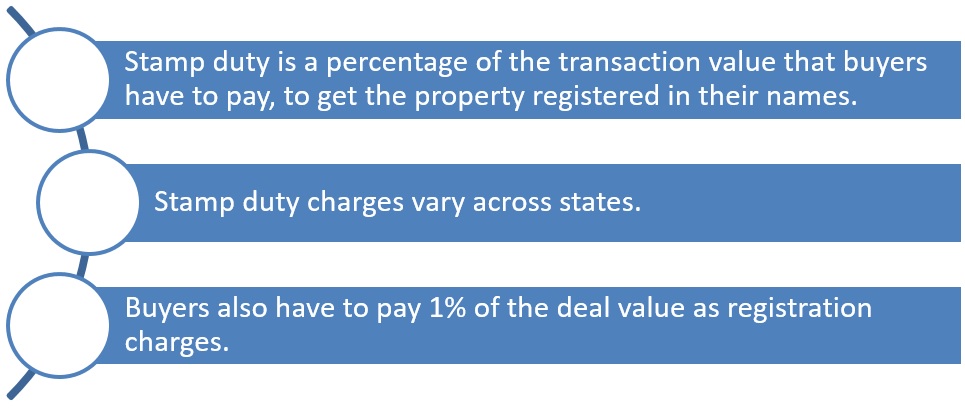

Facts About Stamp Duty In Property Purchase Housing News

Facts About Stamp Duty In Property Purchase Housing News

Stamp Duty Holiday Explained What Does It Mean For You

Stamp Duty Holiday Explained What Does It Mean For You

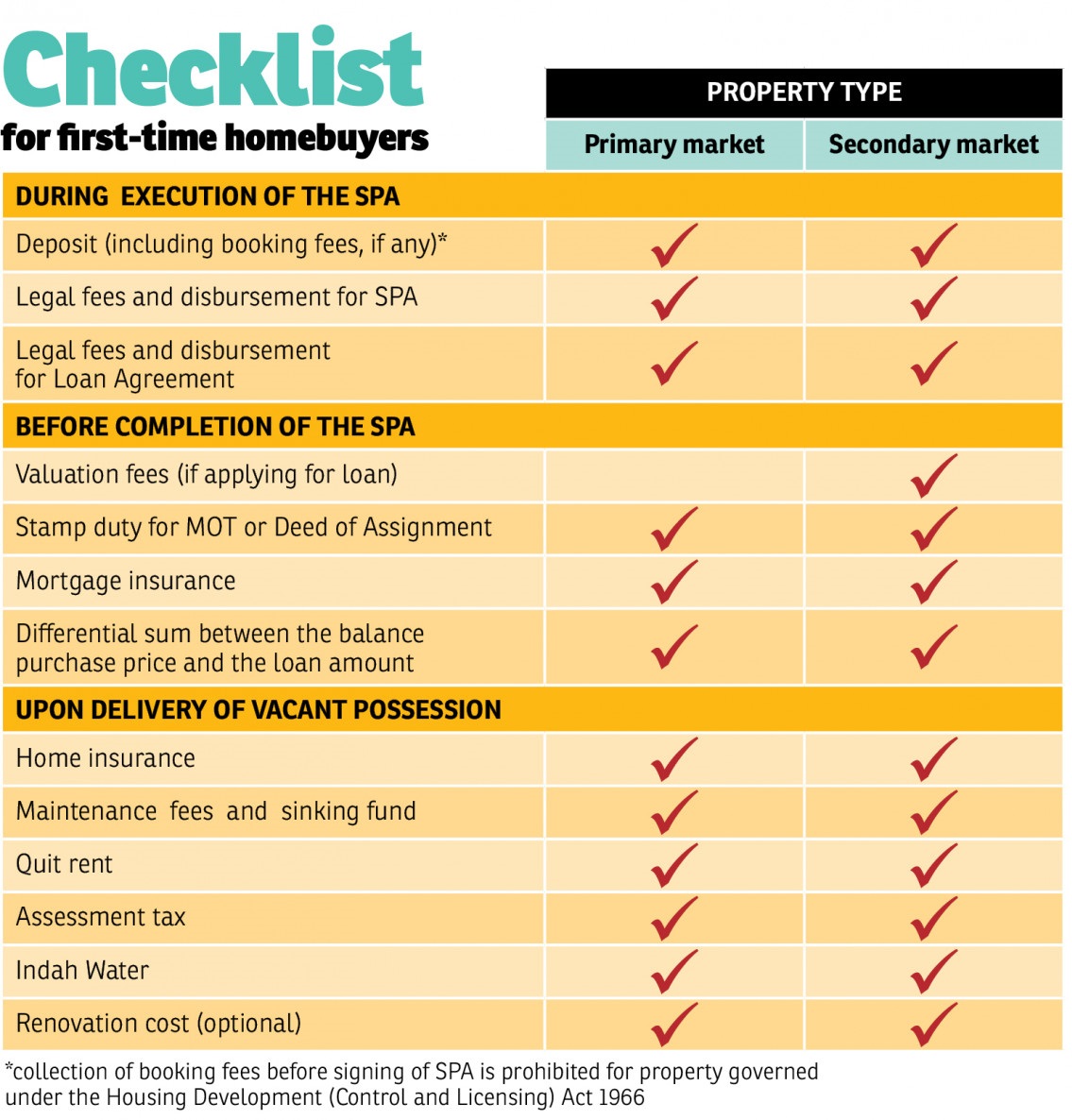

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

Cost Of Buying House In Malaysia

Cost Of Buying House In Malaysia

Post a Comment for "Stamp Duty Rate Increase"