Stamp Duty Exemption 2020 Uk

08072020 Note for Non UK Buyers. You may be eligible for Stamp Duty Land Tax SDLT reliefs if youre buying your first home and in certain other.

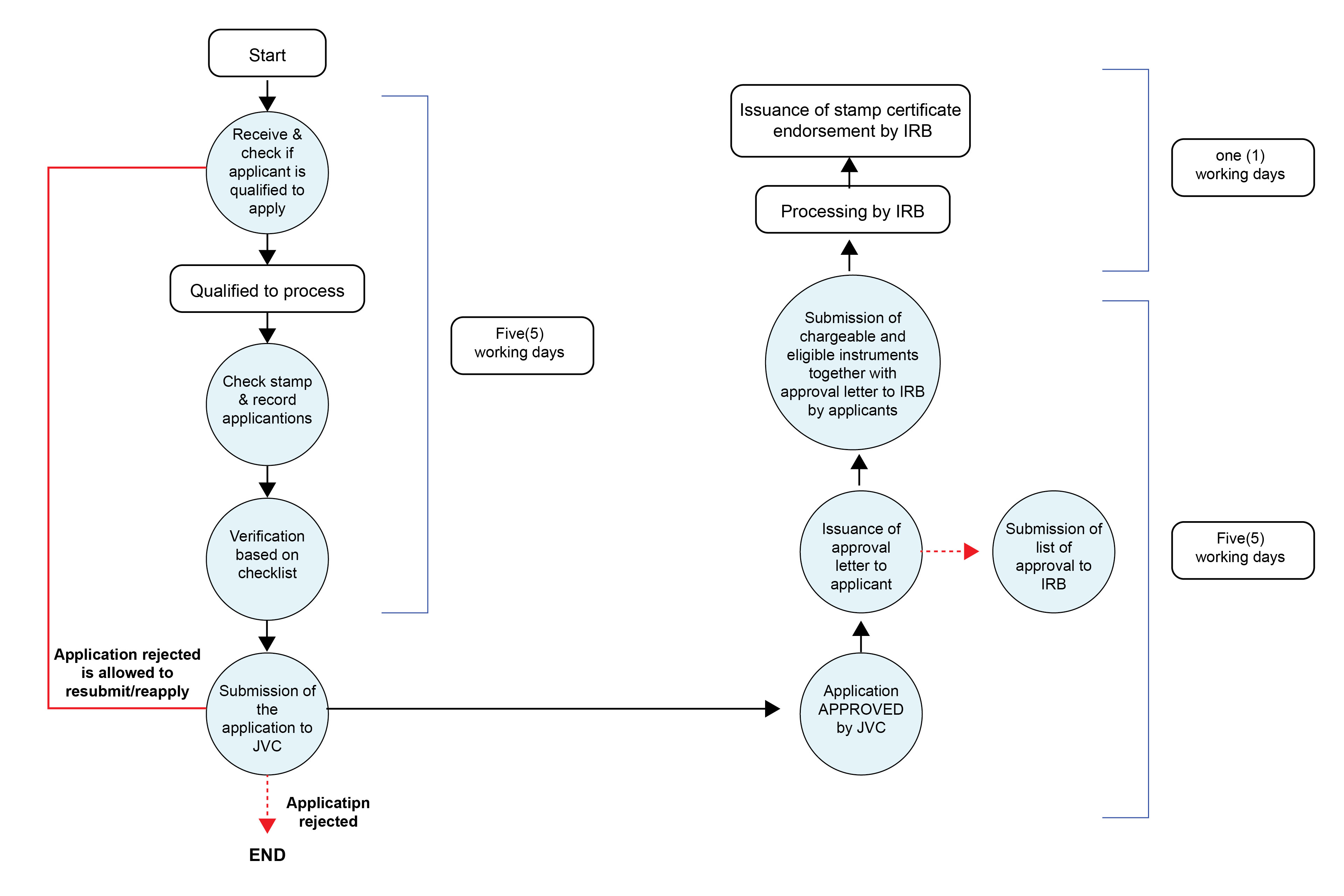

Sme Corporation Malaysia Guidelines Procedures On Incentive Of Stamp Duty Exemptions On M A By Smes

Sme Corporation Malaysia Guidelines Procedures On Incentive Of Stamp Duty Exemptions On M A By Smes

19042021 Stamp duty is a tax paid on property purchases.

Stamp duty exemption 2020 uk. 08072020 As it currently stands people who buy a property for up to 125000 do not need to pay stamp duty the government outlines. Purchases made by private investors in an eligible security are therefore Stamp Duty SDRT exempt. Where we confirm a relief from Stamp Duty has been granted since then the stock transfer form is duly stamped for.

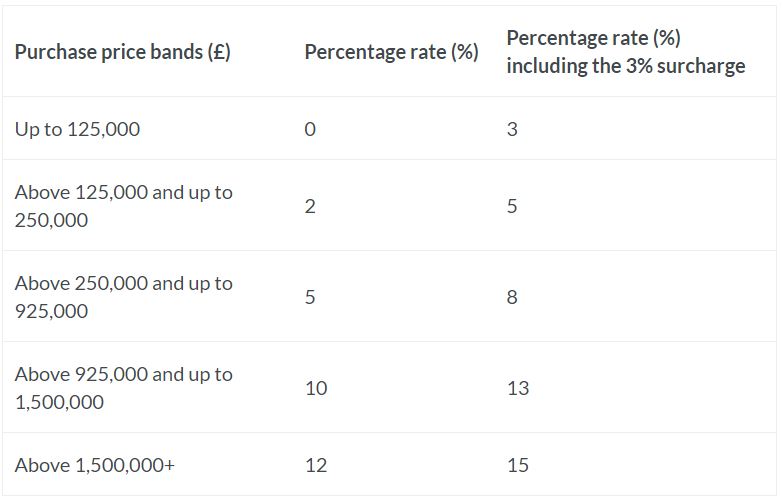

08032021 Up until July 8 2020 most house-buyers in England and Northern Ireland had to pay stamp duty on properties over 125000. From April 2021 someone living overseas could pay an additional 2 percent in stamp duty if they purchase a property in England or Northern Ireland. You pay Additional Stamp Duty at 3 on the first 500000 and some at 8 on the remaining 200000.

08072020 The nil rate band which applies to the net present value of any rents payable for residential property is also increased to 500000 from 8 July 2020 until 30 June 2021. 05052015 Reliefs and exemptions. This was temporarily increased to 500000 until March 31 2021 in the.

05052015 the purchase price is 500000 or less Youll also be eligible for this discount if you bought your first home before 8 July 2020. The increase in stamp duty means that for an additional property the top rate of SDLT will now be 17. This means youll pay.

An increase to stamp duty for non-UK residents was announced in the 2020 Budget. From 28 April Stamp Duty and SDRT were no longer levied on purchases in eligible AIM and High Growth Segment securities. 04032021 Chancellor Rishi Sunak has extended the stamp duty holiday in the Budget.

31072020 The Stamp Amendment Act 2020 the Act is now in force having been granted assent by the Governor on 23 July 2020 and is anticipated to have a positive impact on the number of property transactions taking place in the British Virgin Islands. How much you pay How much you pay depends on whether the land or. Anyone buying a home worth up to 500000 before the end of June will now not pay the tax and could save up to 15000.

For properties costing up to 500000 you will pay no Stamp Duty on the first 300000. 05052015 You can claim a discount relief if you buy your first home before 8 July 2020 or from 1 July 2021. In July 2020 UK Chancellor of the Exchequer Rishi Sunak announced a stamp duty holiday for property buyers in England and Northern Ireland.

No SDLT up to 300000 5 SDLT on the portion from 300001 to 500000. 11072014 New Stamp Duty processes for claiming reliefs were introduced on 27 March 2020. 30112020 What is the stamp duty holiday.

From 8 July 2020 to 31 March 2021. A 165 gazetted on 21 May 2020 provides a stamp duty exemption on the instrument of loan or financing agreement relating to the restructuring or rescheduling of a business loan or financing between a borrower or customer and a financial institution FI which is executed between 1 March 2020 and 31 December 2020 see Special Tax Alert No. Download a PDF of our Guide to the Stamp Amendment Act 2020.

That means someone spending 248000 the average cost of a house until the 8 th July 2020 would pay 2460 in stamp duty to move home. 30072020 The Stamp Amendment Act 2020 the Act is now in force having been granted assent by the Governor on 23 July 2020 and is anticipated to have a positive impact on the number of property transactions taking place in the British Virgin Islands. The move was aimed at helping buyers whose finances.

09072020 For non-first-time buyers and home movers stamp duty rates were 2 on 125001-250000 5 on 250001-925000 10 on 925001-15m and 12 on any value above 15m. The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020. Stamp Duty and Stamp Duty Reserve Tax exemption on eligible AIM and High Growth Segment securities.

The Exemption Stamp duty is a documentary tax that is levied in connection with certain specified legal documents. 11122020 The maximum rate of Stamp Duty youll pay is 8 but this is only for the portion of your property value over 500000 - ie. Youll then pay Stamp Duty at the relevant rate of 5 on the remaining amount up to 200000.

From 1 July 2021 if youre a first-time buyer in England or Northern Ireland you will pay no Stamp Duty on properties worth up to 300000. If the property is worth between 125001 and 250000 the stamp duty. Valid until 31 st March 2021 anyone purchasing a property to be used as their primary residence will not pay any SDLT if the property is valued below 500000.

An additional 2 stamp duty will be payable for any property completing after 1 April 2021 for Non UK Buyers if contracts were not exchanged prior to 11 March 2020.

Sme Corporation Malaysia Stamp Duty Rate

Sme Corporation Malaysia Stamp Duty Rate

Stamp Duty Cut How Will It Work A9 Architecture Ltd

Stamp Duty Cut How Will It Work A9 Architecture Ltd

Tax Simpson Millar Fined For Part In 4 5m Stamp Duty Avoidance Law Society Gazette Https Www Lawgazette Co Uk Practice Simpson M Stamp Duty Simpson Avoid

Tax Simpson Millar Fined For Part In 4 5m Stamp Duty Avoidance Law Society Gazette Https Www Lawgazette Co Uk Practice Simpson M Stamp Duty Simpson Avoid

Stamp Duty Exemption For Smes On Any Instrument Executed For M A Ey Malaysia

Stamp Duty Exemption For Smes On Any Instrument Executed For M A Ey Malaysia

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Exemption On Instrument Of Loan Or Financing Agreement Ey Malaysia

Exemption On Instrument Of Loan Or Financing Agreement Ey Malaysia

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate And Construction Malaysia

Stamp Duty Exemption London Stock Exchange

Stamp Duty Exemption London Stock Exchange

Realtymonks One Stop Real Estate Blog Stamp Duty Stamp Property Buyers

Realtymonks One Stop Real Estate Blog Stamp Duty Stamp Property Buyers

.webp) Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Sdlt Stamp Duty Calculator Uk Calculate Stamp Duty Land Tax

Stamp Duty Increase For Properties Exceeding Rm1 Mln Now Effective July 1 2019

Stamp Duty Increase For Properties Exceeding Rm1 Mln Now Effective July 1 2019

Property Master Academy Will The Stamp Duty Exemption Be Extended Beyond 31st March 2021

Property Master Academy Will The Stamp Duty Exemption Be Extended Beyond 31st March 2021

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Doing The Maths On The Temporary Stamp Duty Relief Shares Magazine

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Holiday The Winners And The Losers Bbc News

What Is Happening To House Prices In The Uk House Prices Investment Property Greater London

What Is Happening To House Prices In The Uk House Prices Investment Property Greater London

Post a Comment for "Stamp Duty Exemption 2020 Uk"