Is There A Stamp Duty Holiday On Commercial Property

The stamp duty holiday came into immediate effect on 8th July 2020 and is set to end on 30th June 2021. A stamp duty holiday has been introduced for purchases of homes in England.

What Is Stamp Duty My Property Property Stamp Duty

What Is Stamp Duty My Property Property Stamp Duty

Buildings Transaction Tax in Scotland and Land Transaction Tax in Wales.

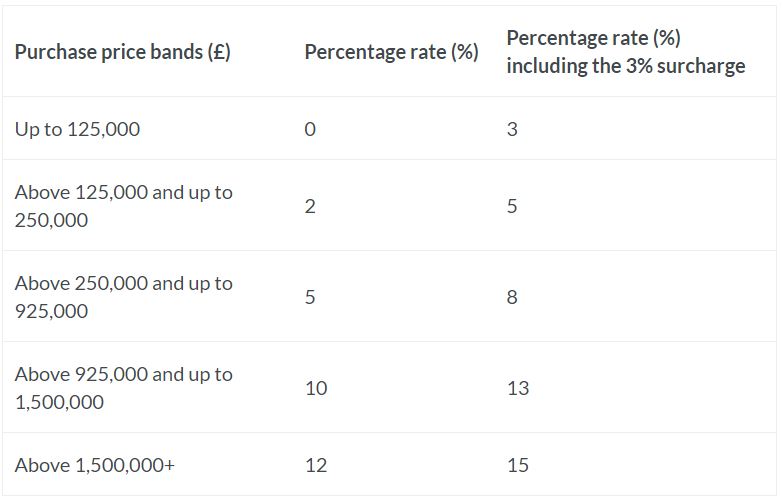

Is there a stamp duty holiday on commercial property. 24022021 Stamp duty is technically only paid in England and Northern Ireland since the devolved administrations of Scotland and Wales have set their own property taxes Land. Landlords pay an extra 3 of stamp. 08072020 If you purchase a residential property between 1 July 2021 to 30 September 2021 you only start to pay SDLT on the amount that you pay for the property above 250000.

By Myra Butterworth For MailOnline. But in the Budget this week the Chancellor moved the deadline until the end of June giving buyers more time to take advantage of the tax break. Stamp Duty Land Tax SDLT most commonly referred to as Stamp Duty is often discussed when buying residential property but is there Stamp Duty on commercial property too.

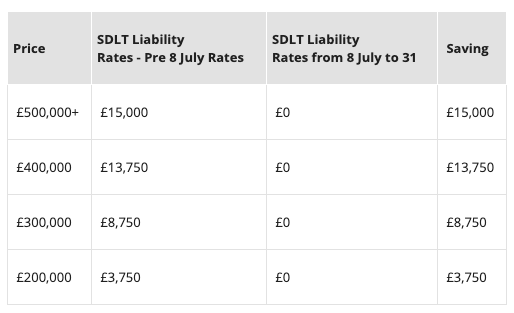

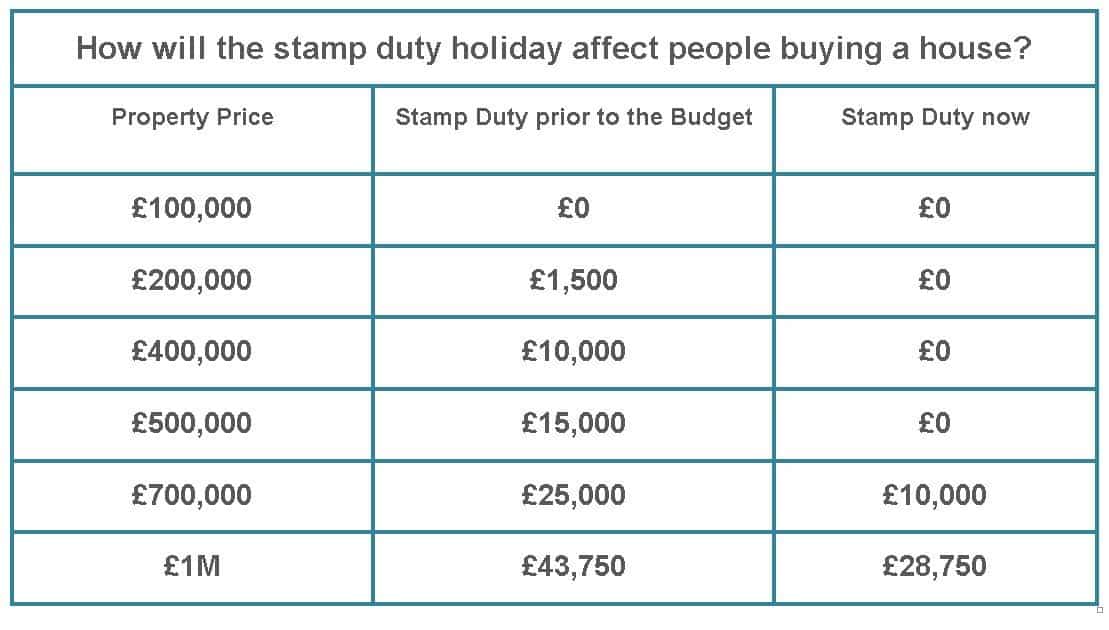

The tax break which was introduced in July last year has brought a flurry of activity to the property market with home movers buoyed by the prospect of saving up to 15000. The new 500000 nil rate band for StampDuty wont end on 31st March it will end on the 30th June. 02032021 Chancellor Rishi Sunak announced a stamp duty holiday for anyone buying new homes up to the value of 500000 in July last year.

What is the stamp duty holiday. The stamp duty holiday was originally due to. One in four homes sold across the UK in March were on the market for less than seven days.

19042021 What is the stamp duty holiday. This has been achieved by. The rate at which youll pay the tax varies depending on the price of the property and the type ie.

0 on the first 150000 0 2 on the next 100000 2000. For this reason only England and NI will enjoy this stamp duty holiday. 08032021 The Treasury announced the stamp duty holiday in a bid to breathe life into the property market after it effectively froze during the first.

10072020 The stamp duty holiday will last until March 31 2021. 24022021 As many as three in five 60 multi-property landlords have expanded their property portfolio since the introduction of the stamp duty holiday in July 2020. 08072020 Now assuming the plans hold true and a Stamp Duty holiday does come into effect today it must also be accompanied with benefits that.

The property website said interest in commercial properties is also up. 09072020 The rate a buyer has to pay varies depending on the price and type of property - usually you would expect to pay more stamp duty if the property is worth more. 05022020 Holiday lets and tax heres what you need to know.

Those buying a main home will not be charged any stamp duty at all on the first 500000. Among commercial landlords this rises to eight in 10 79 research from Direct Line business insurance shows. The short answer is yes.

10032021 The stamp duty holiday was set to run until 31 March 2021. Here are some stats to help put the chancellors comments into context. 26022021 There is speculation that the stamp duty holiday will be extended.

The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020. 05052015 Example If you buy a freehold commercial property for 275000 the SDLT you owe is calculated as follows. Some 43 of landlords have invested in properties outside major cities with 82.

Stamp duty is a tax paid on property purchases. Increasing the tax on acquisition through higher rates of Stamp Duty Land Tax SDLT. 04052021 House prices surge.

In the past few years the government has pursued a policy of increasing taxes on residential property owners. 04032021 The current stamp duty holiday has been extended in England Northern Ireland and Wales. 08072020 Stamp duty is a lump-sum tax that anyone buying a property or land costing more than a certain amount must pay.

27012021 Yes the stamp duty holiday applies to the first 500000 of the price of any residential property so buy-to-let investors and those buying a second home can also benefit. Rishi Sunak announces stamp duty holiday extension until the end of June. Mr Sunak confirmed that the policy would come into effect.

Stamp Duty Land Tax Update Lexology

Stamp Duty Land Tax Update Lexology

Stamp Duty Calculator House Property And Business For Sale Http Www Conveyancingqueensland Com Buying Stamp Duty First Home Owners Buying Quotes Stamp Duty

Stamp Duty Calculator House Property And Business For Sale Http Www Conveyancingqueensland Com Buying Stamp Duty First Home Owners Buying Quotes Stamp Duty

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

Kfh Property On Instagram Take Advantage Of The Stamp Duty Holiday Which Ends In March 2021 With O London Property Market London Property Property Marketing

Kfh Property On Instagram Take Advantage Of The Stamp Duty Holiday Which Ends In March 2021 With O London Property Market London Property Property Marketing

Who Benefits From The Stamp Duty Holiday

Who Benefits From The Stamp Duty Holiday

Buying A House Before The Stamp Duty Holiday Ends Property Help

Buying A House Before The Stamp Duty Holiday Ends Property Help

Stamp Duty Holiday Announced Mincoffs Solicitors

Stamp Duty Holiday Announced Mincoffs Solicitors

When To Use Rent Agreement Commercial Space For Rent Being A Landlord Tenancy Agreement

When To Use Rent Agreement Commercial Space For Rent Being A Landlord Tenancy Agreement

Stamp Duty Holiday The Winners And The Losers Bbc News

Stamp Duty Holiday The Winners And The Losers Bbc News

New Stamp Duty Charges For Residential Property Purchases North Ainley Solicitors

New Stamp Duty Charges For Residential Property Purchases North Ainley Solicitors

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty What You Have To Know About The Changes Stamp Duty Stamp Duties

Stamp Duty What You Have To Know About The Changes Stamp Duty Stamp Duties

Industrial Property Valuation Property Valuation Commercial Property Property

Industrial Property Valuation Property Valuation Commercial Property Property

Stamp Duty Holiday Property Auction Pearson Estate Agent

Stamp Duty Holiday Property Auction Pearson Estate Agent

Stamp Duty Holiday Your Move Blog Homewise

Stamp Duty Holiday Your Move Blog Homewise

Post a Comment for "Is There A Stamp Duty Holiday On Commercial Property"