How Does The Stamp Duty Holiday Work For Second Homes And Buy-to-let Purchases

08032021 For second homes or buy to let properties. So if one owns a buy-to-let property and the other buys a property the second home stamp duty rate still applies.

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

25092020 Purchases of second homes or company purchases still attract a surcharge of 3 of the purchase price but no longer the standard rate of SDLT which was also payable.

How does the stamp duty holiday work for second homes and buy-to-let purchases. Outside of the stamp duty holiday if youre a landlord or otherwise buying a second home youre required to pay a 3 surcharge on top of the normal rates. 24022021 The Chancellor has granted a stamp duty land tax holiday to homebuyers in England and Northern Ireland with immediate effect. What is stamp duty.

09072020 Those purchasing second homes or buy-to-let properties also benefit from the stamp duty holiday. Under the current stamp duty holiday buyers are exempt from paying stamp duty on residential property worth up to. For example an investor buyer purchasing a property for 250000 will now pay 7500 SDLT 3.

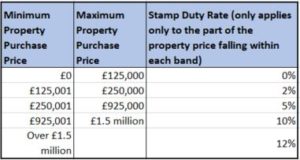

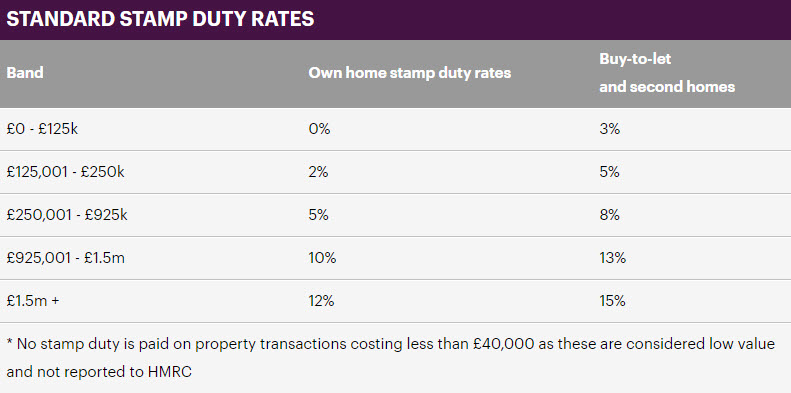

11032021 Do the Stamp Duty changes impact buy-to-let properties and second homes. 5 on purchases between 125001 and 250000. Property investors who purchase through limited companies will also be exempt up to 500000.

Buy-to-let landlords who purchase new investments between now and March 2021 will benefit from this temporary stamp duty waiver. 08072020 Heres how it will affect first-time buyers and second home purchases. 18112020 The savings in Scotland and Wales are less significant with taxes only temporarily waived on home purchases up to 250000.

18032021 Its basically a change to the threshold at which buyers have to pay stamp duty. The move was aimed. This can make things expensive if you are separating and need to buy another home for one partner.

The purchase of a holiday home does not also often require the services of an. This applies to all properties that. Choose Your 1BHK Today.

3 on purchases up to 125000. The charge applies above the. 10072020 The stamp duty holiday for all homes including second homes and buy-to-let purchases can potentially save buy-to-let and second home buyers up to 15000.

01102020 Anyone buying an additional property such as a second home or a buy-to-let property is required to pay an extra 3 in stamp duty on top of the revised rates. 01042021 For stamp duty purposes a married couple or civil partners are classed as one unit by HMRC. We have seen a surge in enquiries and instructions for buy to let property since the announcement and you can understand why.

22032021 Since April 2016 anyone buying an additional property essentially second homes and buy-to-lets has had to pay an additional three percentage points in stamp duty. However the pre-existing 3 surcharge on such purchases will still apply. 02032021 If youre buying a second property or a property on a buy-to-let basis you will still benefit from the increased 500000 threshold however you will still have to pay the Stamp Duty surcharge.

As the SDLT holiday applies to purchases of all residential properties up to 500000 it does mean that property investors in the buy to let market stand to benefit. The financial savings can be twofold. 19042021 What is the stamp duty holiday.

04032021 How does the stamp duty holiday work. 8 on purchases above 250001 and 925000. Does stamp duty apply to second homes.

Previously they would have had a liability of 10000. The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020. Ad Try NoBroker to Find Your Dream Home Today.

It has the potential to save them many thousands of pounds. 09072020 Prior to Wednesday all house-buyers in England and Northern Ireland had to pay stamp duty on properties over 125000 or if you were a first-time home buyer you did not need to pay stamp duty. STAMP duty land tax SDLT is a lump sum payment anyone buying a property or piece of land over a certain.

Worlds Largest Brokerage Free Real Estate Portal. It means that buyers of homes valued at up to 500000 will no longer pay any stamp duty on the purchase. 04092019 The exemption of holiday homes from stamp duty makes them an attractive prospect for those wishing to invest in a second property for holidaying think a peaceful country or coastal bolthole for limitless year-round trips.

It allows people to save up to. Stamp duty is a tax paid on property purchases. When you buy any property in addition to your main residence be it a second home a holiday home or a buy-to-let there is an additional Stamp Duty charge known as Higher Rates on Additional Dwellings tax HRADThis starts at 3 and then rises in bands climbing to 15 for the most expensive properties.

Under the current scheme buyers do not have to pay stamp duty on the value of a property up to 500000 rather than 125000. Article by Nick Green.

How Does The Stamp Duty Holiday Work For Second Homes And Buy To Let Purchases

How Does The Stamp Duty Holiday Work For Second Homes And Buy To Let Purchases

How Does The Stamp Duty Holiday Work For Second Homes And Buy To Let Purchases

How Does The Stamp Duty Holiday Work For Second Homes And Buy To Let Purchases

Stamp Duty For Investment Property An Overview Select Property Group

Stamp Duty For Investment Property An Overview Select Property Group

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty Holiday Extension Will It Impact On Buying A Holiday Let

Stamp Duty 2020 What Are The Changes To Stamp Duty In 2020

Stamp Duty 2020 What Are The Changes To Stamp Duty In 2020

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Does The Stamp Duty Holiday Apply For A Second Home Or Buy To Let Property How The Tax Break Extension Works

Does The Stamp Duty Holiday Apply For A Second Home Or Buy To Let Property How The Tax Break Extension Works

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

Calls To Extend Stamp Duty Holiday Mount As Fears Of Slump Grow Stamp Duty The Guardian

The Pros And Cons Of The Stamp Duty Holiday Expat Network

The Pros And Cons Of The Stamp Duty Holiday Expat Network

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Experts Warn Thousands Of Buyers Will Miss The Stamp Duty Holiday Deadline What You Can Do

Stamp Duty For Buy To Let Homeowners Alliance

Stamp Duty For Buy To Let Homeowners Alliance

Does The Stamp Duty Holiday Apply To Second Homes Mywallethero

Does The Stamp Duty Holiday Apply To Second Homes Mywallethero

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

Uk Homes Sales Boom In March After Extension Of Stamp Duty Holiday Financial Times

A Quick Guide To Stamp Duty Sykes Holiday Cottages

A Quick Guide To Stamp Duty Sykes Holiday Cottages

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Can You Avoid Paying Stamp Duty On A Second Home Metro News

Post a Comment for "How Does The Stamp Duty Holiday Work For Second Homes And Buy-to-let Purchases"