Stamp Duty Exemption 2020 Scotland

01042021 1st April 2021. Following the announcement of a Stamp Duty holiday in England and Northern Ireland the Scottish Government confirmed that they would be temporarily raising the nil LBTT threshold from 145000 to 250000 on 15th July 2020.

No stamp duty is payable on the first 500000 and 12500 is payable on the 250000 portion within the next band between 500000.

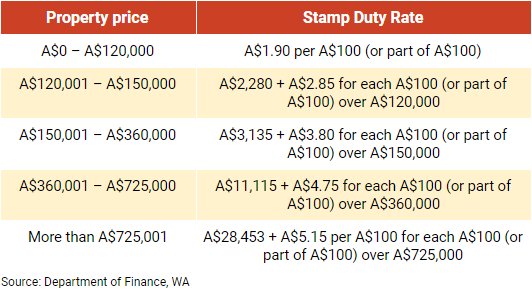

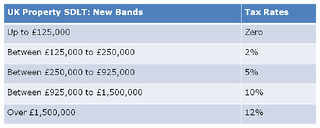

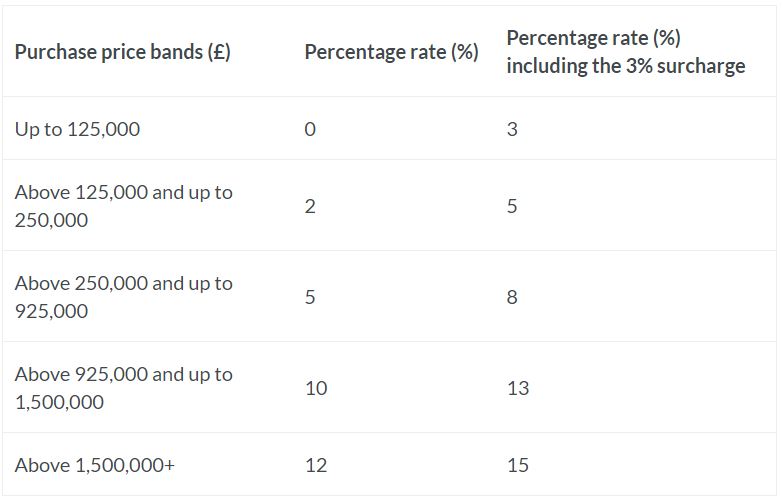

Stamp duty exemption 2020 scotland. If your first home is more expensive than this threshold youll still benefit from the relief on the first 175000 of the price meaning you could save up to 600. 05052015 If you buy a property for less than the threshold theres no SDLT to pay. 12 on the rest above 15 million New Rates of Stamp Duty SDLT that come into effect from 1st April 2016 for buying properties in Scotland for 220000 On the 8th July 2020 the UK Chancellor has announced a temporary holiday on SDLT charges up to 500000.

The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020. 08072020 Reduced rates of Stamp Duty Land Tax SDLT will apply for residential properties purchased from 8 July 2020 until 30 June 2021 and from 1. The stamp duty calculation is as follows.

The move was aimed at helping buyers whose finances. The Exemption Order exempts from stamp duty for qualifying loan or financing agreements relating to the restructuring or rescheduling of existing business loans or financing. As of 7th July 2020 the Chancellor announced a Stamp Duty exemption for all properties up to the value of 500000 in England and Northern Ireland up until the end of 30th June 2021.

So if the property was valued at 250000 the. 15072020 Scotland and Wales are bringing in their own stamp duty holidays meaning the taxes will be waived on purchases up to 250000 in both countries. 09072020 The starting point for land and buildings transaction tax LBTT is to rise from 145000 to 250000.

01032020 The Stamp Duty Exemption No. A 369 and Stamp Duty Exemption No 4 Order 2019 PU. 08072020 If the property is worth between 125001 and 250000 the stamp duty land tax rate is 2 per cent.

It added that the change will mean that 80 of house buyers in Scotland will be exempt from LBTT. 10072020 The Scottish Government has said the level that Land and Buildings Transaction Tax LBTT the equivalent of Stamp Duty Land Tax in England and Northern Ireland - is paid at will be raised from 145000 to 250000. Year 2014 Stamp Duty Order Remittance PUA 360 PUA 361 Year 2016 Stamp Duty Order Remittance PUA 365 PUA 366 Year 2020 Stamp Duty Order Exemption PUA 152 Year 2020 Notification Of Authorized Person To Compound Instrument Under Subsection 91 PUB 142020.

1 I have decided today to cut stamp duty. 04032021 In July last year the threshold at which Scottish house buyers start to pay LBTT was increased from 145000 to 250000 meaning around 80 per cent would not pay anything. The Chancellor Rhisi Sunak has announced that from 8th July 2020 there will be a temporary cut to Stamp Duty which is likely to run until March 2021 this raises the threshold from 125000 to 500000 for all buyers.

Circular No 0212020 Dated 23 Jan 2020 To Members of the Malaysian Bar Stamp Duty Remission No 2 Order 2019 and Stamp Duty Exemption No 4 Order 2019 Please take note of Stamp Duty Remission No 2 Order 2019 PU. On a property purchased for 750000 the total stamp duty payable would be 12500. Previously to be exempt from stamp duty known as the Land and Buildings Transaction Tax LBTT in Scotland purchases had to be less than 145000 north of the border or 180000 in Wales.

19042021 Stamp duty is a tax paid on property purchases. The holiday will then apply to homes up to the value of 250000 until the end of September 2021. Stamp duty calculations are different in England and Northern Ireland to LBTT calculations in Scotland and LTT calculations in Wales.

04122017 The tax-free limit for properties bought by first-time buyers is 175000 meaning that up to 80 of first-time buyers will pay no stamp duty at all. However this LBTT holiday. Came to an end in Scotland on 31st March meaning the zero tax threshold has.

Ms Forbes said this meant eight out of 10 house sales in Scotland would be exempt from the. A 394 dated 26 Dec 2019 and 31 Dec 2019 respectively. The current SDLT threshold for residential properties is 500000.

Stamp duty refunds are available for home movers replacing their main residence. Mobile homes caravans and houseboats are exempt. The original home must be sold within 3 years.

2 Order 2020 Exemption Order was gazetted on 21 May 2020 and came into operation retrospectively on 1 March 2020.

Stamp Duty Cut How Will It Work A9 Architecture Ltd

Stamp Duty Cut How Will It Work A9 Architecture Ltd

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Six Week Stamp Duty Holiday Extension Considered 2021

Six Week Stamp Duty Holiday Extension Considered 2021

Property Duty Holidays Extended In England N Ireland Wales Forbes Advisor Uk

Property Duty Holidays Extended In England N Ireland Wales Forbes Advisor Uk

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

What The Stamp Duty Charge For Overseas Buyers Means For London Financial Times

What The Stamp Duty Charge For Overseas Buyers Means For London Financial Times

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

What Is Happening To House Prices In The Uk House Prices Investment Property Greater London

What Is Happening To House Prices In The Uk House Prices Investment Property Greater London

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Stamp Duty Australia Property Investment Uk Property Investment Csi Prop

Everything You Need To Know On The Stamp Duty Holiday Acre Invest

Everything You Need To Know On The Stamp Duty Holiday Acre Invest

Cuts To Uk Stamp Duty But Expats And Non Domiciles Face Higher Taxes

Cuts To Uk Stamp Duty But Expats And Non Domiciles Face Higher Taxes

Post a Comment for "Stamp Duty Exemption 2020 Scotland"