Karnataka Stamp Act Schedule 2020

- Under article 16 of the Schedule appended to the Mysore Stamp Act 1957 the stamp duty payable on a share certificate is 30 naye paise. The following amendments are introduced by the Ordinance in the Karnataka Stamp Act.

Buy Karnataka Stamp Act 1957 Book Online At Low Prices In India Karnataka Stamp Act 1957 Reviews Ratings Amazon In

Buy Karnataka Stamp Act 1957 Book Online At Low Prices In India Karnataka Stamp Act 1957 Reviews Ratings Amazon In

Instruments chargeable with duty.

Karnataka stamp act schedule 2020. 500- on the derivation of mortgage property. Amending Act 0 of 20169 - It is considered nessecery to amend the Karnataka Stamp Act 1957 Karnataka Act No 34 of 1957 to give effect to proposal made in the Karnataka Tourism Policy 2015-2020 and to give impetus to the growth in the Tourism Industry. Shridevi Incharge Phone.

Executed or execution with reference to documents means signed or. 55 OF 2020 First Published in the Karnataka Gazette Extra-ordinary on the 30th day of December 2020 The Karnataka Stamp Second Amendment Act 2020 Received the assent of the Governor on the 30th day of December 2020 An Act further to amend the Karnataka Stamp Act 1957. - Under article 16 of the Schedule appended to the Mysore Stamp Act 1957 the stamp duty payable on a share certificate is 30 naye paise.

01072020 On January 9 2020 the amendments related to collection of Stamp Duty on securities were first schedule which was later extended to April 1 2020 vide notification dated January 8 2020. Bill No05 of 2016 File No. 91-80-2222 0436 email.

In the Karnataka Stamp Act 1957 a new proviso is inserted in Section 91a related to relating to power of Government to reduce remit or compound duties specifying that the State Government may. Thousands of share certificates have to be. Instruments Governed By The Stamp Act 1899Central As Applicable To The State of Karnataka Abstract of The Karnataka Stamp Act 1957- Concerning Levy of Addl- Stamp Duty The Karnataka Stamp Act 1957 Schedule.

18012021 Prabhakara HL Phone. Through a gazette notification dated March 30 2020 the implementation was further extended until July 1 2020. Aigrcompkarnatakago vin Law related issues AIGR Law Smt.

Sub - Article Sub - sub Article Description of Instrument Proper Stamp Duty 1 21. 10042021 Stamp duty on the agreement or arrangement under Article 5 H of the Karnataka stamp duty calendar in relation to mortgage documents that are not to be registered but paying stamp duty under Section 51 of Schedule 1 of the Bombay stamp Act must mention the five-cent stamp duty aff. Acknowledgement of- ia debt written or signed by or on behalf of a debtor in order to supply evidence of such debit in any book other than a Bankers passbook or on a separate piece of paper when such book or paper is left in the creditors possession and the amount or value of such debt.

20 1 - For Conveyance. Stamp Duty Paid On Original Deed. 19052020 The Karnataka Stamp Act 1957 Stamp Act requires that every instrument chargeable with duty and executed by a person in India must be duly stamped before or at the time of execution with a value not less than the amount prescribed under the Stamp Act.

91-80-2222 0579 email. THE KARNATAKA STAMP ACT 1957 ARRANGEMENT OF SECTIONS Statement of Objects and Reasons Sections. Section 11 of the Mysore Stamp Act 1957 does not permit the use of adhesive stamps for payment of the stamp duty exceeding 15 naye paise.

Hence the Bill LA. Clause r inserted by Act No1 of 2008 CHAPTER II Stamp Duties A. CHAPTER II STAMP DUTIES A- OF THE LIABILITY OF INSTRUMENTS TO DUTY 3.

- Of the Liability of Instruments to duty. 03072020 However the Department of Revenue of the Ministry of Finance India has issued two Notifications dated March 30 2020 deferring the implementation of Part I of Chapter IV of the Finance Act 2019 ie. Fields marked with are mandatory Property Details.

Section 11 of the Mysore Stamp Act 1957 does not permit the use of adhesive stamps for payment of the stamp duty exceeding 15 naye paise. Number of Shares. Rs200- d Authorizing 510 persons to act jointly or severally in one transaction or generally.

Subject to the provisions of this Act and the exemptions contained in the Schedule the following instruments shall be chargeable with. THE KARNATAKA STAMP ACT 1957 1Schedule Stamp Duty on Instruments Updated till 20th April 2017 Sl No. The following amendments have been made.

Amendments pertaining to the Indian Stamp Act 1899 14 and corresponding enforcement of the Indian Stamp Collection of Stamp-Duty through Stock Exchanges Clearing Corporations and Depositories Rules 2019 15 to July 1 2020. 27102020 The State Government of Karnataka on October 19 2020 has published the Karnataka Stamp Amendment Act 2020 to further amend the Karnataka Stamp Act 1957. Samvyashae 38 Shasana 2015 entry 63 of List II of the Seventh Schedule.

I a debt written or signed by or on behalf of a debtor in order to supply evidence of such debt in any. Short title extent and commencement. CHAPTER I PRELIMINARY 1.

Rs200- egiven for consideration. Instruments liable to duty in multiples of five naye paise. Instruments chargeable with duty.

1 ea given to a promoter developer. C Authorizing 5 persons to act jointly or severally in one transaction or generally. 18122020 Karnataka Stamp Second Amendment Act 2020 Dec 18 2020 by Avantis RegTech Legal Research Team The State Government of Karnataka has issued the Karnataka Stamp Second Amendment Act 2020 to further amend the Karnataka Stamp Act 1957.

24112020 The State Governor of Karnataka on November 19 2020 has issued a Notification to notify the Karnataka Stamp Amendment Ordinance 2020 by amending Karnataka Stamp Act 1957.

Stamp Duty Payable On Joint Development Agreement

Stamp Duty Payable On Joint Development Agreement

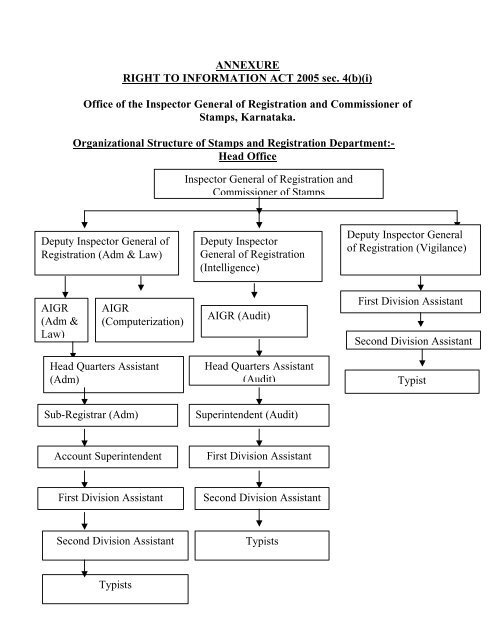

Section 4 B Government Of Karnataka

Section 4 B Government Of Karnataka

Karnataka Stamp Act No Discretion Of Courts In Incomplete Stamp Documents Says Sc Fastforward Justice

Karnataka Stamp Act No Discretion Of Courts In Incomplete Stamp Documents Says Sc Fastforward Justice

Buy Karnataka Stamp Act 1957 Book Online At Low Prices In India Karnataka Stamp Act 1957 Reviews Ratings Amazon In

Buy Karnataka Stamp Act 1957 Book Online At Low Prices In India Karnataka Stamp Act 1957 Reviews Ratings Amazon In

Buy Karnataka Stamp Act 1957 Book Online At Low Prices In India Karnataka Stamp Act 1957 Reviews Ratings Amazon In

Buy Karnataka Stamp Act 1957 Book Online At Low Prices In India Karnataka Stamp Act 1957 Reviews Ratings Amazon In

Is Backdate Rent Agreement Created On Today S Date Stamp Paper Allowed Quora

Buy Karnataka Stamp Act 1957 Kannada Book Online At Low Prices In India Karnataka Stamp Act 1957 Kannada Reviews Ratings Amazon In

Buy Karnataka Stamp Act 1957 Kannada Book Online At Low Prices In India Karnataka Stamp Act 1957 Kannada Reviews Ratings Amazon In

Buy Karnataka Stamp Act 1957 Kannada Book Online At Low Prices In India Karnataka Stamp Act 1957 Kannada Reviews Ratings Amazon In

Buy Karnataka Stamp Act 1957 Kannada Book Online At Low Prices In India Karnataka Stamp Act 1957 Kannada Reviews Ratings Amazon In

Are E Contracts Amenable To Stamp Duty Bar Bench

Are E Contracts Amenable To Stamp Duty Bar Bench

Stamp Duty On Indemnity Bond List For All States Uts In India

Stamp Duty On Indemnity Bond List For All States Uts In India

The Karnataka Stamp Second Amendment Act 2020 Ksge

The Karnataka Stamp Second Amendment Act 2020 Ksge

Stamp Duty In Karnataka Karnataka Promulgates Ordinance To Reduce Stamp Duty From 5 To 2 Real Estate News Et Realestate

Stamp Duty In Karnataka Karnataka Promulgates Ordinance To Reduce Stamp Duty From 5 To 2 Real Estate News Et Realestate

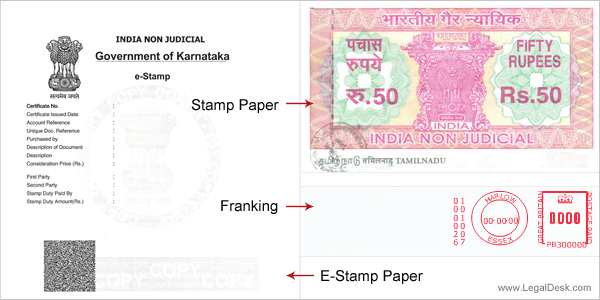

How To Verify The Authenticity Of An E Stamp Paper Quora

Buy Karnataka Stamp Act 1957 Kannada Book Online At Low Prices In India Karnataka Stamp Act 1957 Kannada Reviews Ratings Amazon In

Buy Karnataka Stamp Act 1957 Kannada Book Online At Low Prices In India Karnataka Stamp Act 1957 Kannada Reviews Ratings Amazon In

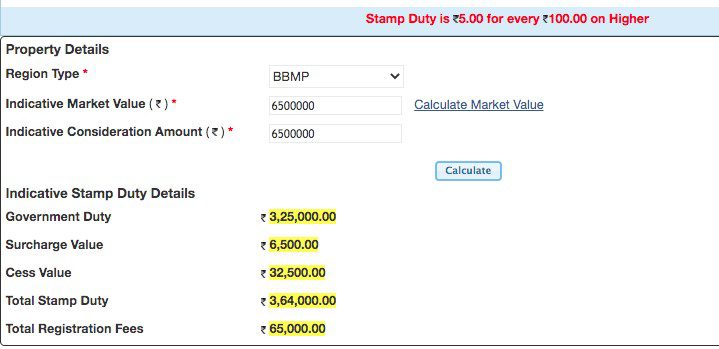

What Are The Stamp Duty Registration Charges In Bangalore

What Are The Stamp Duty Registration Charges In Bangalore

E Stamp Paper E Stamping Karnataka Issuing E Stamp Karnataka

E Stamp Paper E Stamping Karnataka Issuing E Stamp Karnataka

Guide To Register Your Property Online In 2021 Stamp Duty Online Homeowner

Guide To Register Your Property Online In 2021 Stamp Duty Online Homeowner

Sc Rules Arbitration Clauses Not Actionable Unless Agreements Are Sufficiently Stamped Read The Judgement

Sc Rules Arbitration Clauses Not Actionable Unless Agreements Are Sufficiently Stamped Read The Judgement

Karnataka Stamp Duty 5 On Homes Of Rs21 35l 2 For Less Than Rs 20l

Karnataka Stamp Duty 5 On Homes Of Rs21 35l 2 For Less Than Rs 20l

Post a Comment for "Karnataka Stamp Act Schedule 2020"