Stamp Duty Exemption 2020 Extended

These exemptions are consistent with the other policy decisions announced to encourage tourism. 3 Order 2020.

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

03082020 Stamp Duty Exemption No4 Order 2020 The exemption of stamp duty with effective on 1 June 2020 for the residential property price between RM300000 to RM25Million.

Stamp duty exemption 2020 extended. 2 2020 Amendment Order 2021 PUA 27 was gazetted on 25 January 2021. A The exemption will be extended to instruments of loan or financing agreements executed by 30 June 2021 previously 31 December 2020. Following the above the Stamp Duty Exemption No.

Govt To Extend PRS Tax Relief ETF Stamp Duty Exemption. 07012019 Stamp duty exemption on contract notes for sale and purchase transaction of structured warrant or exchange-traded fund approved by the Securities Commission executed from 1 January 2018 to 31 December 2020 extended to 31 December 2025. The stamp duty exemption is effective for instruments of transfer executed from 1 January 2020 to 31 December 2022.

07082020 1 Stamp Duty Exemption No. Stamp Duty Exemption No. Incidentally stamp duty exemptions on loan agreements and the transfer instrument for abandoned housing projects will also be extended for another five years.

01032020 The Stamp Duty Exemption No. Press Citations 06 November 2020. The Exemption Order exempts from stamp duty for qualifying loan or financing agreements relating to the restructuring or rescheduling of existing business loans or financing.

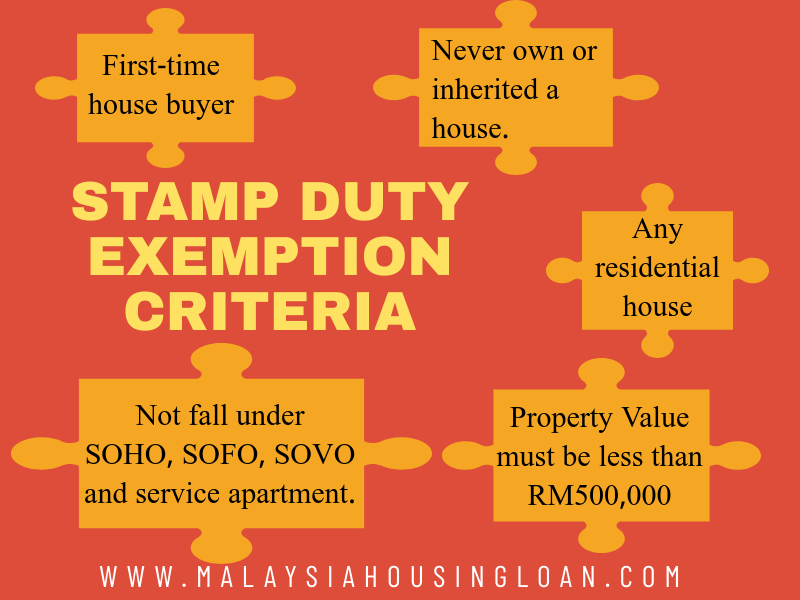

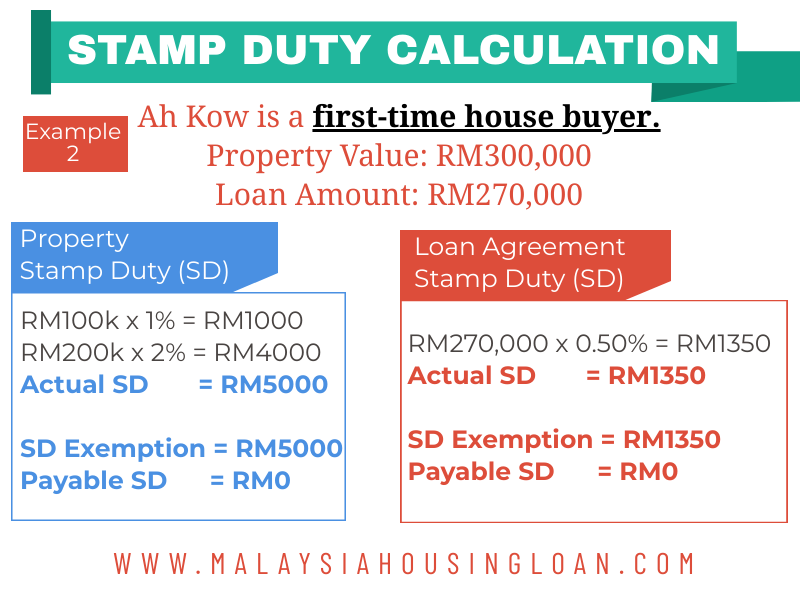

01062020 The stamp duty exemptions are applicable for the purchase of residential units for Sale. The stamp duty exemption limit has been increased from RM300000 to RM500000 and it is applicable for Sale and Purchase Agreement dated from 1st January 2021 until 31st December 2025. The government has decided to extend the stamp duty tax exemption deadline for property worth less than US70000 from January to December 2021.

It is proposed that the stamp duty chargeable will be given a 100 exemption on loan agreements arising from such restructuring and rescheduling of business loans between borrowers and financial institutions executed from 1 March 2020 to 31 December 2020 provided the original loan agreement has been duly stamped. A 379 was gazetted on 28 December 2020 to provide a stamp duty exemption on the financing agreements under the TSPKS and IPPKS financing programmes pursuant to the Tawarruq concept executed between an individual and Bank Pertanian Malaysia Berhad Agrobank. 24122020 Stamp Duty Tax Exemption Extended to December 2021.

18112020 Stamp duty exemption will be extended for another 5 years on the Trading of Exchange Traded Fund ETF There were a number of other incentives announced around Indirect Taxes. Year 2014 Stamp Duty Order Remittance PUA 360 PUA 361 Year 2016 Stamp Duty Order Remittance PUA 365 PUA 366 Year 2020 Stamp Duty Order Exemption PUA 152 Year 2020 Notification Of Authorized Person To Compound Instrument Under Subsection 91 PUB 142020. Our full report covers these and the above highlights in more detail.

7 Order 2020 PU. 06112020 Bernama - Budget 2021. Photo by The Edge.

03032021 The current stamp duty holiday in England and Northern Ireland has been extended until the end of June and some relief will continue until the end of September the Chancellor announced in the Budget today. 09112020 This exemption will now be applicable for the sale and purchase agreement on purchases that are completed from 1 January 2021 until 31 December 2025. The exemption on the instrument of transfer is limited to the first RM1Million of the property price and the stamp duty will be charged RM3 for every RM100 of the balance property.

The Amendment Order provides that. Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small. KUALA LUMPUR Nov 6 - The government will extend the income tax relief period on Private Retirement Scheme PRS contributions by individual taxpayers.

A stamp duty exemption will be given for the purchase of residential property priced more than RM300000 but not more than RM25 million subject to a discount of at least 10 provided by the developer except for a residential property which is subject to. 30062019 Stamp duty exemption for HOC first-time homebuyers extended for 6 months until Dec 31. A minimum of 10 discount from property price applicable to all units that are not subjected to.

The Finance Ministry has accepted the KPKT Minister YB Puan Hajah Zuraida Kamaruddins request in support of REHDAs Real Estate and Housing Developers Association appeal to extend the HOC period for another six months. The Stamp Duty Exemption No. 28022021 Save for the stamp duty exemption applied to Home Ownership Campaign taking effect from last June 2020 it is now extended to the secondary market.

Stamp Duty exemption on Rent-to-Own Scheme Pursuant to the Budget 2020 proposals the Stamp Duty Exemption No 4 Order 2019 has been gazetted to provide stamp duty exemption under the Rent-to-Own scheme. 2 Order 2020 Exemption Order was gazetted on 21 May 2020 and came into operation retrospectively on 1 March 2020. Purchase Agreement executed between 1 June 2020 to 31 May 2021.

Service tax and tourism tax exemption for hotels The existing service tax exemption for hotels will be extended to 30 June 2021 and a new exemption for tourism tax from 1 July 2020 to 30 June 2021 has been introduced. According to the official announcement released on 23 December the government also urged developers to provide.

Budget 2021 Key Property Highlights Donovan Ho

Budget 2021 Key Property Highlights Donovan Ho

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

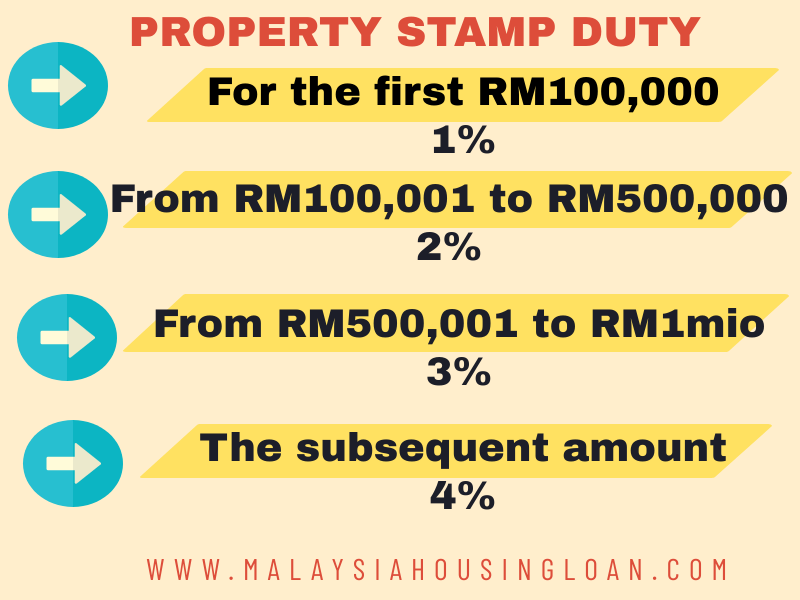

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2021 Malaysia Housing Loan

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

Hoc 2020 Get 10 Discounts Free Stamp Duty When You Buy A House

New Tax Regime Tax Slabs Income Tax Income Tax

New Tax Regime Tax Slabs Income Tax Income Tax

Property Market Five Changes To Make Property Investment Attractive Property Marketing Investment Property Real Estate Investor

Property Market Five Changes To Make Property Investment Attractive Property Marketing Investment Property Real Estate Investor

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Cbdt Notification For Tds Challan And Tds Return Under 194m And 194n Tax Rules Taxact Income Tax Return

Cbdt Notification For Tds Challan And Tds Return Under 194m And 194n Tax Rules Taxact Income Tax Return

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Reduced Interface Between Trade Customs Officer And Enhanced Ease Of Doing Business Paperless Reform Custom

Reduced Interface Between Trade Customs Officer And Enhanced Ease Of Doing Business Paperless Reform Custom

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Post a Comment for "Stamp Duty Exemption 2020 Extended"